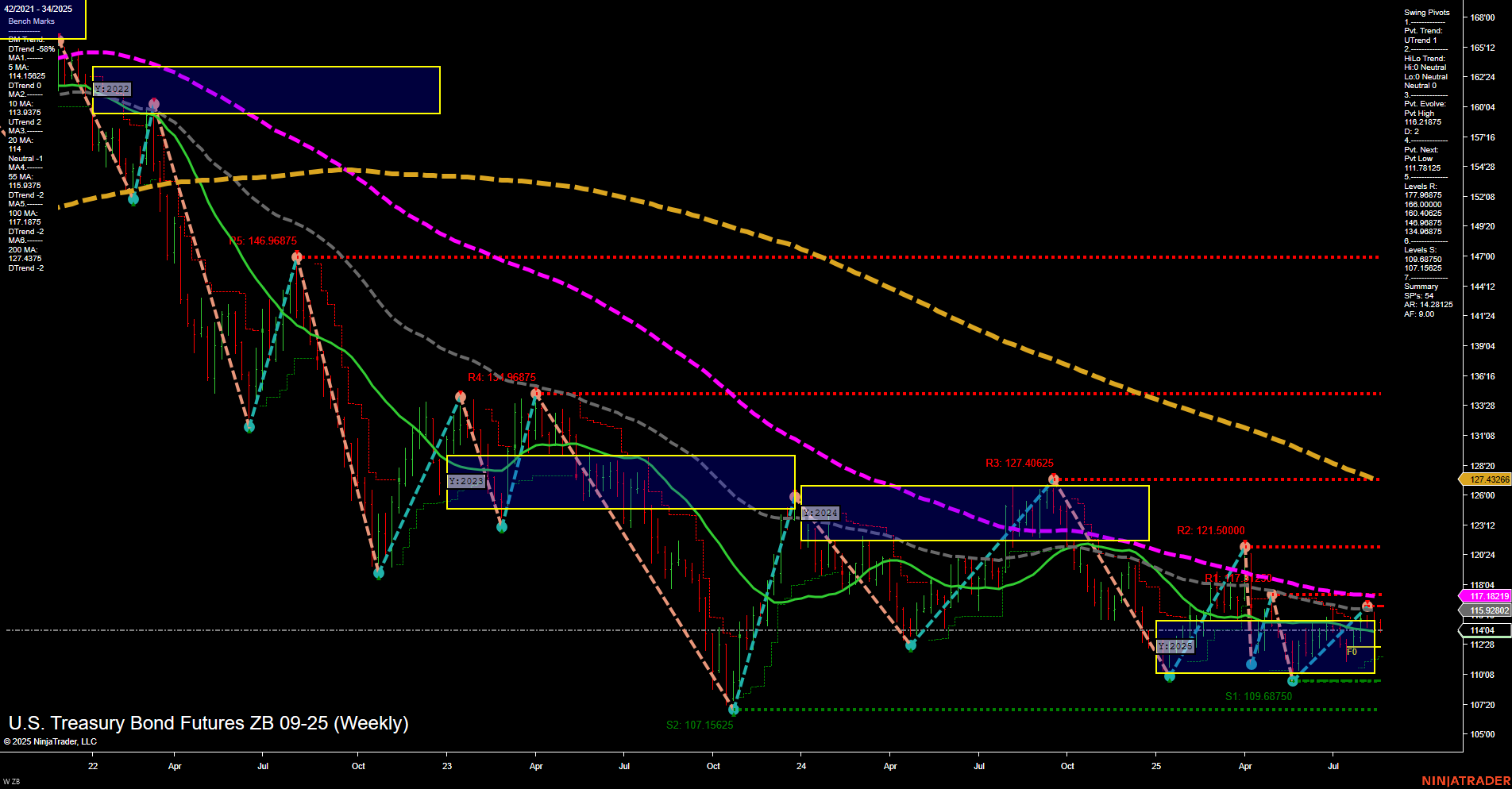

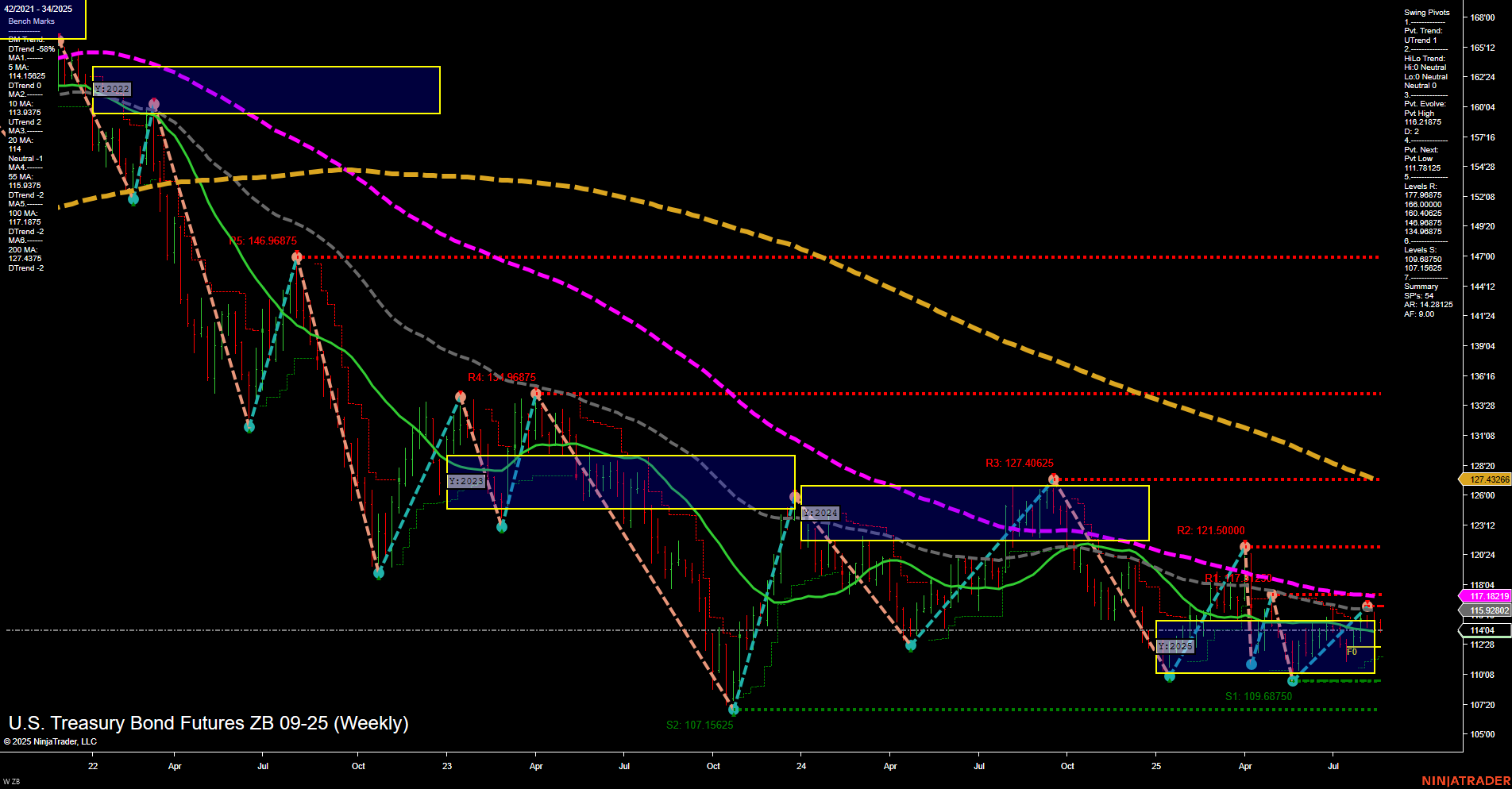

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-17 18:11 CT

Price Action

- Last: 127.43,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 116.21875,

- 4. Pvt. Next: Pvt low 111.71875,

- 5. Levels R: 146.96875, 134.96875, 127.40625, 121.50000, 116.00000,

- 6. Levels S: 109.68750, 107.15625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 114.19 Up Trend,

- (Intermediate-Term) 10 Week: 113.09 Up Trend,

- (Long-Term) 20 Week: 117.18 Up Trend,

- (Long-Term) 55 Week: 115.89 Down Trend,

- (Long-Term) 100 Week: 118.75 Down Trend,

- (Long-Term) 200 Week: 134.97 Down Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in consolidation, with price action contained within a broad neutral zone as indicated by the NTZ and F0% levels across all timeframes. The most recent swing pivot trend is up in the short term, but the intermediate-term HiLo trend remains neutral, reflecting a lack of clear directional conviction. Resistance levels are stacked well above current price, with the nearest significant resistance at 127.41 and major resistance at 134.97 and 146.97, while support is found at 109.68 and 107.15. Moving averages show a mixed picture: short and intermediate-term MAs are trending up, but longer-term MAs (55, 100, 200 week) remain in a downtrend, reinforcing a bearish long-term bias. Momentum is slow, and the market is likely digesting previous moves, with no strong breakout or breakdown evident. This environment suggests a choppy, range-bound market with potential for mean reversion trades, but no clear trend continuation or reversal signal at this time.

Chart Analysis ATS AI Generated: 2025-08-17 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.