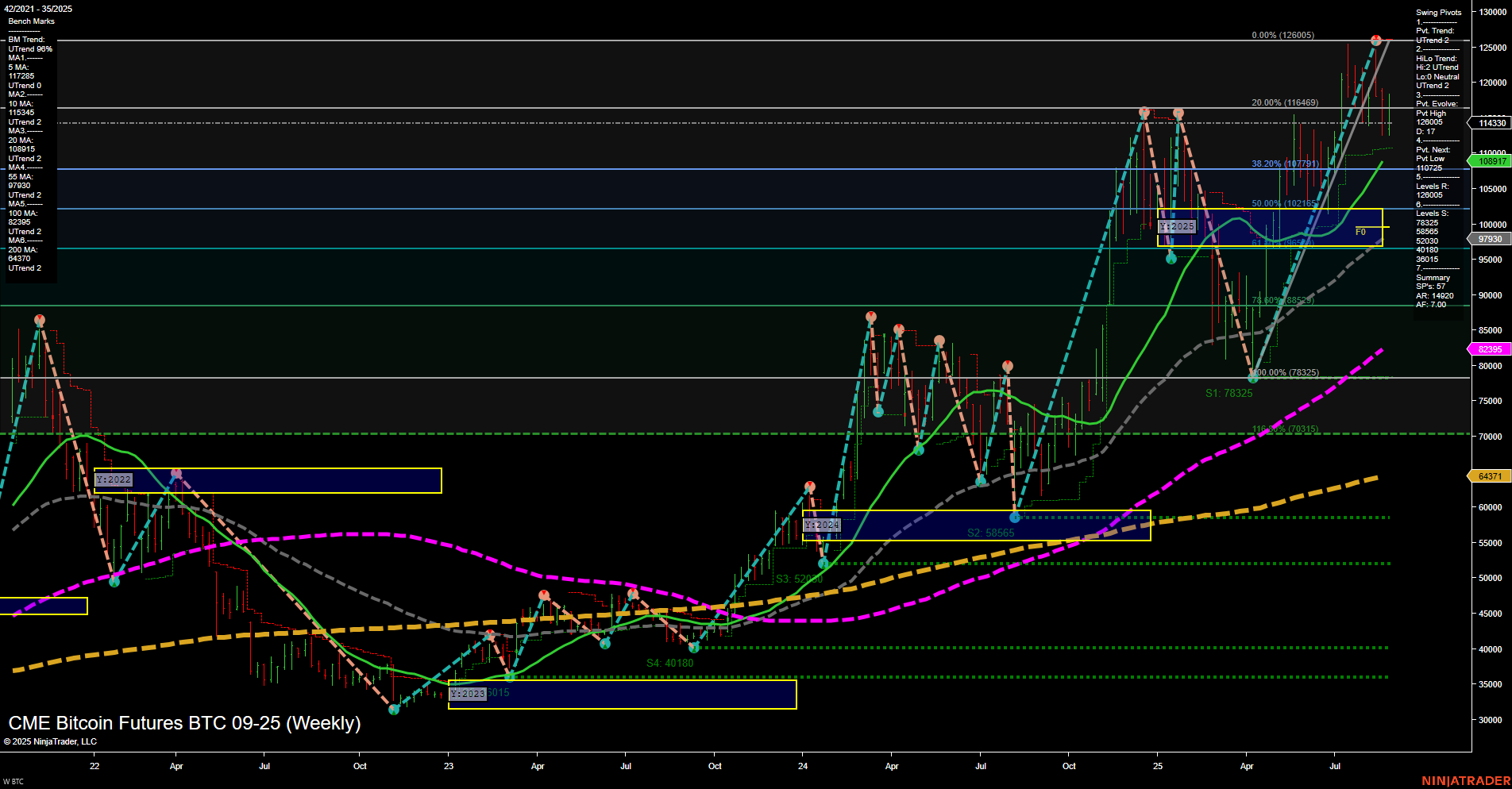

The BTC CME weekly futures chart shows a market in transition. Price action is volatile with large bars and fast momentum, reflecting heightened activity and possible positioning ahead of a major move. Short- and intermediate-term Fib grid trends (WSFG, MSFG) are both down, with price below their respective NTZ/F0% levels, indicating recent weakness or a corrective phase. However, the long-term YSFG remains up, with price well above the yearly NTZ/F0%, suggesting the broader uptrend is intact. Swing pivots highlight an evolving uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 126005 and the next key support at 104090. Resistance levels are stacked above, while support is layered below, providing clear reference points for future price swings. All benchmark moving averages from 5 to 200 weeks are trending up, reinforcing the underlying bullish structure despite recent pullbacks. Recent trade signals are mixed, with both long and short entries triggered in the past week, reflecting the choppy, two-way action typical of a market consolidating after a strong advance. Overall, the short- and intermediate-term outlooks are neutral as the market digests gains and tests support, while the long-term trend remains bullish. This environment favors swing traders who can adapt to both breakout and mean-reversion setups, as the market oscillates between key levels within a larger uptrend.