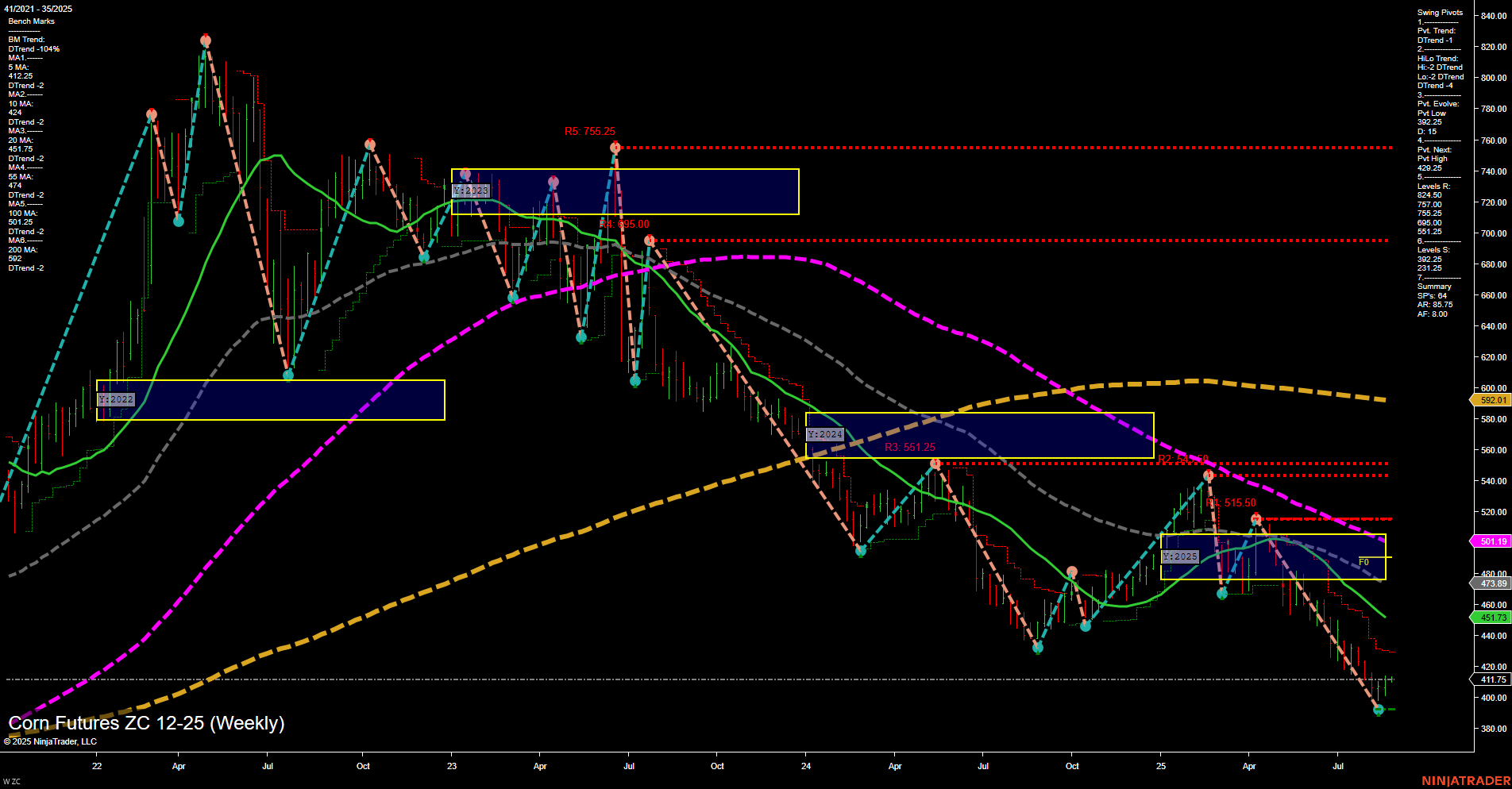

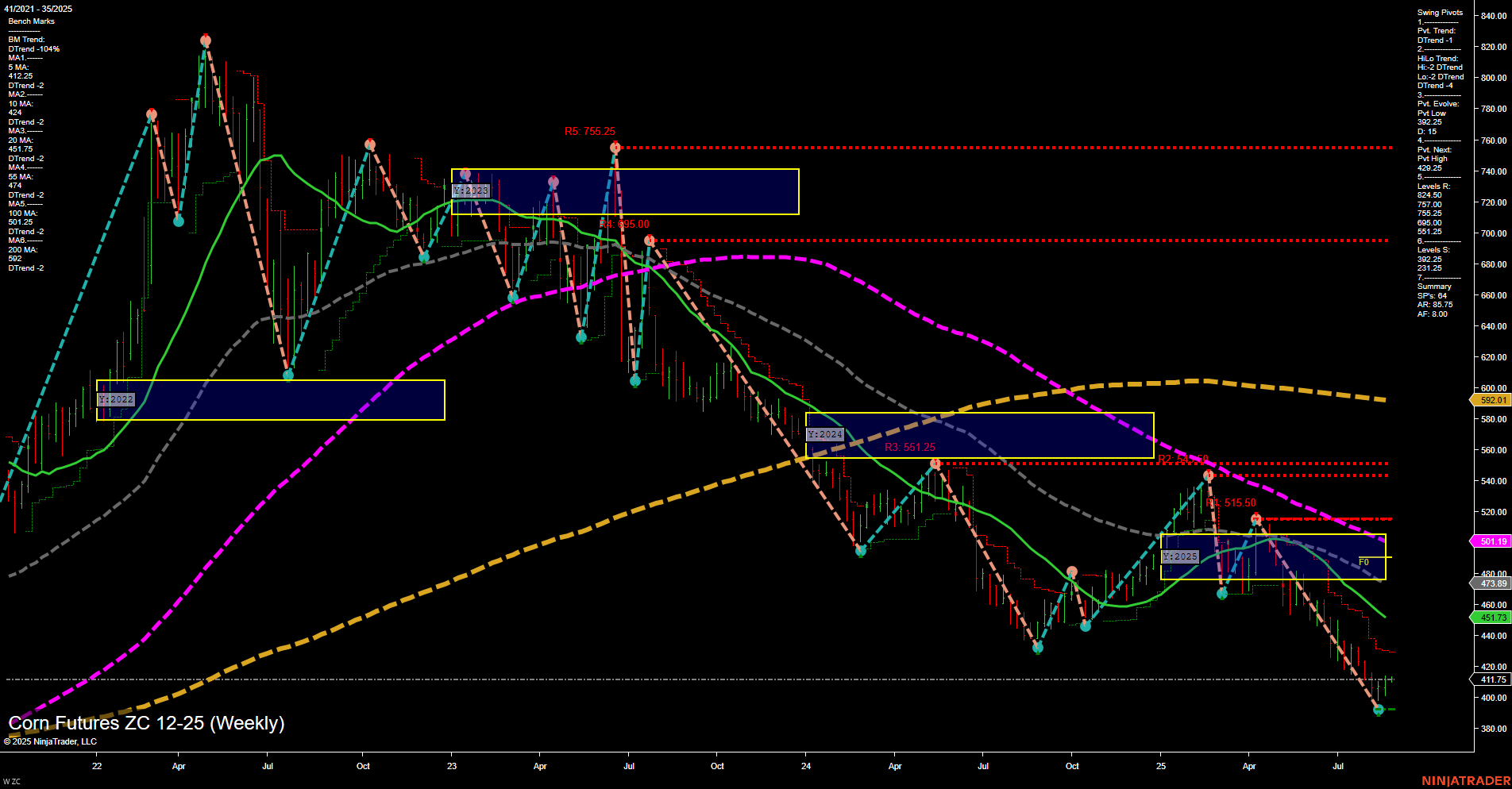

ZC Corn Futures Weekly Chart Analysis: 2025-Aug-24 18:13 CT

Price Action

- Last: 411.75,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -18%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -53%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 396.25,

- 4. Pvt. Next: Pvt High 520.48,

- 5. Levels R: 755.25, 705.00, 681.25, 551.25, 515.50,

- 6. Levels S: 396.25, 371.25, 231.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 451.73 Down Trend,

- (Intermediate-Term) 10 Week: 473.75 Down Trend,

- (Long-Term) 20 Week: 501.19 Down Trend,

- (Long-Term) 55 Week: 592.01 Down Trend,

- (Long-Term) 100 Week: 601.19 Down Trend,

- (Long-Term) 200 Week: 704.25 Down Trend.

Recent Trade Signals

- 21 Aug 2025: Long ZC 12-25 @ 408.5 Signals.USAR-WSFG

- 19 Aug 2025: Long ZC 12-25 @ 402.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures remain in a pronounced long-term and intermediate-term downtrend, as confirmed by the negative YSFG and MSFG trends, persistent lower swing highs and lows, and all major moving averages trending downward. The most recent price action shows a slow momentum bounce from a new swing low at 396.25, with price currently trading just above 410. Short-term, there is a modest upward bias as price has moved above the weekly session F0%/NTZ, but this is countered by the prevailing downtrend in both swing pivots and moving averages. Resistance levels are stacked well above current price, with significant overhead supply at 515.50 and 551.25, while support is thin below, with the next key level at 371.25. Recent long signals suggest a potential for a short-term corrective rally or oversold bounce, but the broader context remains bearish, with rallies likely to encounter strong resistance. The market is in a phase of potential short-term stabilization within a larger bearish structure, with volatility likely to persist as price tests the lower end of the multi-year range.

Chart Analysis ATS AI Generated: 2025-08-24 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.