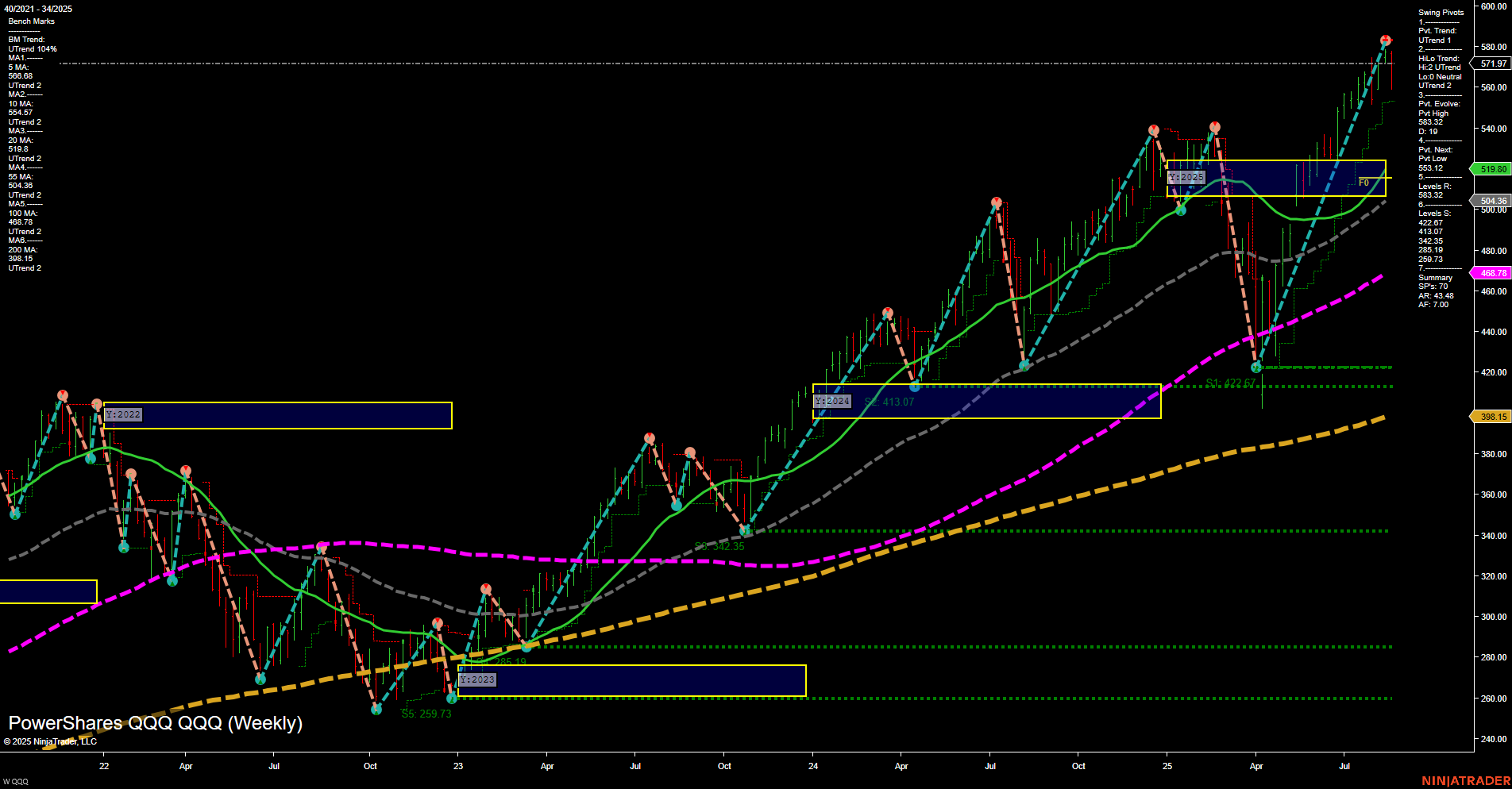

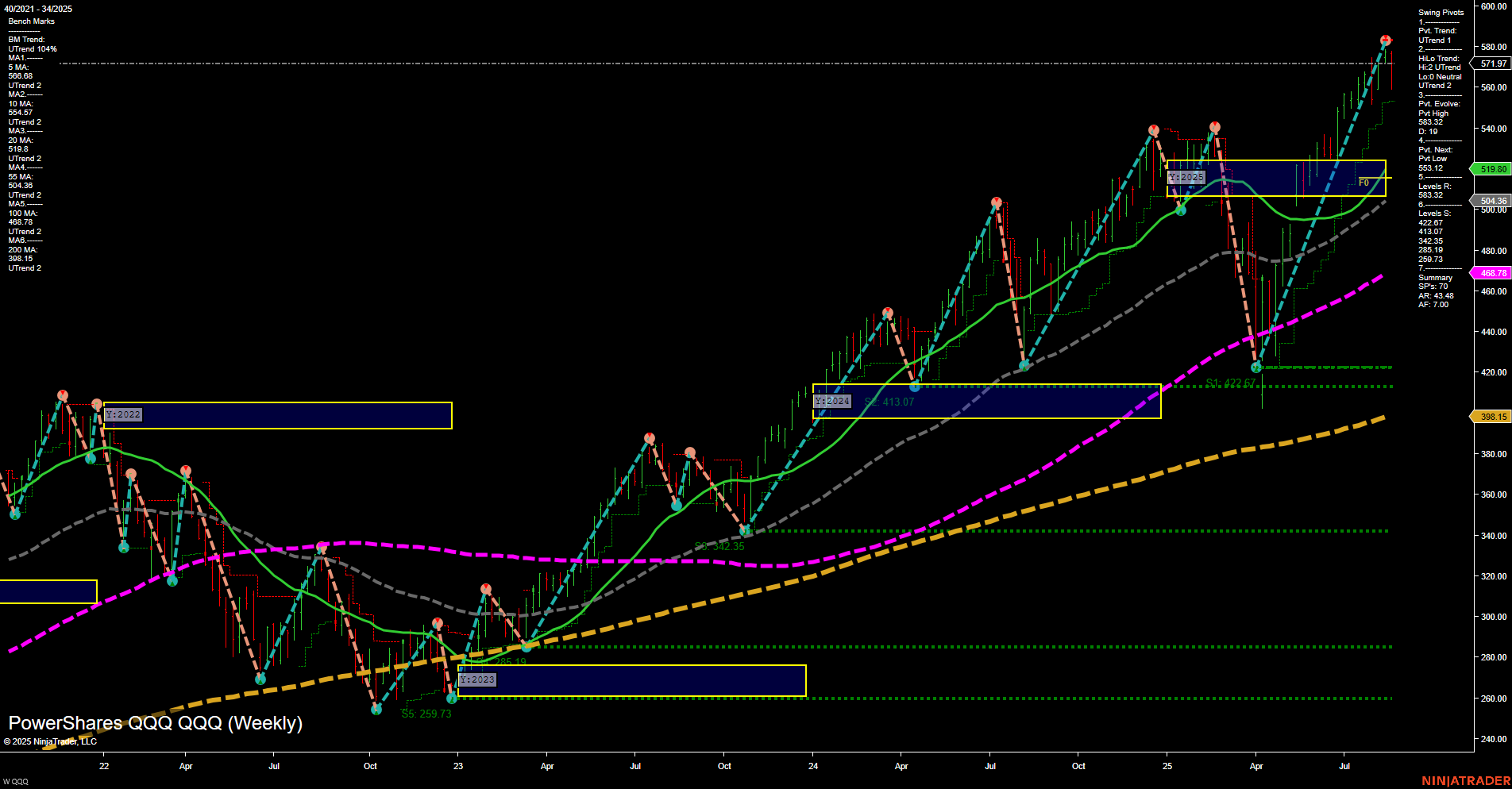

QQQ PowerShares QQQ Weekly Chart Analysis: 2025-Aug-24 18:09 CT

Price Action

- Last: 519.60,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 553.98,

- 4. Pvt. Next: Pvt low 519.60,

- 5. Levels R: 571.97, 553.98,

- 6. Levels S: 500.11, 468.78, 413.07, 372.35, 322.67, 259.73, 246.37.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 519.68 Up Trend,

- (Intermediate-Term) 10 Week: 514.57 Up Trend,

- (Long-Term) 20 Week: 518.9 Up Trend,

- (Long-Term) 55 Week: 500.34 Up Trend,

- (Long-Term) 100 Week: 468.78 Up Trend,

- (Long-Term) 200 Week: 398.15 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ weekly chart shows a strong bullish structure across all timeframes, with price recently making a new swing high at 553.98 before pulling back to the current level of 519.60. Momentum remains fast, and the size of the recent bars suggests heightened volatility, likely reflecting a period of active price discovery. All benchmark moving averages are trending upward, confirming the underlying strength and trend alignment from intermediate to long-term perspectives. Swing pivot analysis highlights a clear uptrend in both short- and intermediate-term trends, with resistance at 571.97 and 553.98, and multiple support levels below, the nearest being 500.11. The price is currently consolidating near the upper end of the yearly range, within a neutral NTZ zone, indicating a pause after a strong rally. This setup is typical of a market in a bullish continuation phase, with the potential for further upside if resistance levels are cleared, or a deeper retracement if support is tested. The overall technical landscape favors trend-following strategies, with the market showing resilience and buyers maintaining control.

Chart Analysis ATS AI Generated: 2025-08-24 18:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.