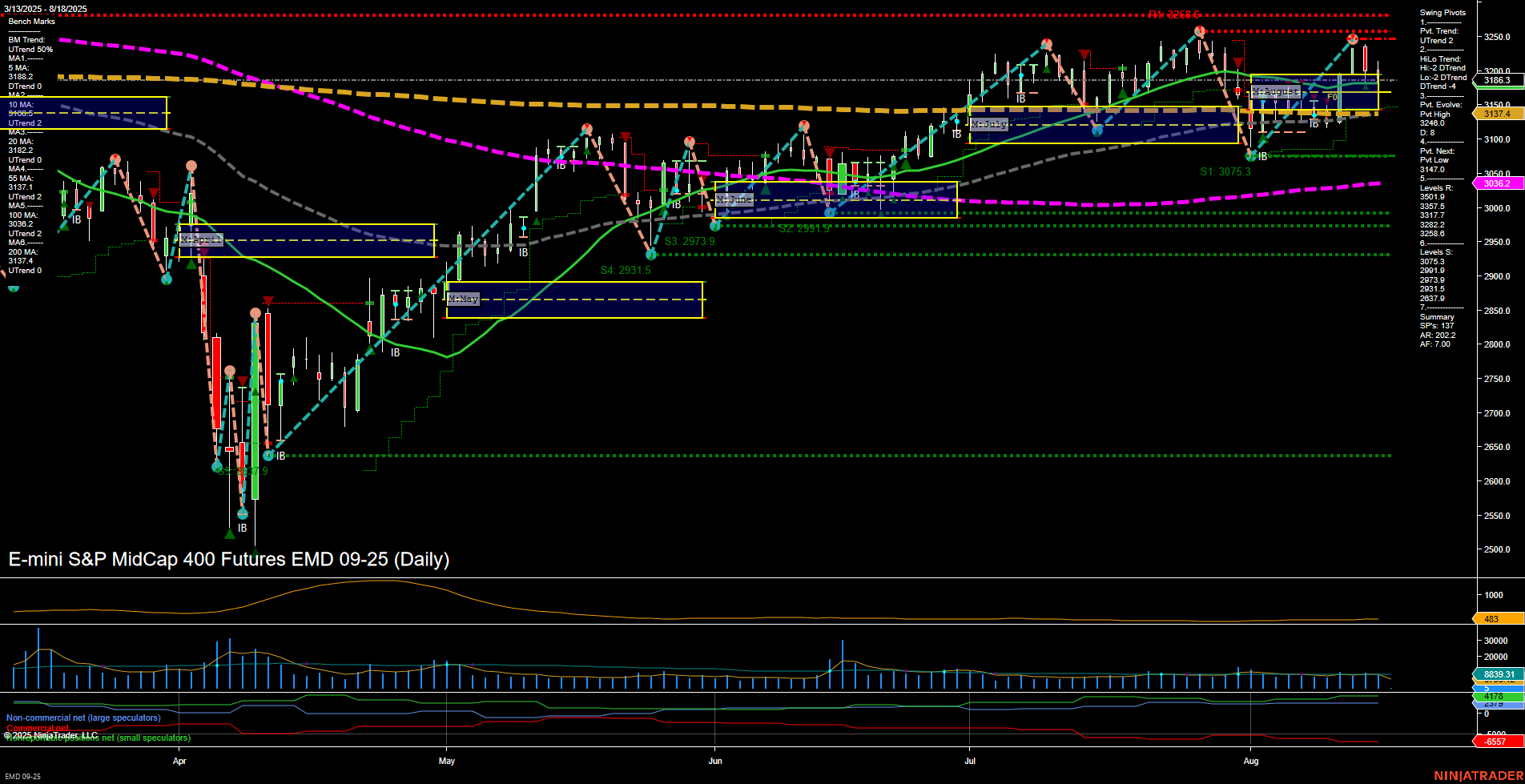

The EMD futures daily chart shows a market in transition, with mixed signals across timeframes. Short-term price action is consolidating after a recent pullback, as indicated by medium-sized bars and average momentum. The weekly and monthly session fib grids both show price holding above their respective NTZ/F0% levels, supporting an upward bias in the short and intermediate term. However, the yearly grid remains negative, with price below the annual NTZ/F0%, reflecting a longer-term downtrend. Swing pivots highlight a short-term uptrend, but the intermediate-term HiLo trend is down, suggesting a possible corrective phase within a broader up move. Resistance is layered above at 3186–3265, while support is well below at 3075 and 2973, indicating a wide trading range. Moving averages are mixed: short-term MAs are trending down, while intermediate and some long-term MAs are up, but the 200-day MA is still in a downtrend, reinforcing the longer-term bearish backdrop. ATR and volume metrics suggest moderate volatility and participation. Recent trade signals have alternated between short and long, reflecting the choppy, indecisive nature of the current market. Overall, the market is in a consolidation phase with no clear directional conviction in the short and intermediate term, while the long-term trend remains under pressure. Swing traders may observe for a decisive breakout above resistance or breakdown below support to clarify the next major move.