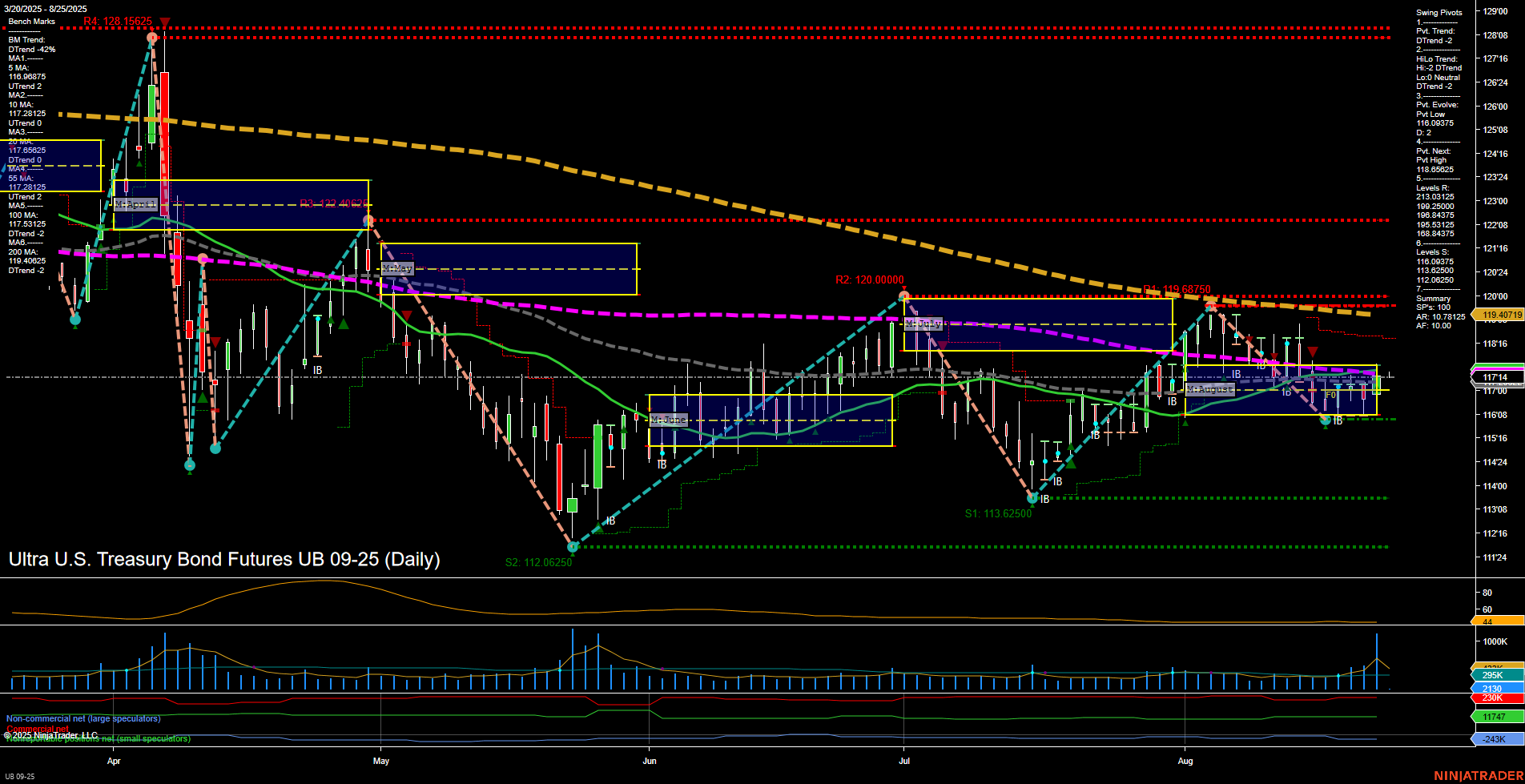

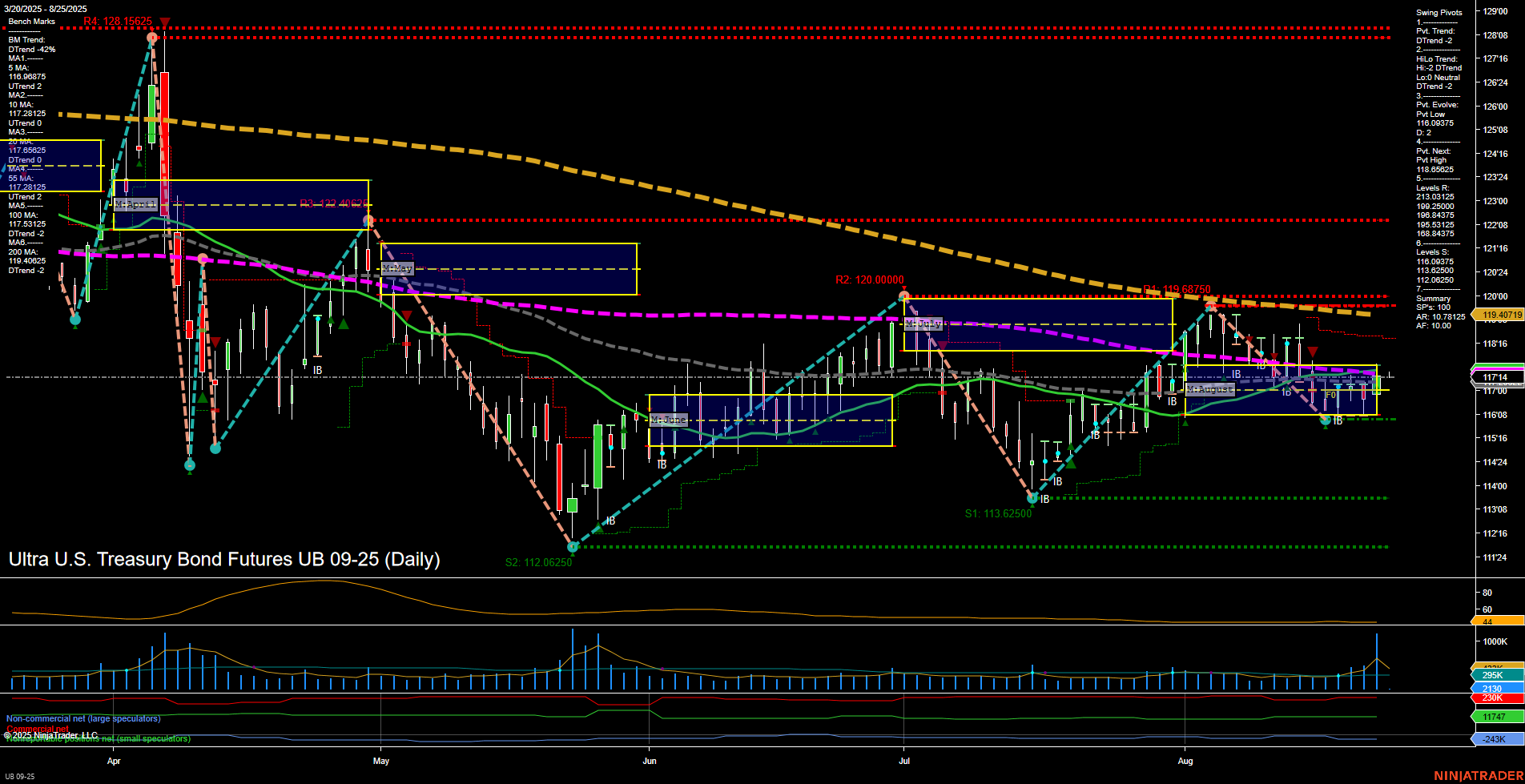

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Aug-24 18:11 CT

Price Action

- Last: 117.14,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 116.09375,

- 4. Pvt. Next: Pvt high 119.6875,

- 5. Levels R: 128.15625, 124.40625, 120.0, 119.6875, 118.53125, 116.96875,

- 6. Levels S: 113.625, 112.0625.

Daily Benchmarks

- (Short-Term) 5 Day: 117.88 Down Trend,

- (Short-Term) 10 Day: 117.68 Down Trend,

- (Intermediate-Term) 20 Day: 117.38 Down Trend,

- (Intermediate-Term) 55 Day: 117.58 Down Trend,

- (Long-Term) 100 Day: 118.09 Down Trend,

- (Long-Term) 200 Day: 119.40 Down Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Long UB 09-25 @ 117.5 Signals.USAR-MSFG

- 22 Aug 2025: Long UB 09-25 @ 117.125 Signals.USAR-WSFG

- 21 Aug 2025: Short UB 09-25 @ 116.40625 Signals.USAR.TR120

- 18 Aug 2025: Short UB 09-25 @ 116.25 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart reflects a market in transition, with short-term and long-term trends remaining bearish, as indicated by both the swing pivot trends and the alignment of all major moving averages in a downtrend. Price is currently consolidating just above recent swing lows, with medium-sized bars and average momentum, suggesting a pause after recent volatility. The weekly session fib grid (WSFG) shows price below the NTZ, reinforcing short-term downside pressure, while the monthly session fib grid (MSFG) is more constructive, with price above the NTZ and an uptrend bias, hinting at potential for intermediate-term stabilization or a countertrend rally. However, resistance levels remain stacked above, and the next significant swing high is some distance away, while support is clustered near recent lows. Recent trade signals show mixed activity, with both long and short entries triggered in the past week, reflecting the choppy, range-bound nature of the current environment. Volatility remains elevated, as seen in the ATR and volume metrics, which may continue to fuel sharp moves in either direction. Overall, the market is in a corrective phase, with a bearish tilt dominating the short and long-term outlooks, while the intermediate-term picture is more neutral as the market tests key support and resistance zones.

Chart Analysis ATS AI Generated: 2025-08-24 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.