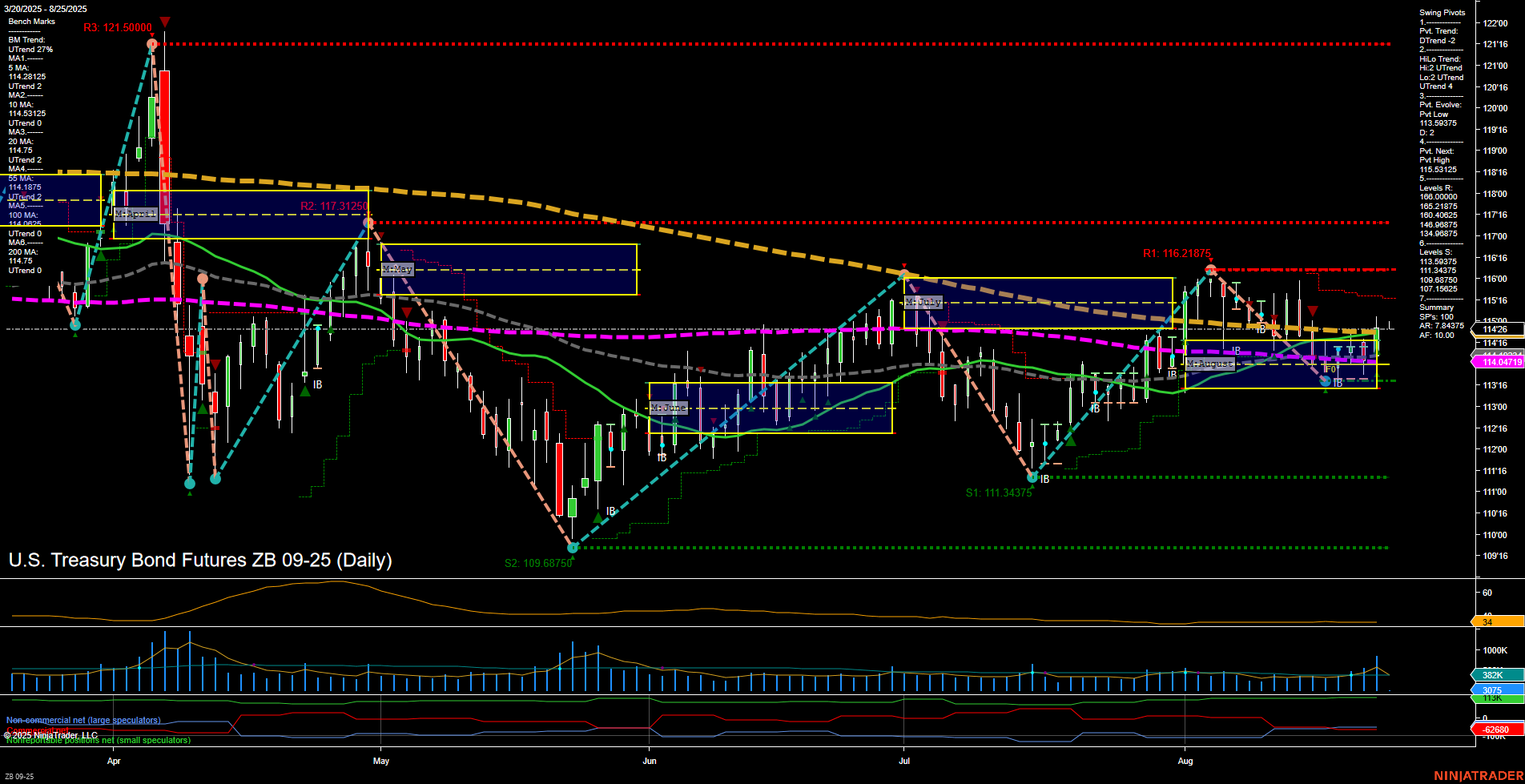

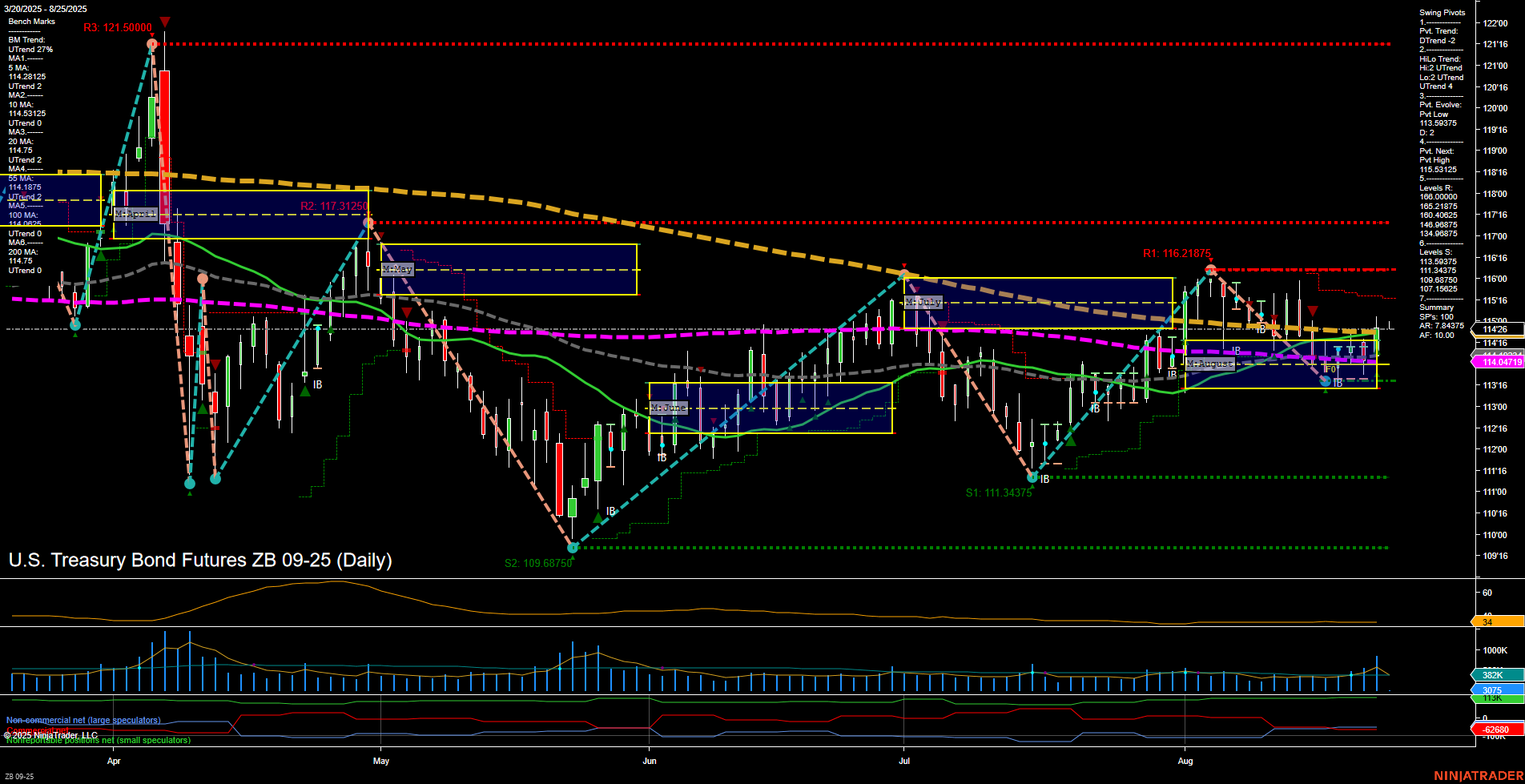

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Aug-24 18:12 CT

Price Action

- Last: 114'26,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 113.03275,

- 4. Pvt. Next: Pvt High 115.53125,

- 5. Levels R: 121.50000, 117.31250, 116.21875, 115.53125, 114.6875, 113.96875,

- 6. Levels S: 111.34375, 109.68750.

Daily Benchmarks

- (Short-Term) 5 Day: 114.1875 Down Trend,

- (Short-Term) 10 Day: 114.28125 Down Trend,

- (Intermediate-Term) 20 Day: 114.04719 Down Trend,

- (Intermediate-Term) 55 Day: 114.71875 Up Trend,

- (Long-Term) 100 Day: 113.5625 Up Trend,

- (Long-Term) 200 Day: 114.71875 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in consolidation with a short-term bearish tilt. Price action is contained within a medium range, and momentum is slow, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, supported by declining 5-day, 10-day, and 20-day moving averages, while the intermediate-term HiLo trend remains up, suggesting underlying support from previous higher lows. Key resistance levels are clustered above, with 115.53125 as the next significant pivot high, while support is found at 113.03275 and further below at 111.34375. The ATR and volume metrics indicate moderate volatility and participation. Overall, the market is in a holding pattern, with neither bulls nor bears in clear control, and price is oscillating within a neutral monthly and yearly session fib grid context. Swing traders may observe for a breakout from this range or a test of the nearby support/resistance levels to gauge the next directional move.

Chart Analysis ATS AI Generated: 2025-08-24 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.