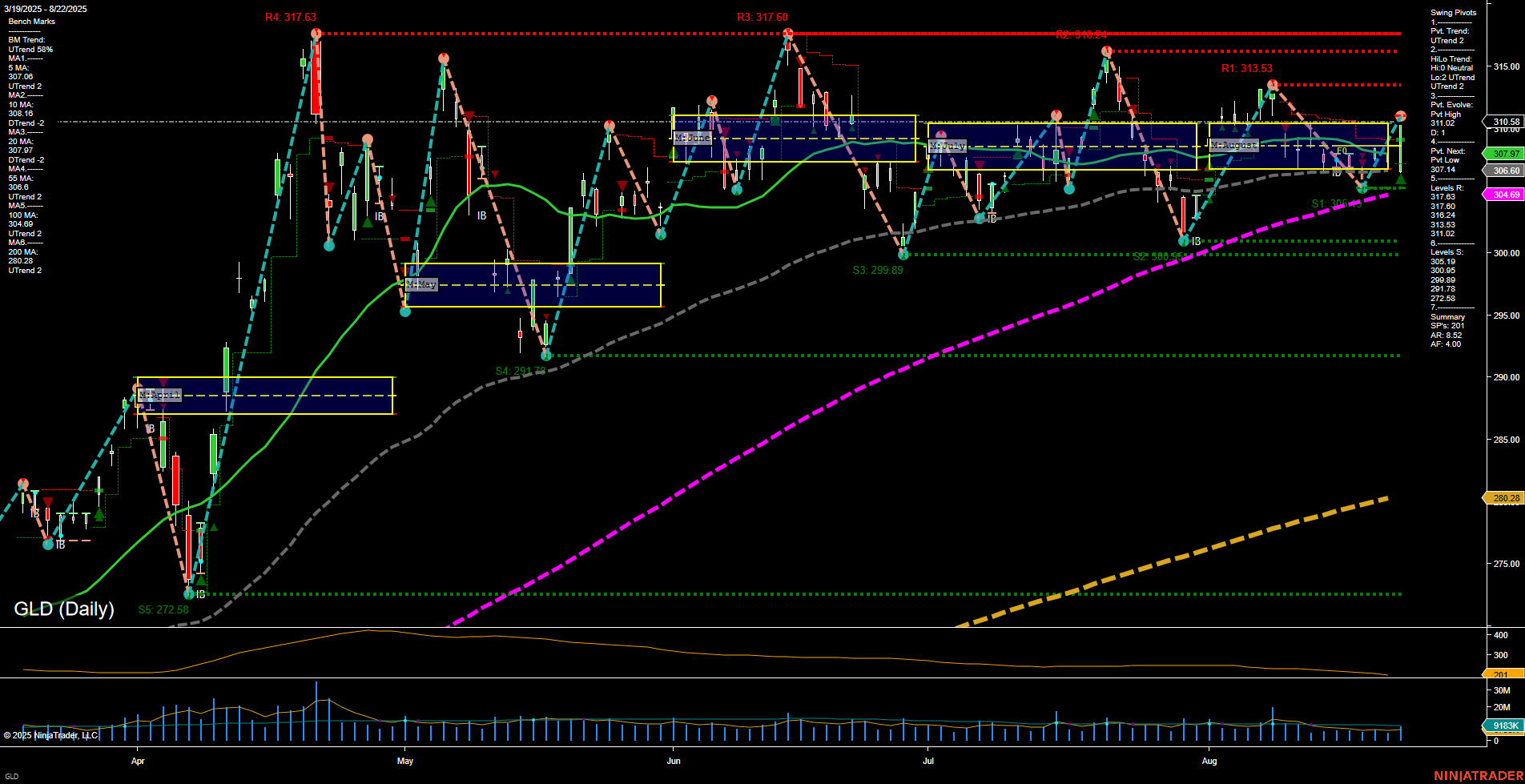

GLD is currently trading in a consolidation phase, with price action showing medium-sized bars and average momentum. The short-term and intermediate-term trends, as indicated by both the swing pivots and the session fib grids, are neutral, reflecting a lack of clear directional conviction. The most recent swing pivot is a high at 310.58, with the next potential pivot low at 306.69, suggesting the market is at a decision point near key support and resistance levels. Benchmark moving averages show a mixed picture: short-term MAs (5 and 10 day) are in uptrends, but the 20-day MA is in a downtrend, indicating some short-term weakness within a broader uptrend context. The 55, 100, and 200-day MAs remain in uptrends, supporting a bullish long-term outlook. Volatility, as measured by ATR, is moderate, and volume is steady, indicating neither a breakout nor a selloff environment. Overall, the chart reflects a market in balance, with neither buyers nor sellers in control. The price is oscillating between well-defined support and resistance levels, and the technicals suggest a wait-and-see approach as the market digests recent moves. The long-term structure remains constructive, but short- and intermediate-term traders may find limited directional edge until a breakout or breakdown occurs.