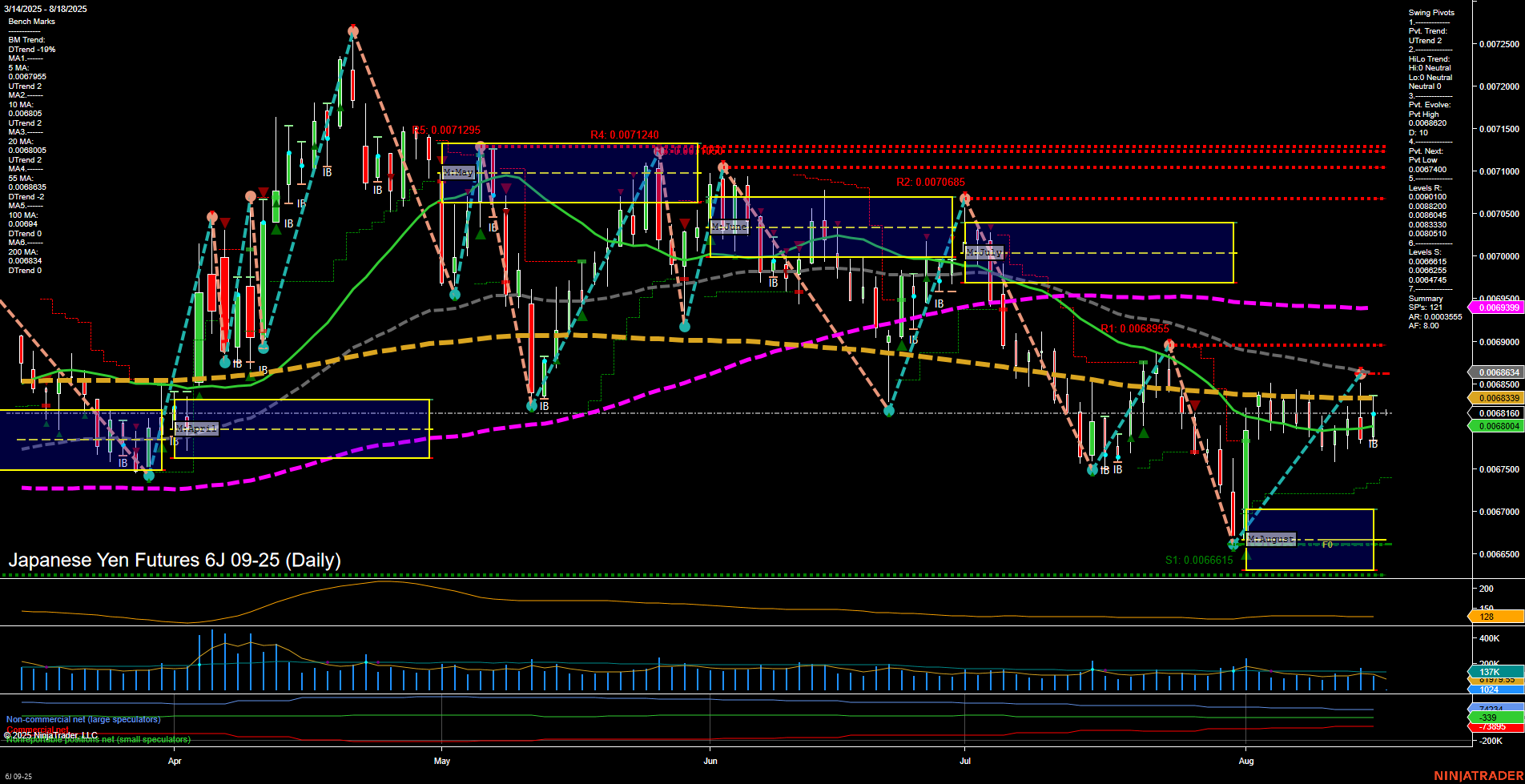

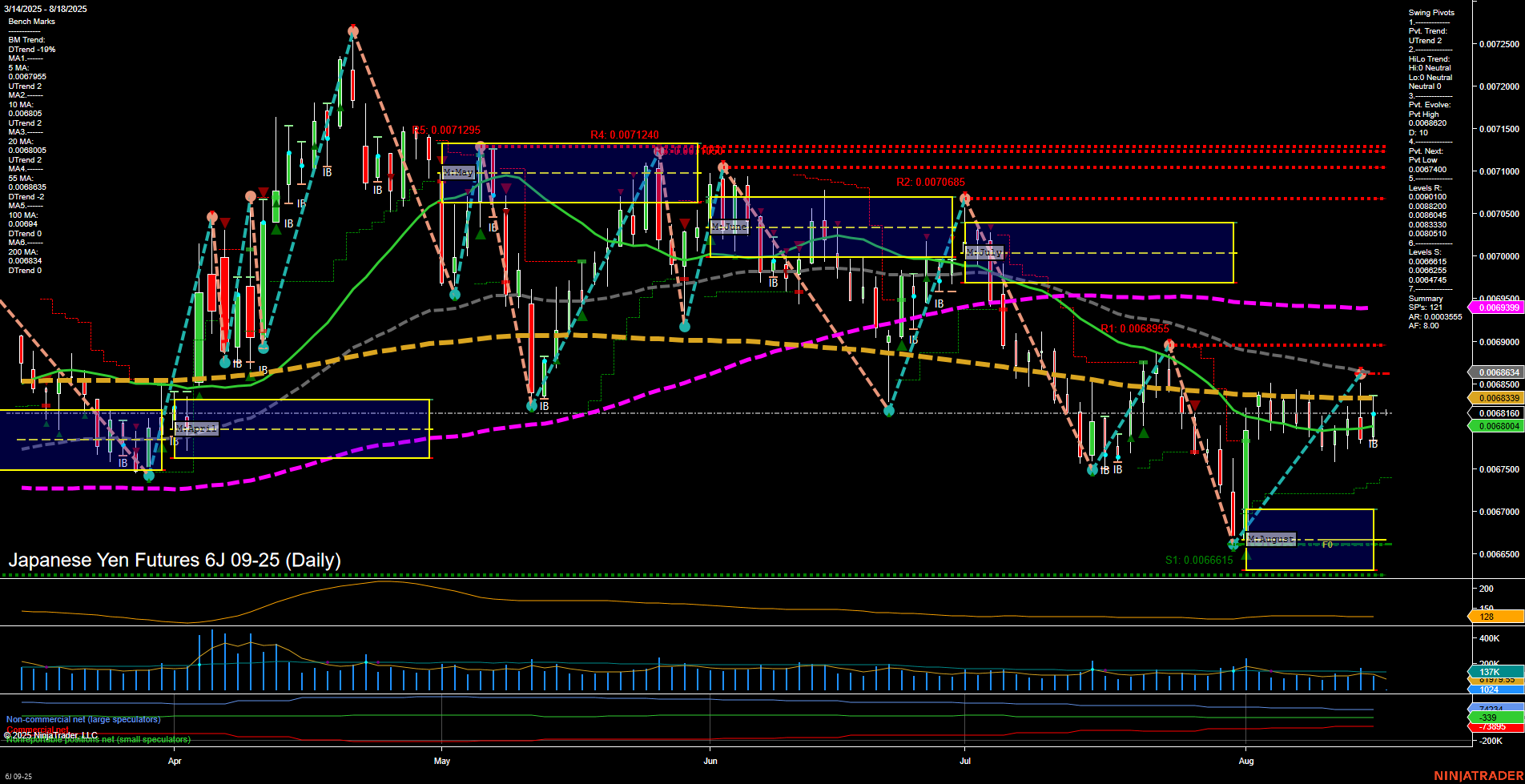

6J Japanese Yen Futures Daily Chart Analysis: 2025-Aug-17 18:01 CT

Price Action

- Last: 0.0068534,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 0.0068502,

- 4. Pvt. Next: Pvt Low 0.0067400,

- 5. Levels R: 0.0072400, 0.0071240, 0.0070685, 0.0070510, 0.0068855, 0.0068745,

- 6. Levels S: 0.0066615.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0067955 Down Trend,

- (Short-Term) 10 Day: 0.0068085 Up Trend,

- (Intermediate-Term) 20 Day: 0.0068363 Up Trend,

- (Intermediate-Term) 55 Day: 0.0068136 Down Trend,

- (Long-Term) 100 Day: 0.0069939 Down Trend,

- (Long-Term) 200 Day: 0.0068350 Down Trend.

Additional Metrics

Recent Trade Signals

- 15 Aug 2025: Long 6J 09-25 @ 0.0068145 Signals.USAR-WSFG

- 14 Aug 2025: Short 6J 09-25 @ 0.0067935 Signals.USAR.TR120

- 14 Aug 2025: Long 6J 09-25 @ 0.0068465 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The 6J Japanese Yen Futures daily chart shows a market in transition, with price currently above the key F0%/NTZ levels across weekly, monthly, and yearly session fib grids, indicating a general upward bias. However, the swing pivot structure is mixed: the short-term pivot trend is up, but the intermediate-term HiLo trend is neutral, and the next pivot is a potential low, suggesting possible near-term consolidation or a pause in the uptrend. Resistance levels are clustered above, with the nearest at 0.0068745 and major resistance at 0.0072400, while support is well-defined at 0.0066615. Moving averages are mixed, with short-term and intermediate-term MAs showing both up and down trends, and long-term MAs still in a downtrend, reflecting a market that is attempting to recover but not yet in a confirmed bullish phase. ATR and volume metrics indicate moderate volatility and participation. Recent trade signals show both long and short entries, further supporting a neutral, range-bound environment. Overall, the chart suggests a market in a corrective phase, with no clear directional conviction in the short, intermediate, or long term.

Chart Analysis ATS AI Generated: 2025-08-17 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.