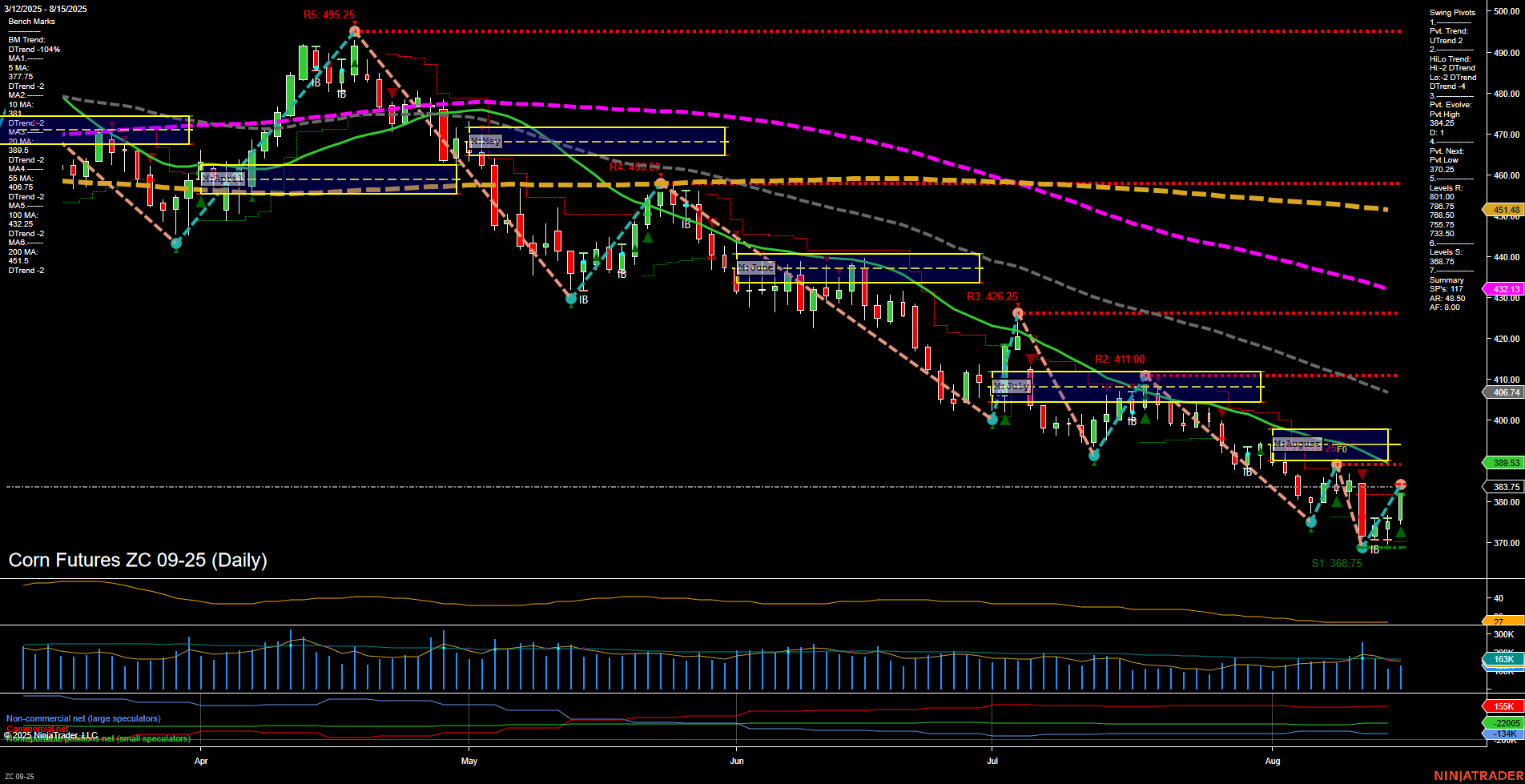

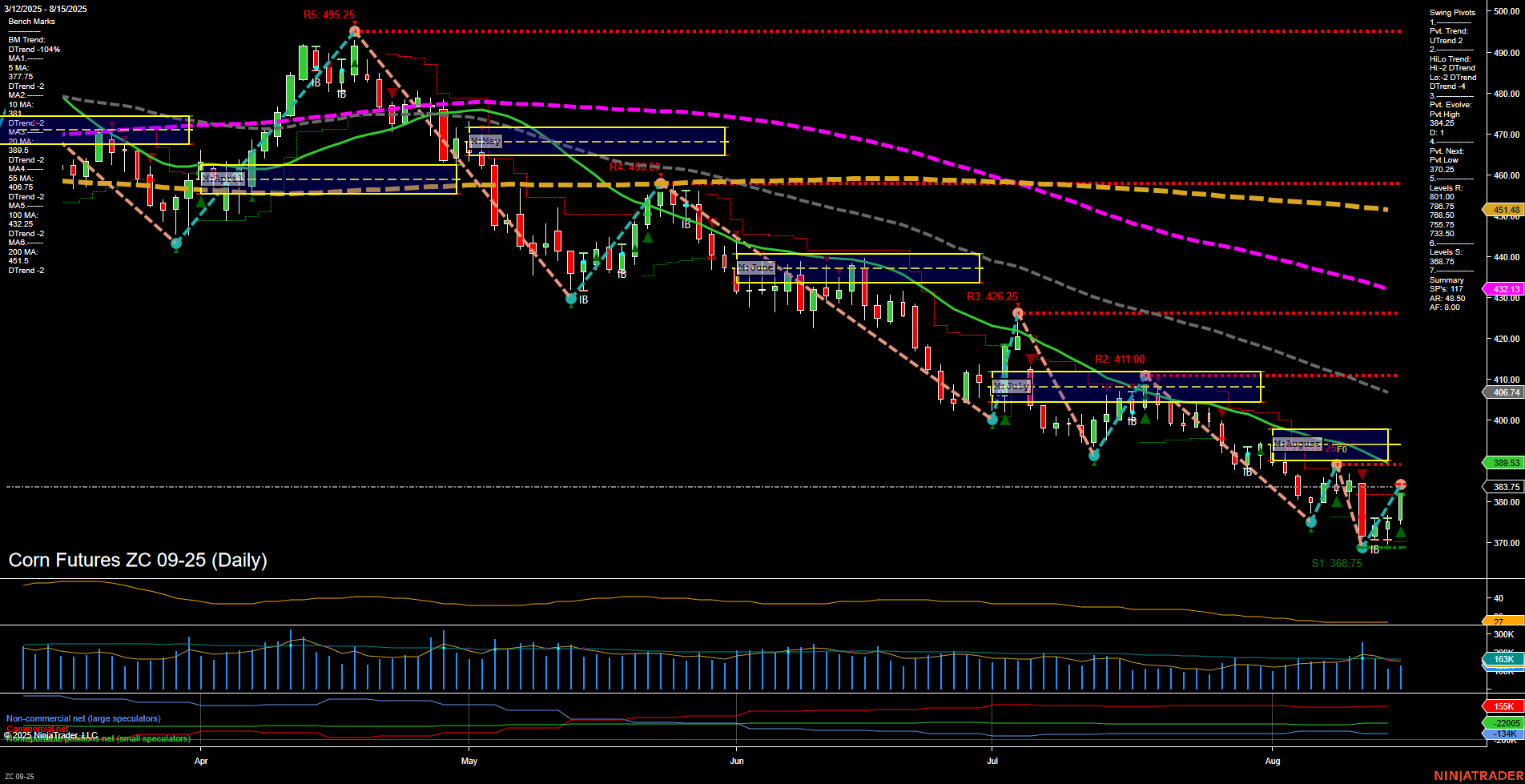

ZC Corn Futures Daily Chart Analysis: 2025-Aug-17 18:11 CT

Price Action

- Last: 383.75,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -28%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -56%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 368.75,

- 4. Pvt. Next: Pvt high 389.75,

- 5. Levels R: 389.75, 411.00, 426.25, 459.25, 495.25,

- 6. Levels S: 368.75.

Daily Benchmarks

- (Short-Term) 5 Day: 377.75 Down Trend,

- (Short-Term) 10 Day: 383.9 Down Trend,

- (Intermediate-Term) 20 Day: 389.53 Down Trend,

- (Intermediate-Term) 55 Day: 406.76 Down Trend,

- (Long-Term) 100 Day: 432.13 Down Trend,

- (Long-Term) 200 Day: 451.48 Down Trend.

Additional Metrics

Recent Trade Signals

- 15 Aug 2025: Long ZC 09-25 @ 377.75 Signals.USAR.TR120

- 11 Aug 2025: Short ZC 09-25 @ 386.25 Signals.USAR-MSFG

- 11 Aug 2025: Long ZC 09-25 @ 386.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures remain in a broad downtrend across intermediate and long-term timeframes, as confirmed by the negative MSFG and YSFG readings, persistent DTrend in swing pivots, and all major moving averages trending lower. The recent price action shows a modest bounce from the 368.75 swing low, with average momentum and medium-sized bars, but the recovery is encountering resistance near the 389.75 pivot and the 20-day moving average. Short-term signals are mixed, with a recent long entry following a prior short, reflecting choppy, two-way trade as the market tests support and resistance levels. The weekly fib grid bias is slightly positive, but the overall structure suggests rallies are being sold and the path of least resistance remains down unless price can reclaim and hold above key resistance levels. Volatility is moderate, and volume remains steady, indicating active participation but no clear directional conviction. The market is in a corrective phase within a dominant downtrend, with potential for further consolidation or a retest of recent lows if resistance holds.

Chart Analysis ATS AI Generated: 2025-08-17 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.