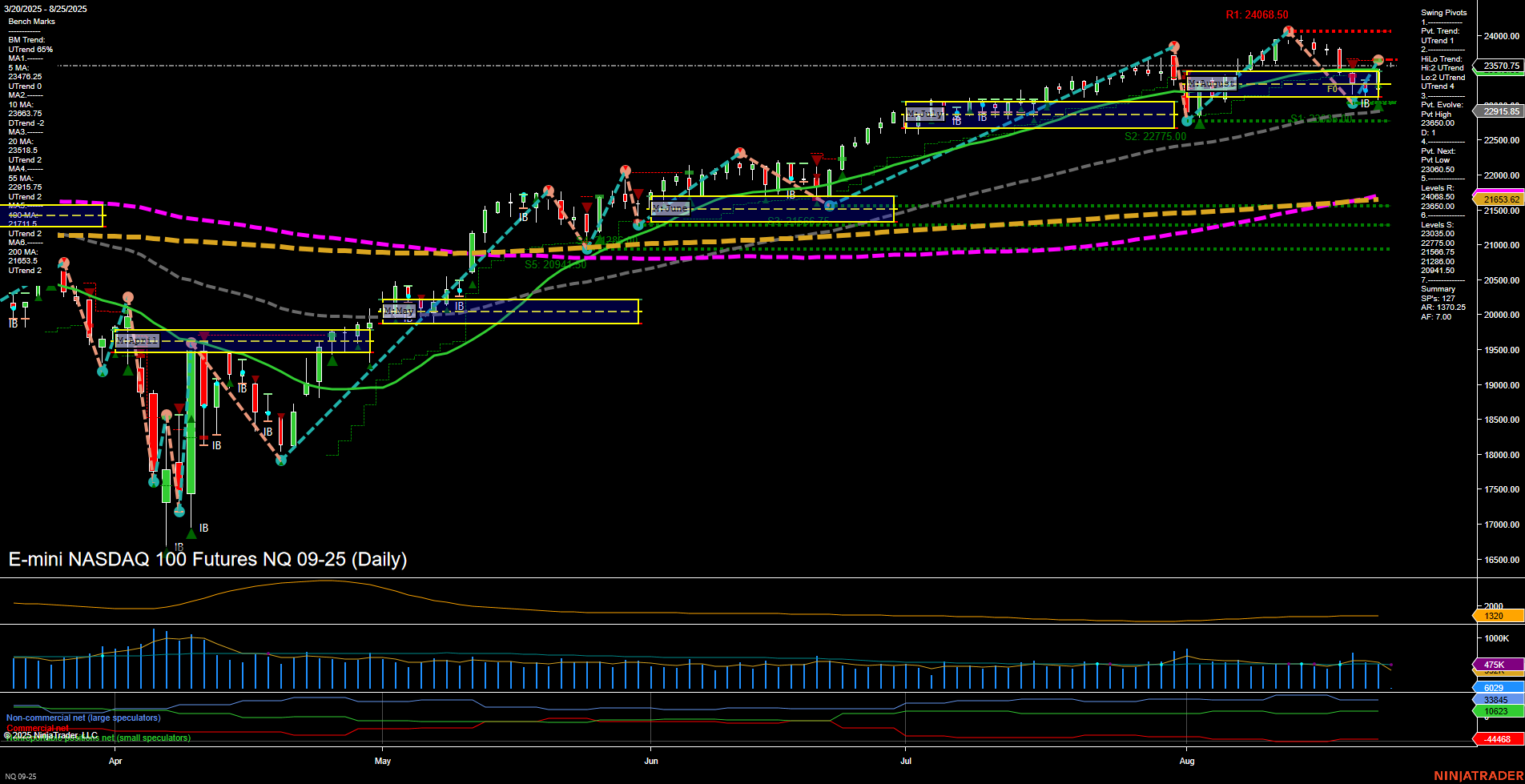

The NQ E-mini NASDAQ 100 Futures daily chart shows a market in transition. Price action is holding above key monthly and yearly session fib grid levels, with the last price at 23,570.75 and medium-sized bars reflecting average momentum. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term weakness or consolidation. However, both the intermediate (monthly) and long-term (yearly) session fib grids remain in uptrends, with price above their respective NTZs, supporting a broader bullish structure. Swing pivots confirm this mixed environment: the short-term pivot trend is up, and the intermediate-term HiLo trend is also up, but the most recent evolution is a pivot high, suggesting the market is testing resistance and could be vulnerable to a pullback toward the next pivot low at 22,951.85. Resistance levels are clustered near recent highs, while support is layered below, providing clear reference points for swing traders. All benchmark moving averages from short to long term are trending up, reinforcing the underlying bullish bias, especially for intermediate and long-term participants. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals show both long and short entries, reflecting the choppy, rotational nature of the current environment. In summary, the market is consolidating after a strong advance, with short-term signals mixed but the intermediate and long-term trends still favoring the upside. Swing traders may observe a period of digestion or minor retracement before the next directional move, with key levels to watch for potential breakout or breakdown scenarios.