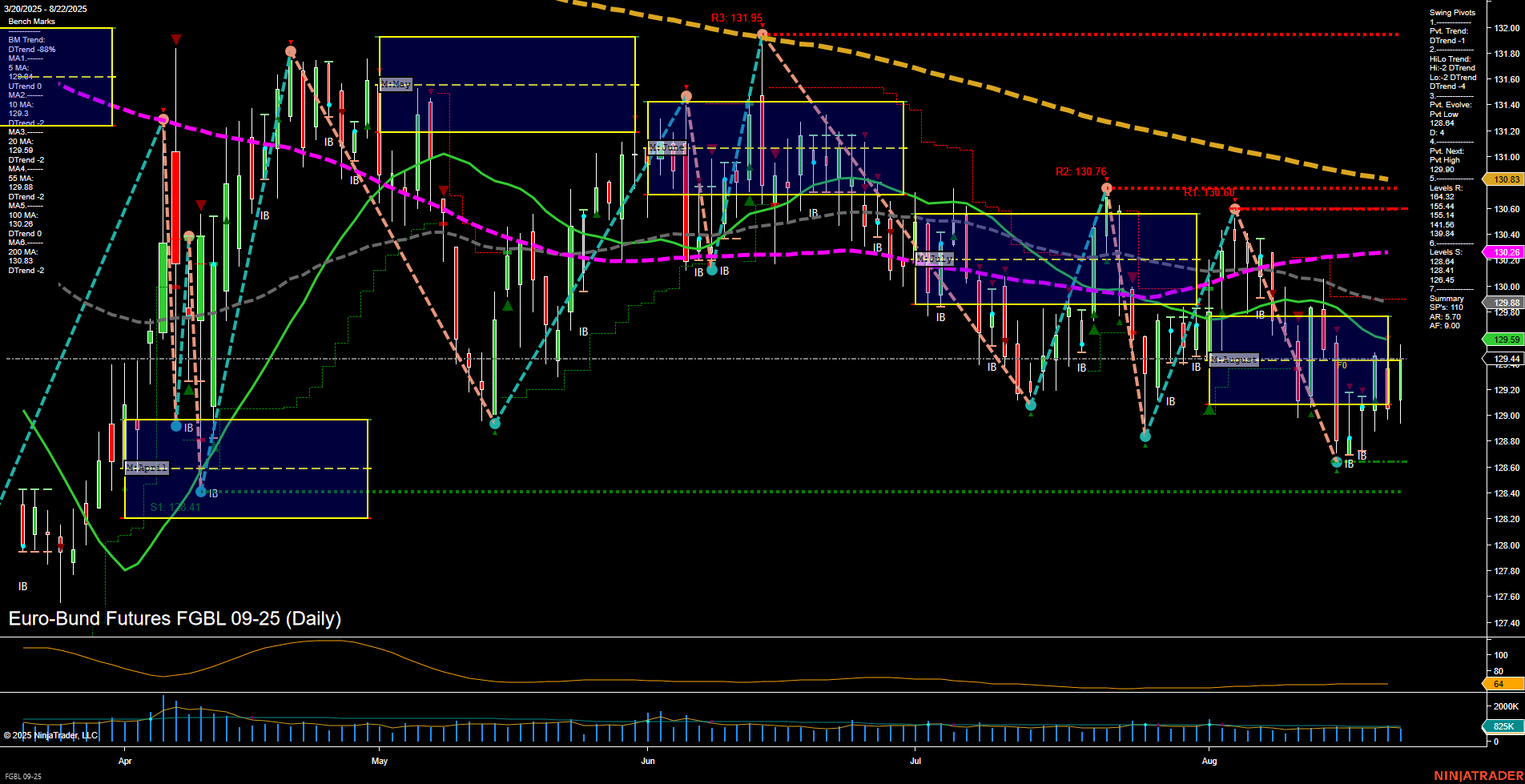

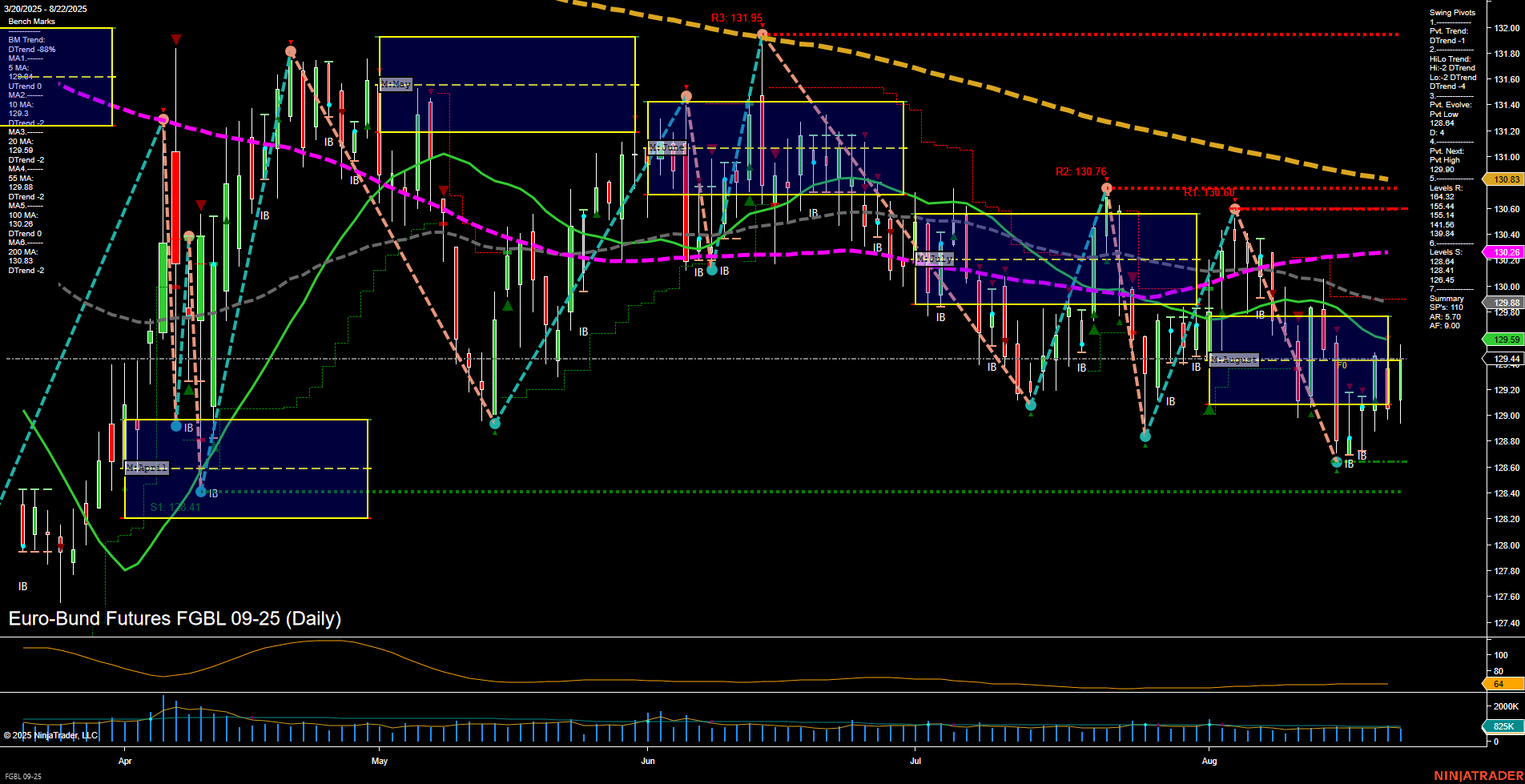

FGBL Euro-Bund Futures Daily Chart Analysis: 2025-Aug-24 18:05 CT

Price Action

- Last: 129.59,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 128.60,

- 4. Pvt. Next: Pvt high 130.03,

- 5. Levels R: 131.95, 130.76, 130.03,

- 6. Levels S: 128.60, 128.41, 128.45.

Daily Benchmarks

- (Short-Term) 5 Day: 129.44 Down Trend,

- (Short-Term) 10 Day: 129.34 Down Trend,

- (Intermediate-Term) 20 Day: 129.54 Down Trend,

- (Intermediate-Term) 55 Day: 129.84 Down Trend,

- (Long-Term) 100 Day: 130.40 Down Trend,

- (Long-Term) 200 Day: 130.83 Down Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Short FGBL 09-25 @ 129.09 Signals.USAR-MSFG

- 19 Aug 2025: Long FGBL 09-25 @ 128.89 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures daily chart shows a market in transition, with short-term price action stabilizing after a recent swing low, but intermediate and long-term trends remain bearish. Price is currently trading just above the recent swing low support (128.60) and below several key resistance levels (130.03, 130.76, 131.95), indicating a range-bound environment with downward pressure. All benchmark moving averages across timeframes are trending down, reinforcing the broader bearish bias. The ATR and VOLMA suggest moderate volatility and steady participation. Recent trade signals reflect mixed short-term direction but a prevailing intermediate-term downside bias. The market is consolidating after a sell-off, with potential for either a short-term bounce or further downside if support fails. Swing traders should note the dominance of lower highs and lower lows, with any rallies likely to encounter resistance at the overhead pivot and moving average levels.

Chart Analysis ATS AI Generated: 2025-08-24 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.