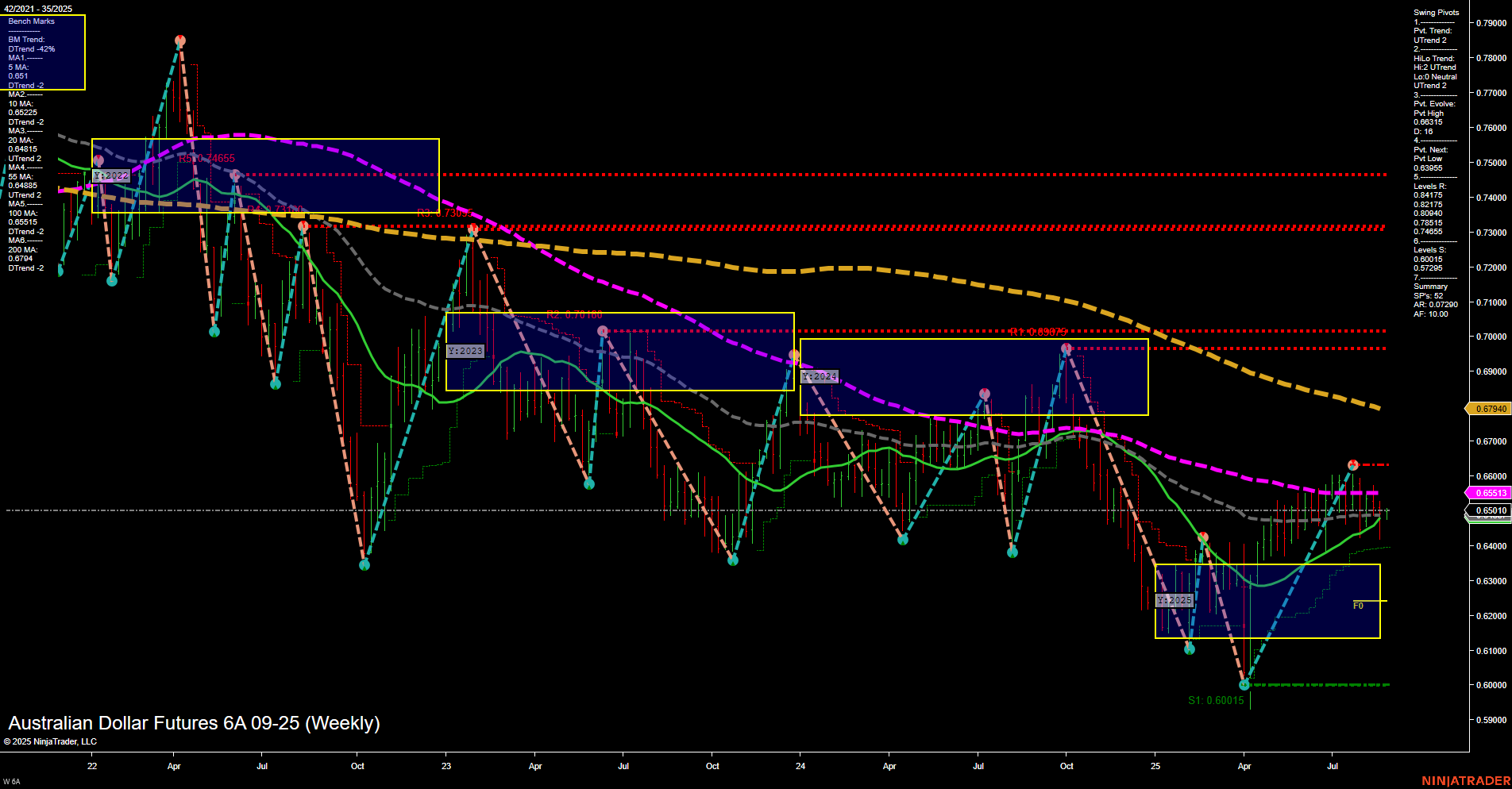

The Australian Dollar Futures (6A) weekly chart shows a market in transition. Price action has recently shifted to an average momentum phase, with medium-sized bars reflecting a period of consolidation after a strong recovery from the 0.60015 swing low. Both short-term and intermediate-term swing pivot trends have turned upward, supported by rising 5, 10, and 20-week moving averages, indicating bullish sentiment in the near to intermediate term. However, the long-term structure remains bearish, as the 55, 100, and 200-week moving averages are still trending down and positioned above current price, acting as significant resistance. Swing resistance levels are clustered between 0.65511 and 0.68975, with the most immediate resistance at the current swing high. The only major support is the recent swing low at 0.60015, highlighting a wide range and potential for volatility. Recent trade signals show mixed short-term and intermediate-term activity, with both long and short entries, reflecting the choppy and indecisive nature of the current market environment. Overall, the chart suggests a market attempting a bullish reversal in the short and intermediate term, but still facing headwinds from entrenched long-term downtrends. Price is currently testing key resistance levels, and a sustained breakout above the 55 and 100-week moving averages would be required to confirm a longer-term trend change. Until then, the market remains in a consolidation phase, with potential for both further upside tests and sharp pullbacks.