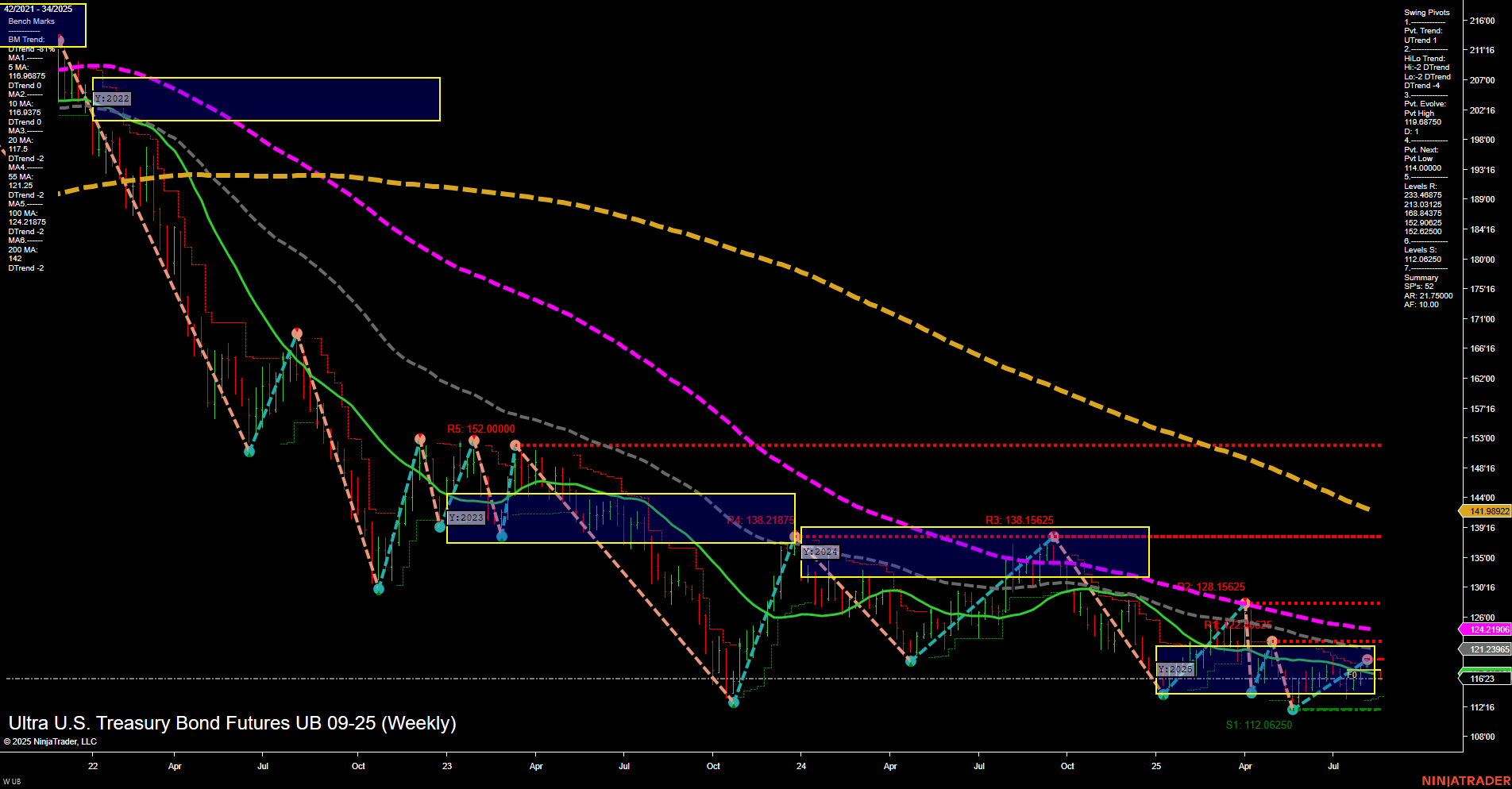

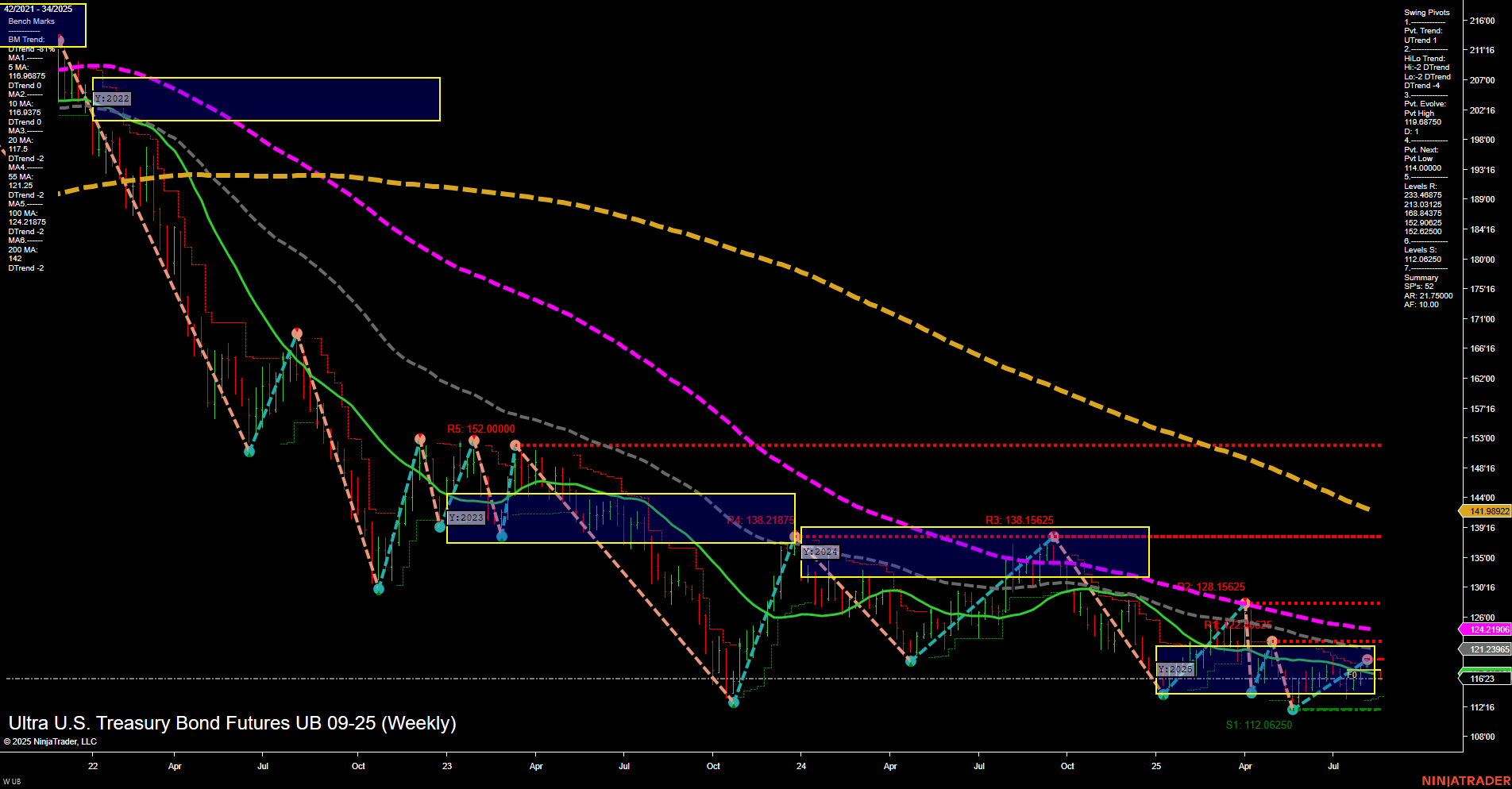

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-17 18:09 CT

Price Action

- Last: 117.71875,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 119.87500,

- 4. Pvt. Next: Pvt low 114.00000,

- 5. Levels R: 152.00000, 138.21875, 128.15625, 126.30475, 124.80425, 121.89225,

- 6. Levels S: 112.06250.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 119.09875 Down Trend,

- (Intermediate-Term) 10 Week: 119.0975 Down Trend,

- (Long-Term) 20 Week: 121.2395 Down Trend,

- (Long-Term) 55 Week: 124.21906 Down Trend,

- (Long-Term) 100 Week: 141.89822 Down Trend,

- (Long-Term) 200 Week: 149.74875 Down Trend.

Recent Trade Signals

- 15 Aug 2025: Short UB 09-25 @ 117.71875 Signals.USAR-WSFG

- 14 Aug 2025: Short UB 09-25 @ 117.5625 Signals.USAR.TR120

- 13 Aug 2025: Long UB 09-25 @ 118.3125 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart reflects a market in a prolonged downtrend, with all major long-term moving averages (20, 55, 100, 200 week) trending lower and price trading well below these benchmarks. The short-term WSFG trend has turned up, with price just above the weekly NTZ center, but momentum remains slow and recent bars are of medium size, suggesting a lack of strong conviction. Intermediate and long-term Fib grid trends remain down, with price below both the monthly and yearly NTZ centers, reinforcing the dominant bearish structure. Swing pivots show a short-term uptrend but an intermediate-term downtrend, with the next key support at 114.00 and major resistance levels overhead, notably at 121.89, 124.80, and 128.15. Recent trade signals have shifted to short, aligning with the prevailing intermediate and long-term bearish bias. Overall, the market is in a corrective or consolidative phase within a broader downtrend, with any short-term strength facing significant resistance from both technical levels and moving averages. The environment remains challenging for sustained rallies, and the structure favors trend continuation to the downside unless a decisive breakout above key resistance levels occurs.

Chart Analysis ATS AI Generated: 2025-08-17 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.