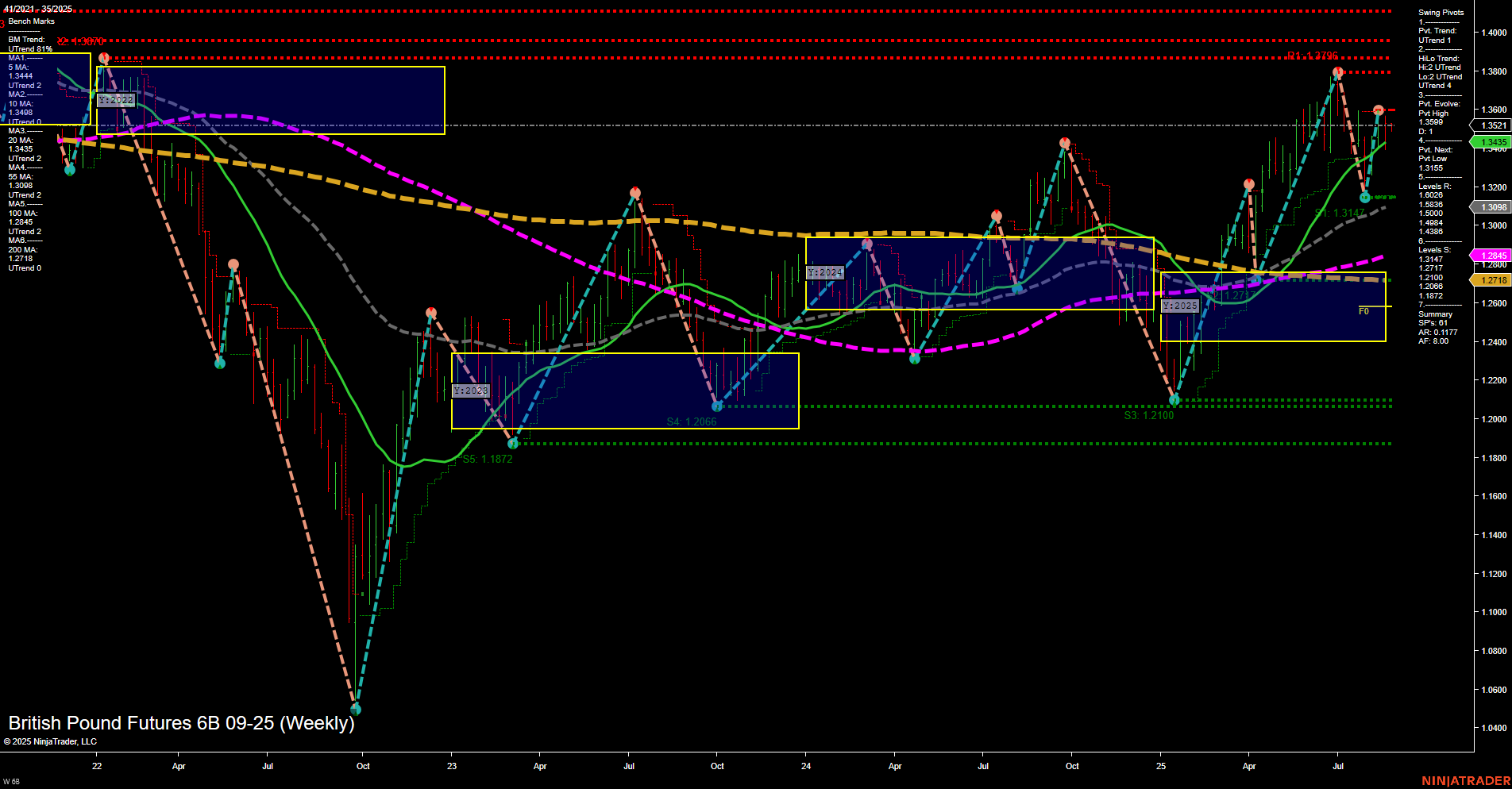

The British Pound Futures (6B) weekly chart shows a market in transition. Price action is currently at 1.3521 with medium-sized bars and average momentum, indicating neither strong acceleration nor deceleration. The short-term WSFG trend is down, with price below the NTZ center, suggesting some near-term weakness or consolidation after a recent move. However, both the intermediate and long-term MSFG and YSFG trends are up, with price above their respective NTZ centers, reflecting a broader bullish structure. Swing pivot analysis confirms an uptrend in both short- and intermediate-term trends, with the most recent pivot high at 1.3521 and the next key support at 1.3142. Resistance levels are stacked above, with 1.3796 as a major ceiling. All benchmark moving averages from 5 to 200 weeks are trending up, reinforcing the underlying bullish bias over the medium and long term. Recent trade signals show mixed short-term direction, with both long and short entries triggered within days of each other, highlighting choppy or indecisive short-term price action. Overall, the market is consolidating after a strong rally, with the potential for further upside if support levels hold and momentum resumes. The structure suggests a market in a bullish phase on higher timeframes, but with short-term pullbacks and volatility as price tests key resistance and support zones.