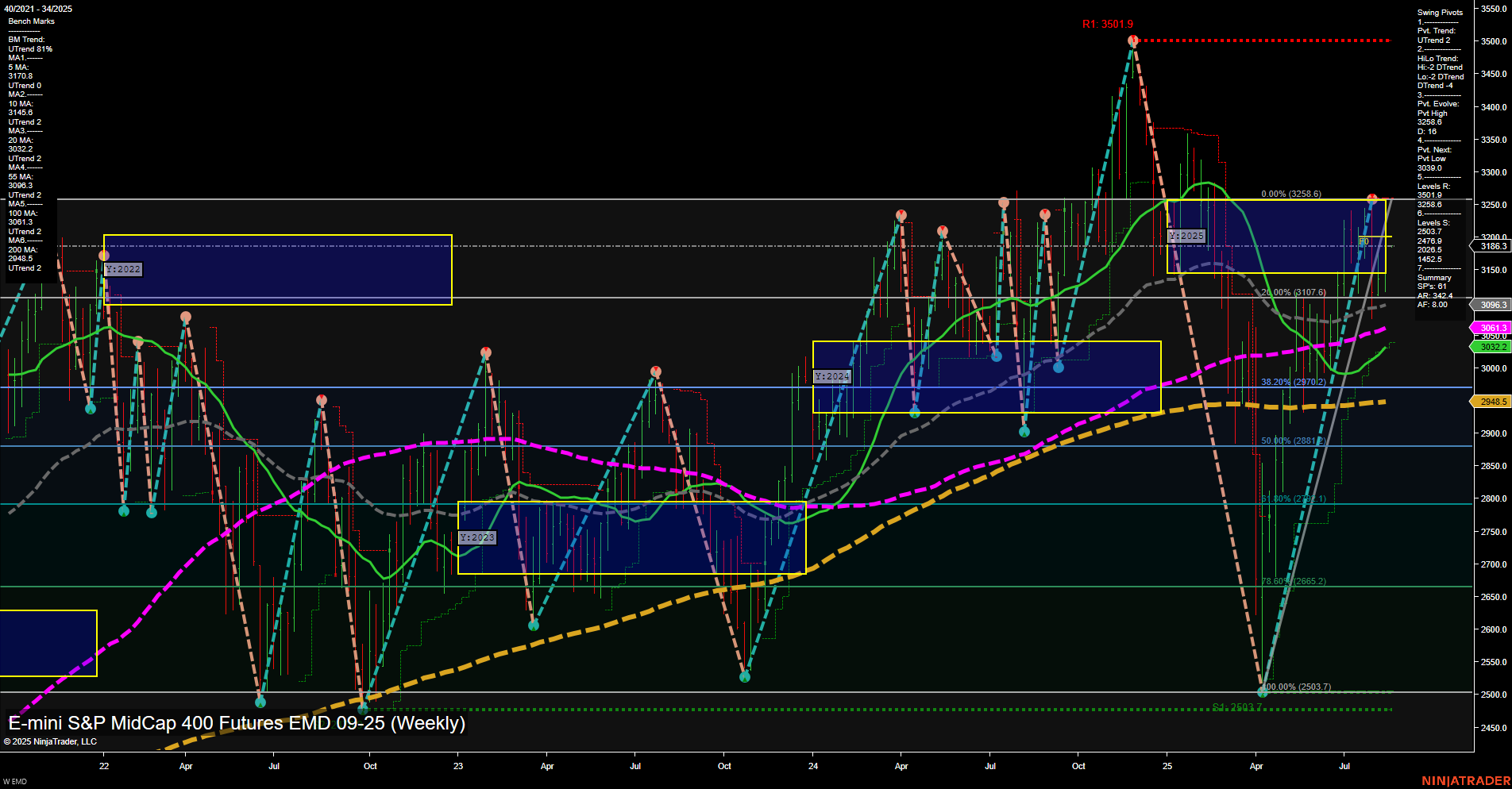

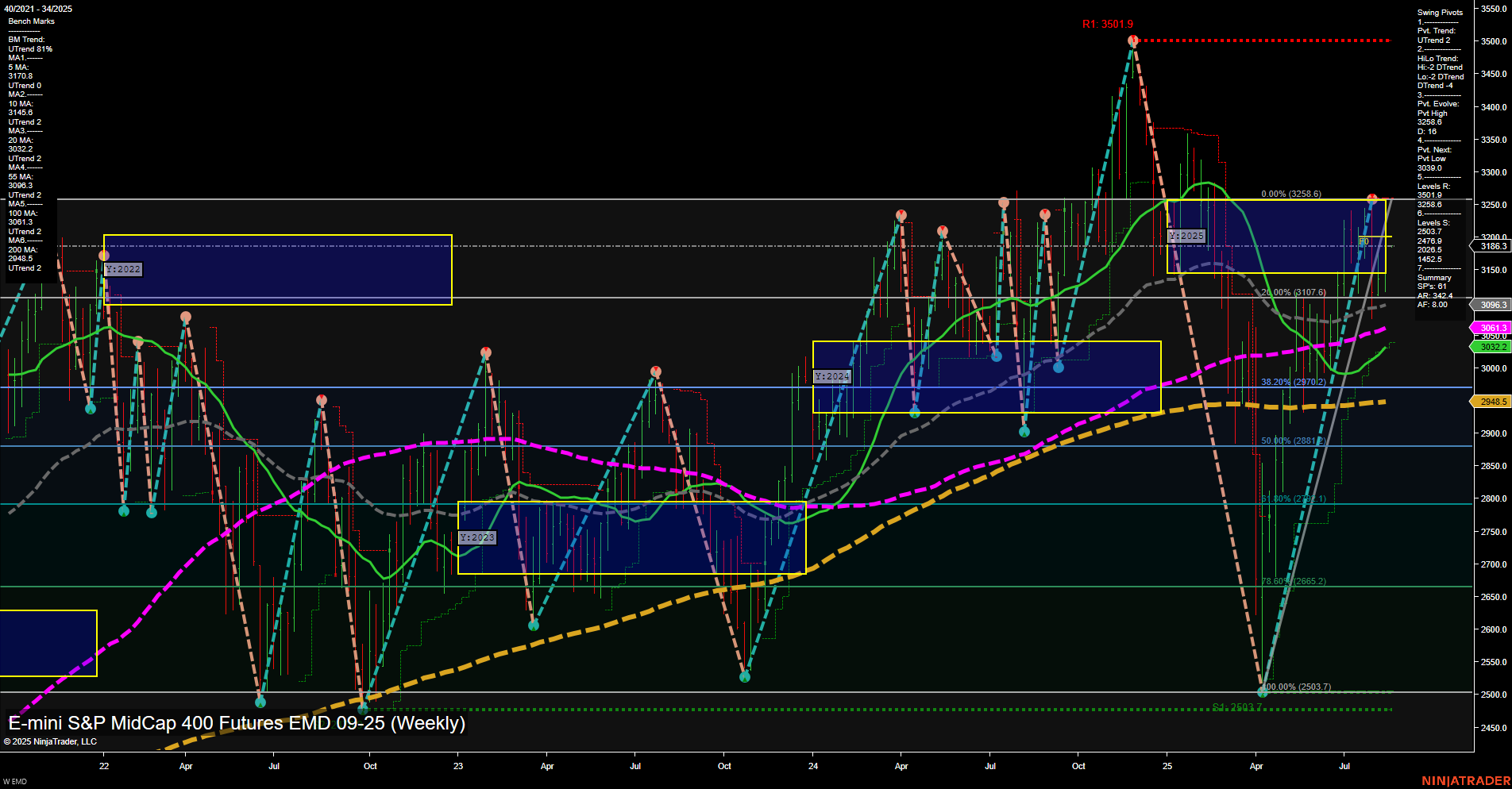

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Aug-17 18:03 CT

Price Action

- Last: 3188.6,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3258.6,

- 4. Pvt. Next: Pvt low 3109.0,

- 5. Levels R: 3501.9, 3258.6,

- 6. Levels S: 3109.0, 2945.5, 2902.5, 2665.2, 2503.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3144.6 Up Trend,

- (Intermediate-Term) 10 Week: 3096.3 Up Trend,

- (Long-Term) 20 Week: 3032.2 Up Trend,

- (Long-Term) 55 Week: 2970.2 Up Trend,

- (Long-Term) 100 Week: 2945.5 Up Trend,

- (Long-Term) 200 Week: 2945.5 Up Trend.

Recent Trade Signals

- 14 Aug 2025: Short EMD 09-25 @ 3194.7 Signals.USAR.TR120

- 13 Aug 2025: Long EMD 09-25 @ 3210.6 Signals.USAR-MSFG

- 11 Aug 2025: Short EMD 09-25 @ 3125.2 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The EMD futures are exhibiting strong short-term bullish momentum, with price action characterized by large bars and fast momentum, and the current price trading above the weekly and monthly session fib grid centers. The short-term swing pivot trend is up, supported by a series of higher highs, while the intermediate-term HiLo trend remains down, indicating some underlying caution as the market digests recent gains. All key moving averages from 5 to 200 weeks are trending upward, reflecting a broad-based recovery from the spring lows and a supportive technical backdrop. However, the yearly session fib grid trend is still down, and price remains just below the annual NTZ center, suggesting that the longer-term structure is still in a corrective or consolidative phase. Resistance is noted at 3258.6 and the major swing high at 3501.9, while support is layered at 3109.0 and further below at 2945.5 and 2902.5. Recent trade signals show mixed short-term activity, with both long and short entries triggered in a volatile environment. Overall, the market is in a short-term uptrend with intermediate and long-term trends in transition, reflecting a market that is attempting to recover but still faces overhead resistance and potential for further consolidation.

Chart Analysis ATS AI Generated: 2025-08-17 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.