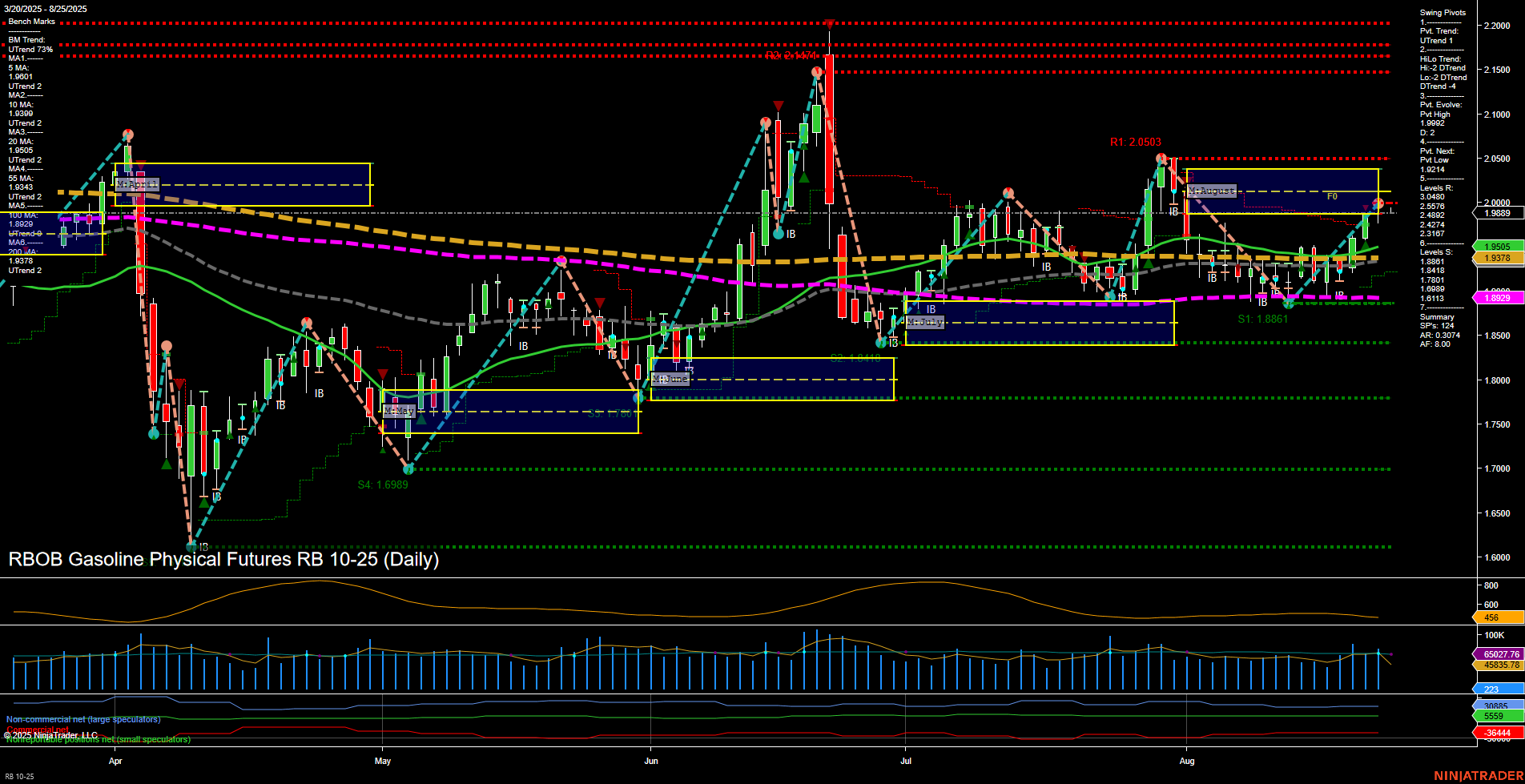

The RBOB Gasoline futures daily chart shows a market in transition. Short- and intermediate-term trends are bearish, as indicated by both the WSFG and MSFG being below their respective NTZ/F0% levels and showing downward trends. Swing pivot analysis confirms this with both short-term and intermediate-term pivot trends in a downtrend, and the next key pivot low at 1.9022. Resistance is layered above at 1.9889, 2.0089, and up to 2.0503, while support is well below at 1.8861 and 1.6989, suggesting a wide range for potential price movement. Despite the bearish short- and intermediate-term outlook, all benchmark moving averages from short to long term are in uptrends, and the yearly session fib grid (YSFG) remains bullish, with price above the annual F0% and a positive trend. This divergence highlights a market that is correcting or consolidating within a broader uptrend. The recent trade signal (Long RB 09-25 @ 2.1015) suggests that there was an attempt to catch a reversal or continuation higher, but price has since pulled back below key resistance. ATR and volume metrics indicate moderate volatility and healthy participation. The market appears to be in a corrective phase within a larger bullish structure, with the potential for further downside in the short term before any resumption of the longer-term uptrend. Watch for price action near the key support and resistance levels for signs of reversal or continuation.