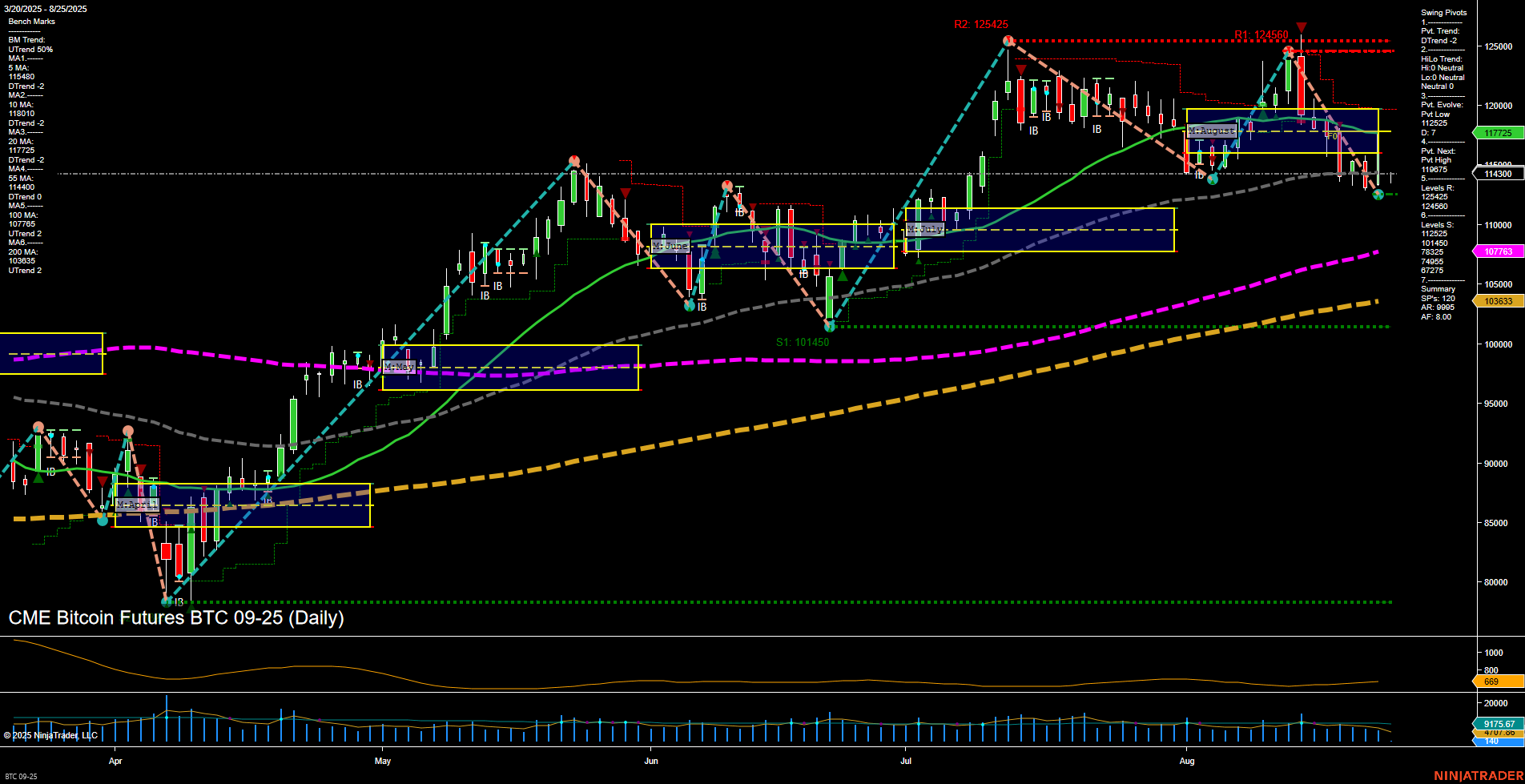

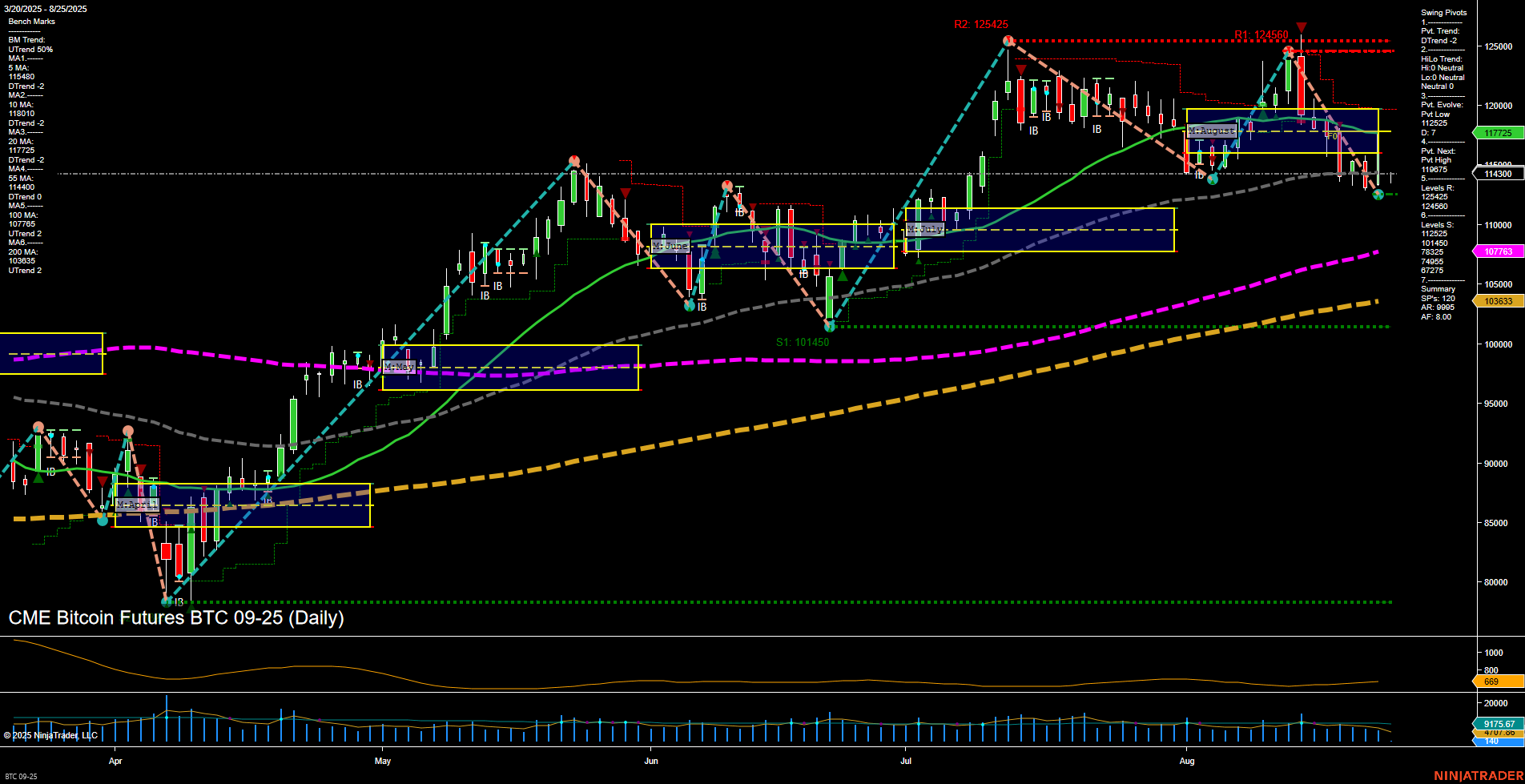

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Aug-24 18:02 CT

Price Action

- Last: 117725,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -60%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 56%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt Low 117225,

- 4. Pvt. Next: Pvt High 119875,

- 5. Levels R: 125425, 124650, 119875, 113905, 110450, 107275,

- 6. Levels S: 117225, 114400, 107653, 103633.

Daily Benchmarks

- (Short-Term) 5 Day: 118100 Down Trend,

- (Short-Term) 10 Day: 114800 Down Trend,

- (Intermediate-Term) 20 Day: 117725 Down Trend,

- (Intermediate-Term) 55 Day: 114400 Down Trend,

- (Long-Term) 100 Day: 107653 Up Trend,

- (Long-Term) 200 Day: 103633 Up Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Long BTC 08-25 @ 117245 Signals.USAR.TR120

- 19 Aug 2025: Short BTC 08-25 @ 113905 Signals.USAR-MSFG

- 19 Aug 2025: Short BTC 08-25 @ 113905 Signals.USAR.TR720

- 18 Aug 2025: Short BTC 08-25 @ 116615 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The current daily chart for CME Bitcoin Futures shows a market in transition. Short-term momentum is slow, with price action consolidating below key weekly and monthly session fib grid levels, indicating a bearish short-term bias. The swing pivot structure confirms a short-term downtrend, with the most recent pivot low at 117225 acting as immediate support, while resistance is layered above at 119875 and higher at 124650 and 125425. Intermediate-term signals are mixed, with the HiLo trend reading as neutral and the monthly fib grid also trending down, suggesting a lack of clear direction in the medium term. However, the long-term outlook remains bullish, supported by the yearly fib grid and both the 100-day and 200-day moving averages trending up. Recent trade signals reflect this mixed environment, with both long and short entries triggered in the past week. Volatility, as measured by ATR, remains moderate, and volume is steady. Overall, the market is in a corrective or consolidative phase, with short-term weakness but underlying long-term strength, typical of a market digesting prior gains and potentially setting up for the next directional move.

Chart Analysis ATS AI Generated: 2025-08-24 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.