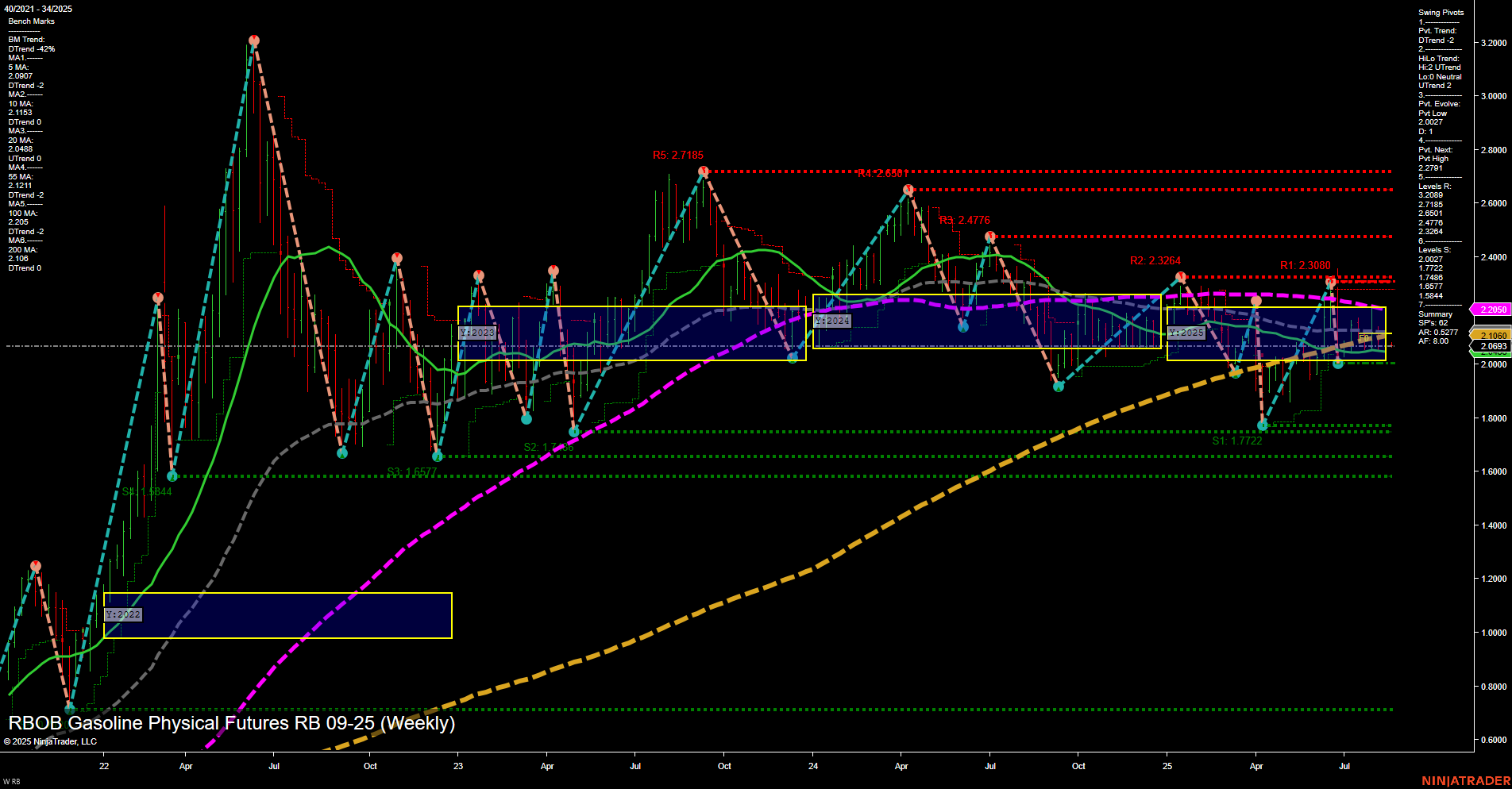

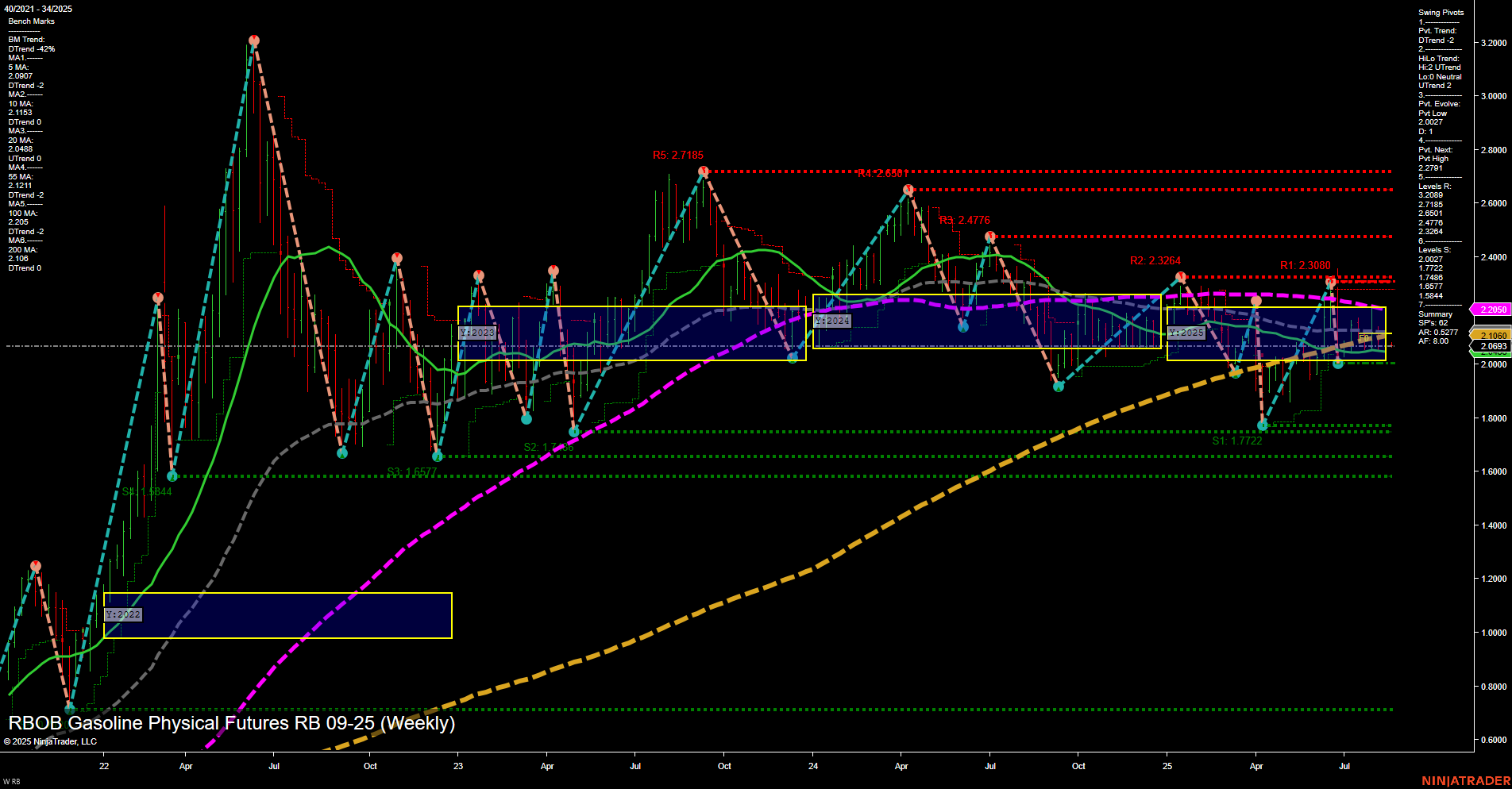

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Aug-17 18:07 CT

Price Action

- Last: 2.0693,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -42%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.027,

- 4. Pvt. Next: Pvt high 2.2091,

- 5. Levels R: 2.3080, 2.3264, 2.4776, 2.6581, 2.7185,

- 6. Levels S: 1.7722, 1.8748, 1.9447, 2.027.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2.0667 Down Trend,

- (Intermediate-Term) 10 Week: 2.0488 Down Trend,

- (Long-Term) 20 Week: 2.1139 Down Trend,

- (Long-Term) 55 Week: 2.0541 Down Trend,

- (Long-Term) 100 Week: 2.2055 Down Trend,

- (Long-Term) 200 Week: 2.0600 Down Trend.

Recent Trade Signals

- 15 Aug 2025: Short RB 09-25 @ 2.0797 Signals.USAR.TR120

- 14 Aug 2025: Long RB 09-25 @ 2.0835 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures market is currently exhibiting a slow momentum with medium-sized weekly bars, reflecting a period of consolidation after recent volatility. Price is trading below the key F0%/NTZ levels across all timeframes, with the short-term, intermediate-term, and long-term Fib Grid trends all pointing down. The most recent swing pivot trend is down, though the intermediate HiLo trend remains up, suggesting some underlying support from previous lows. Resistance levels are stacked above current price, with the nearest at 2.3080, while support is found at 2.027 and lower at 1.9447 and 1.8748. All benchmark moving averages are trending down, reinforcing the broader bearish structure. Recent trade signals show mixed short-term activity, but the prevailing technicals favor a cautious stance as the market remains below major resistance and within a broad range. The overall environment is characterized by a lack of strong directional conviction, with the potential for further downside unless a significant reversal develops above resistance levels.

Chart Analysis ATS AI Generated: 2025-08-17 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.