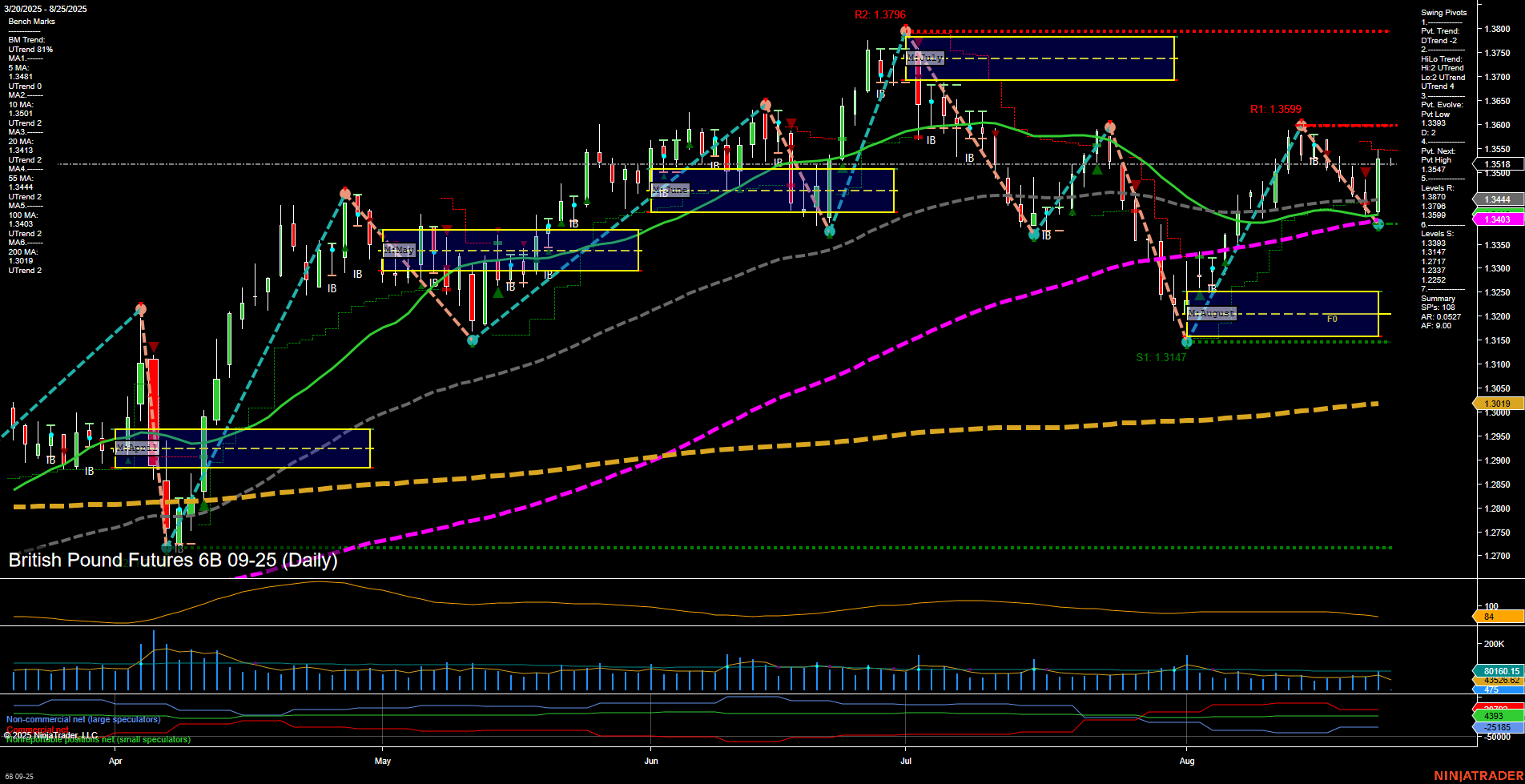

The British Pound Futures (6B) daily chart shows a market in transition. Price action is currently consolidating near 1.3547 with medium-sized bars and average momentum, reflecting a pause after recent directional moves. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term weakness or corrective action. However, the intermediate and long-term MSFG and YSFG trends remain up, with price above their respective NTZs, suggesting underlying bullish structure. Swing pivots highlight a recent pivot high at 1.3599 and a next potential pivot low at 1.3302, with resistance at 1.3796 and 1.3599, and support at 1.3147 and 1.3302. This sets up a range-bound environment with possible tests of both support and resistance in the coming sessions. All benchmark moving averages (from 5-day to 200-day) are trending up, reinforcing the broader bullish bias despite short-term choppiness. ATR and volume metrics indicate moderate volatility and steady participation. Recent trade signals show both long and short entries, reflecting the mixed short-term signals and the potential for tactical swings within the broader uptrend. Overall, the market is in a consolidation phase short-term, but the intermediate and long-term outlooks remain constructive, with the potential for trend continuation if resistance levels are overcome.