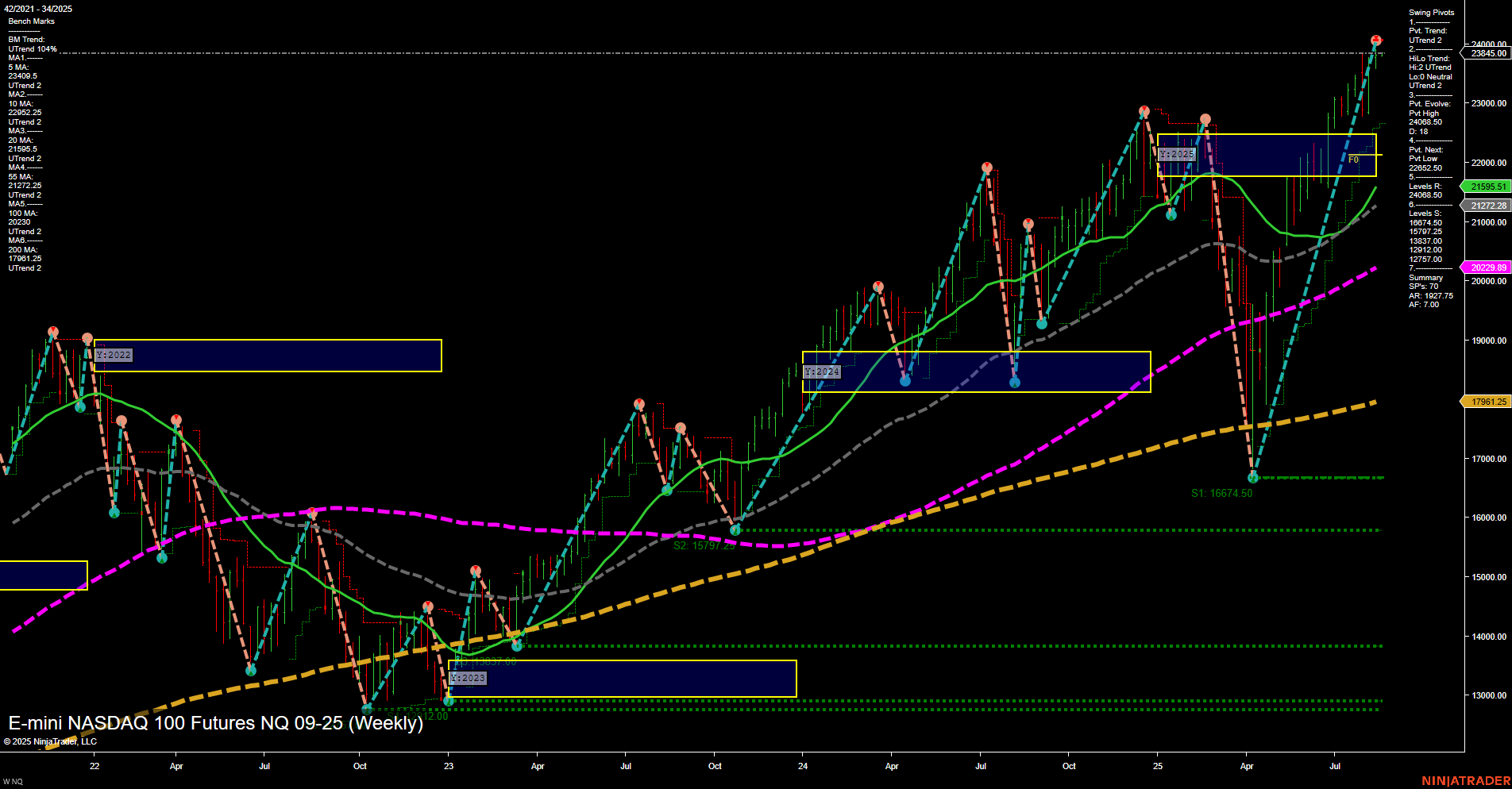

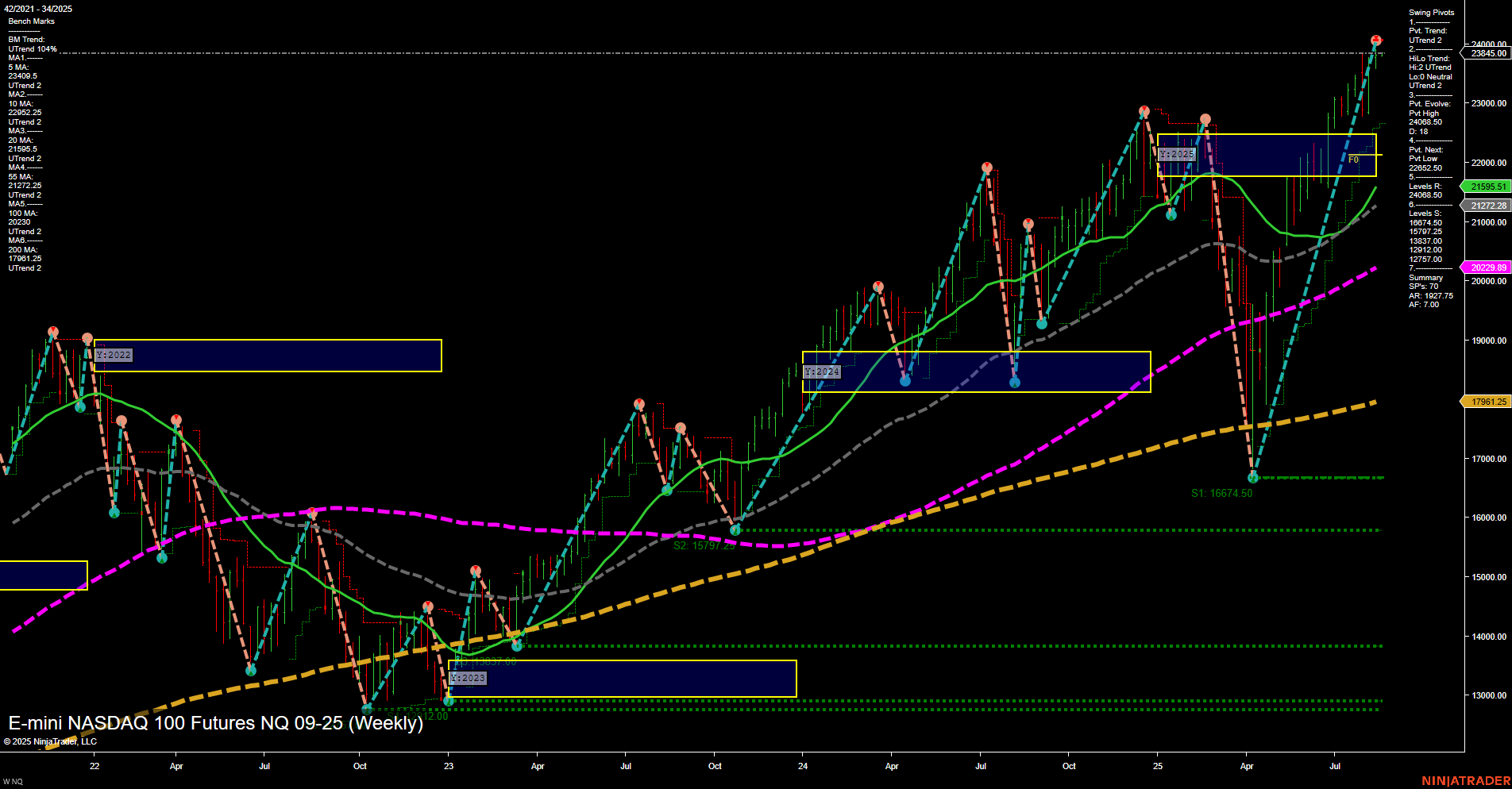

NQ E-mini NASDAQ 100 Futures Weekly Chart Analysis: 2025-Aug-17 18:07 CT

Price Action

- Last: 23440.00,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 30%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 23440.00,

- 4. Pvt. Next: Pvt Low 20408.00,

- 5. Levels R: 23440.00, 22652.50, 22405.50, 21872.25, 21000.00,

- 6. Levels S: 16674.50, 15797.25, 13277.00, 12717.00.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 21595.51 Up Trend,

- (Intermediate-Term) 10 Week: 21272.28 Up Trend,

- (Long-Term) 20 Week: 20229.89 Up Trend,

- (Long-Term) 55 Week: 17961.25 Up Trend,

- (Long-Term) 100 Week: 20029.99 Up Trend,

- (Long-Term) 200 Week: 17781.25 Up Trend.

Recent Trade Signals

- 15 Aug 2025: Short NQ 09-25 @ 23787.75 Signals.USAR.TR120

- 12 Aug 2025: Long NQ 09-25 @ 23867.5 Signals.USAR-WSFG

- 12 Aug 2025: Long NQ 09-25 @ 23665.75 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures weekly chart shows a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, with the last price at 23,440.00, marking a new swing high. All major session fib grid trends (weekly, monthly, yearly) are up, with price holding above their respective NTZ/F0% levels, confirming persistent upward bias. Swing pivots indicate an evolving uptrend, with the next significant support well below current levels, suggesting a wide buffer for pullbacks. Resistance levels are being tested and surpassed, while support remains unchallenged since the last major low. All benchmark moving averages from short to long term are trending upward, reinforcing the prevailing bullish sentiment. Recent trade signals reflect both long and short tactical entries, but the dominant direction remains up. The market is in a strong trend phase, with higher highs and higher lows, and no immediate signs of reversal or exhaustion. This environment is typically favorable for trend-following strategies, with volatility and momentum supporting continued movement in the prevailing direction.

Chart Analysis ATS AI Generated: 2025-08-17 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.