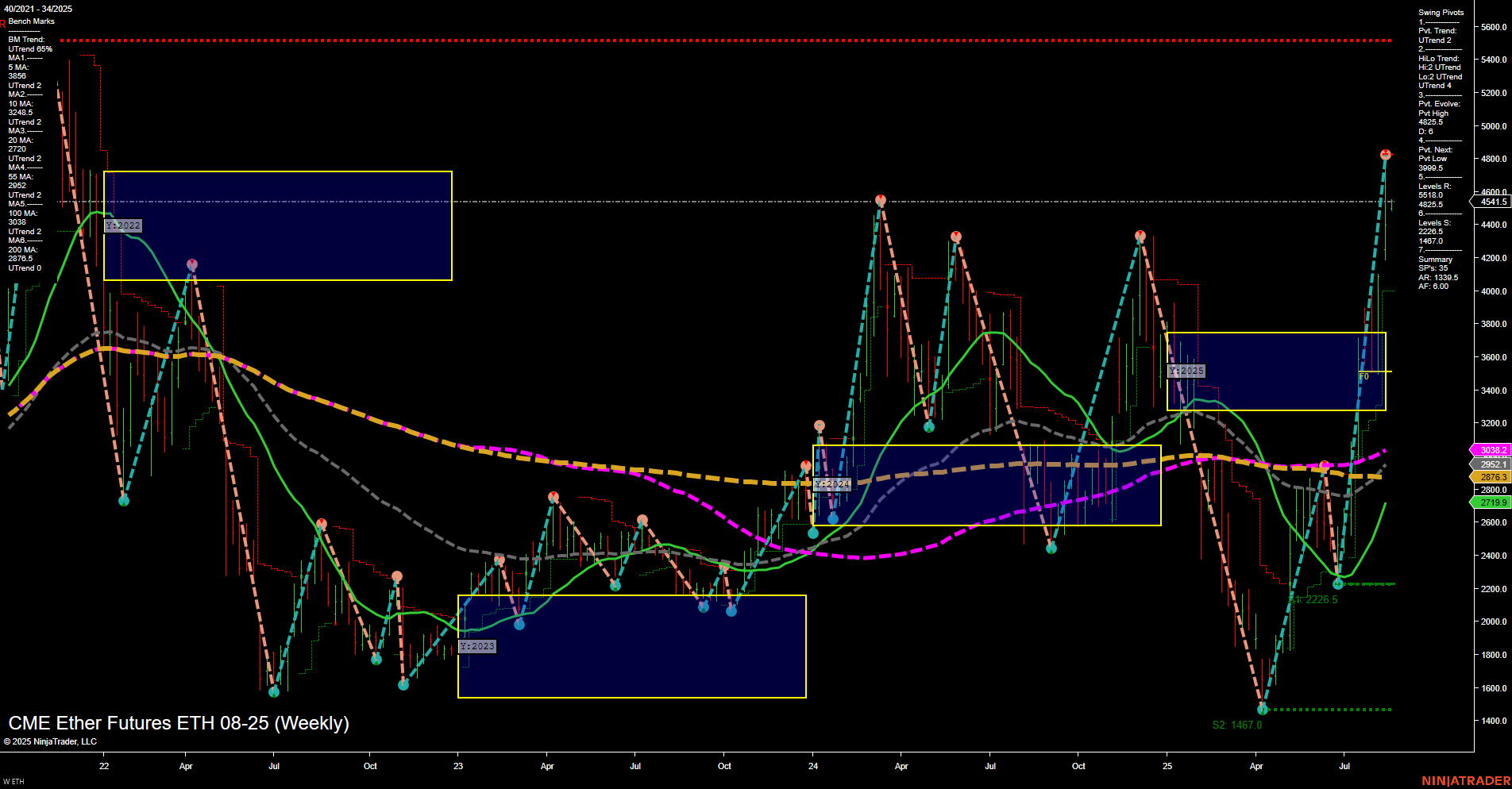

The ETH CME Ether Futures weekly chart shows a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating heightened volatility and strong directional conviction. The price is trading well above all major moving averages, with each benchmark (5, 10, 20, 55, 100, and 200 week) in a confirmed uptrend, reinforcing the underlying strength. The Weekly, Monthly, and Yearly Session Fib Grids all show price above their respective NTZ/F0% levels, with each grid trending upward, suggesting alignment of short, intermediate, and long-term bullish sentiment. Swing pivot analysis highlights an evolving uptrend, with the most recent pivot high at 4542.5 and the next significant support at 2226.5, indicating a wide range for potential retracement but no immediate threat to the uptrend. Resistance levels are noted at 4825.5 and 5895.0, which may act as future targets or pause points. The recent short signal on 14 Aug 2025 appears to be a counter-trend move within a dominant bullish environment, possibly targeting a short-term pullback or mean reversion. Overall, the chart reflects a market in a strong uptrend, with synchronized bullish signals across all technical frameworks. The environment is supportive of trend continuation, though the presence of large bars and fast momentum suggests the potential for sharp swings and volatility spikes. The structure favors trend-following strategies, with key levels to watch for potential resistance and support as the market progresses.