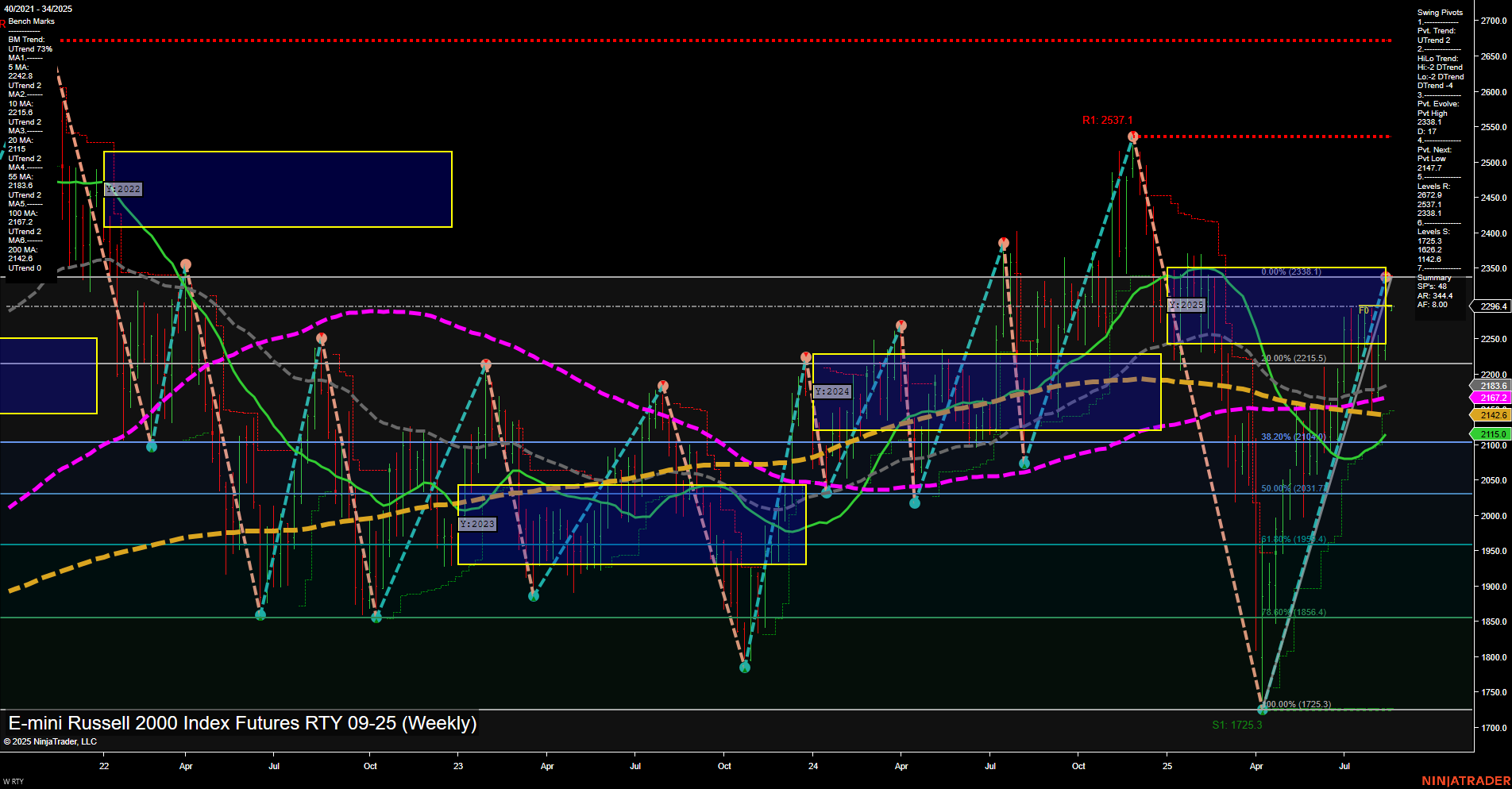

The RTY E-mini Russell 2000 Index Futures weekly chart shows a strong short-term bullish momentum, with price action characterized by large bars and fast momentum. The WSFG and MSFG both indicate an upward trend, with price holding above their respective NTZ/F0% levels, suggesting continued buying interest in the short and intermediate timeframes. However, the yearly grid (YSFG) remains neutral, reflecting a lack of clear long-term directional conviction. Swing pivots highlight an ongoing uptrend in the short term, but the intermediate-term HiLo trend is still down, indicating that the market is in a recovery phase from a previous decline. Key resistance is seen at 2537.1 and 2431.7, while support levels are clustered around 2147.5, 2115.0, and a major low at 1725.3. Benchmark moving averages show a strong uptrend in the 5, 10, 20, and 55-week periods, but the 100 and 200-week MAs are still in a downtrend, underscoring the mixed long-term outlook. Recent trade signals reflect both bullish and bearish activity, with a short signal following two recent longs, suggesting some short-term profit-taking or hedging after a strong rally. Overall, the market is in a bullish short-term phase, with intermediate and long-term trends still working through prior bearishness. The price is testing higher levels after a sharp recovery, but faces significant resistance overhead. The environment is dynamic, with volatility and potential for both trend continuation and corrective pullbacks as the market digests recent gains.