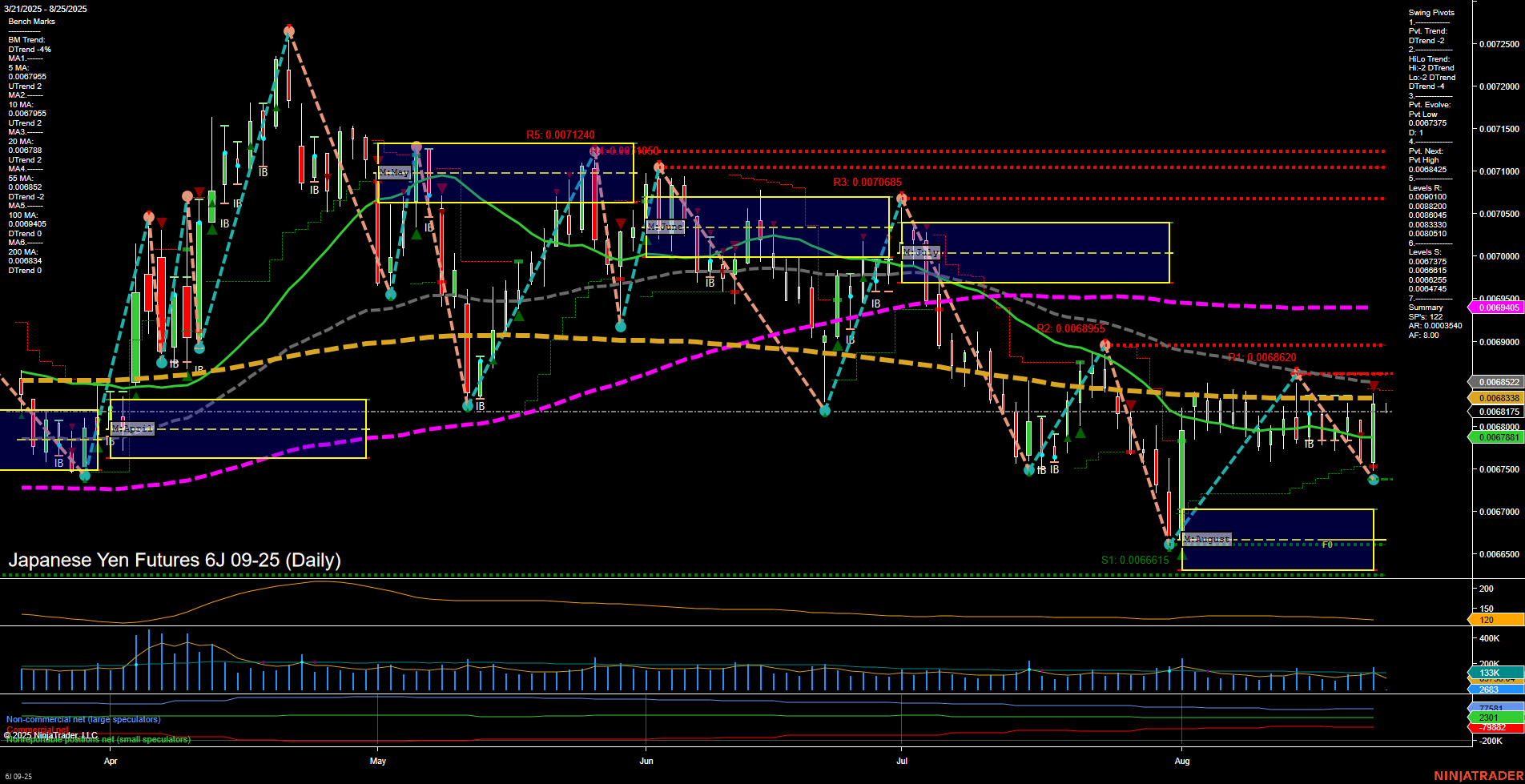

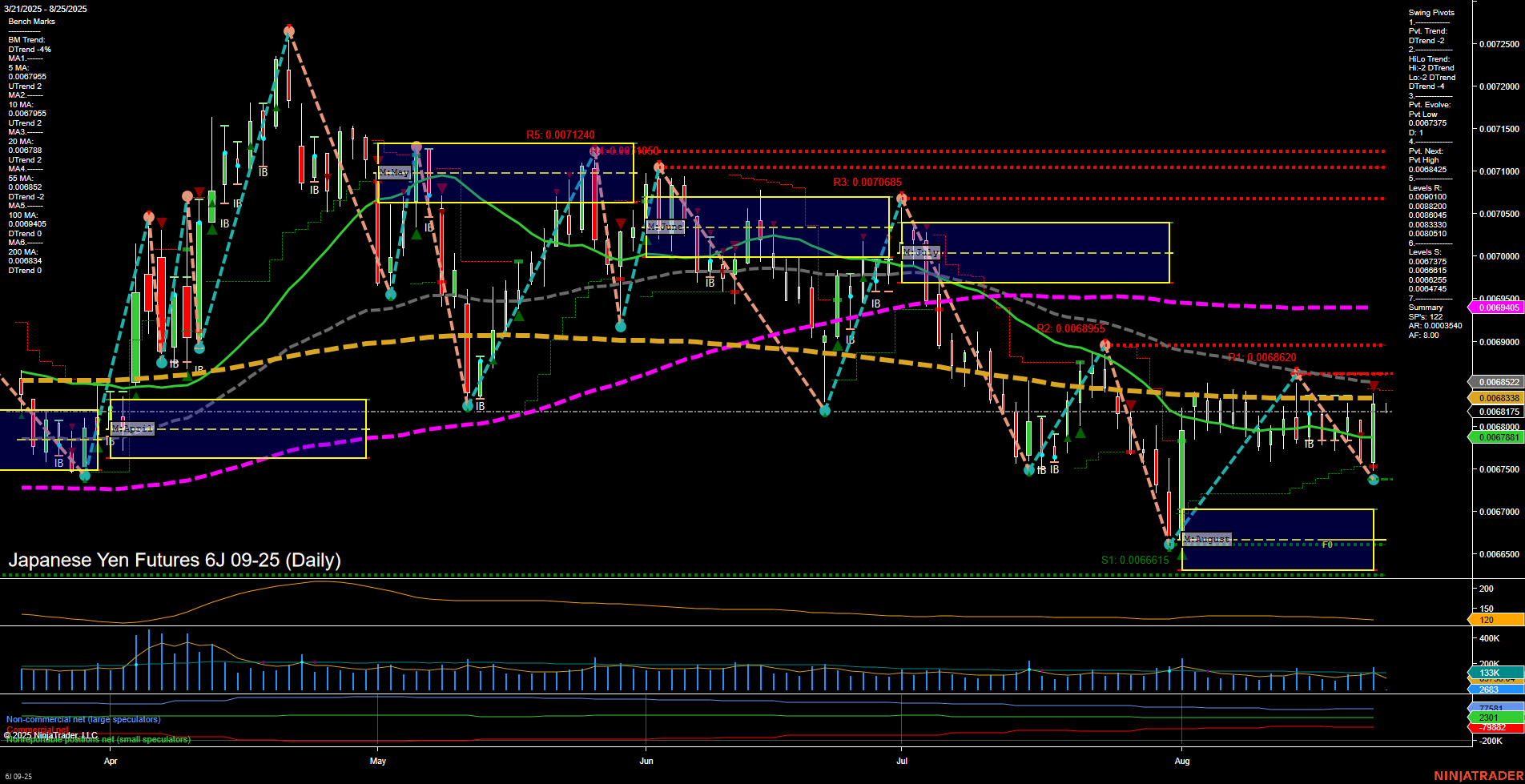

6J Japanese Yen Futures Daily Chart Analysis: 2025-Aug-24 18:01 CT

Price Action

- Last: 0.0067821,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 52%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0067375,

- 4. Pvt. Next: Pvt high 0.0068425,

- 5. Levels R: 0.0071240, 0.0070685, 0.0069855, 0.0068620, 0.0068425,

- 6. Levels S: 0.0067375, 0.0066615.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0067955 Down Trend,

- (Short-Term) 10 Day: 0.0067895 Down Trend,

- (Intermediate-Term) 20 Day: 0.0067881 Down Trend,

- (Intermediate-Term) 55 Day: 0.0068474 Down Trend,

- (Long-Term) 100 Day: 0.0069405 Down Trend,

- (Long-Term) 200 Day: 0.0068343 Down Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Long 6J 09-25 @ 0.006836 Signals.USAR.TR120

- 22 Aug 2025: Long 6J 09-25 @ 0.0068275 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen futures daily chart shows a market in a corrective phase, with price action characterized by medium-sized bars and average momentum. The short-term WSFG trend is down, with price trading below the weekly NTZ, indicating persistent short-term weakness. Both the short-term and intermediate-term swing pivot trends are in a downtrend, with the most recent pivot low at 0.0067375 and the next potential reversal at the pivot high of 0.0068425. Resistance levels are stacked above, with significant barriers at 0.0071240 and 0.0070685, while support is found at 0.0067375 and 0.0066615. All benchmark moving averages across short, intermediate, and long-term horizons are trending down, reinforcing the overall bearish structure. Despite recent long trade signals, the prevailing technical environment remains negative, with the market struggling to sustain rallies and facing overhead resistance. Volatility is moderate, as reflected by the ATR and volume metrics. The chart suggests a market in a consolidation or potential basing phase, but with no clear evidence of a sustained reversal yet, as sellers continue to dominate the trend structure.

Chart Analysis ATS AI Generated: 2025-08-24 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.