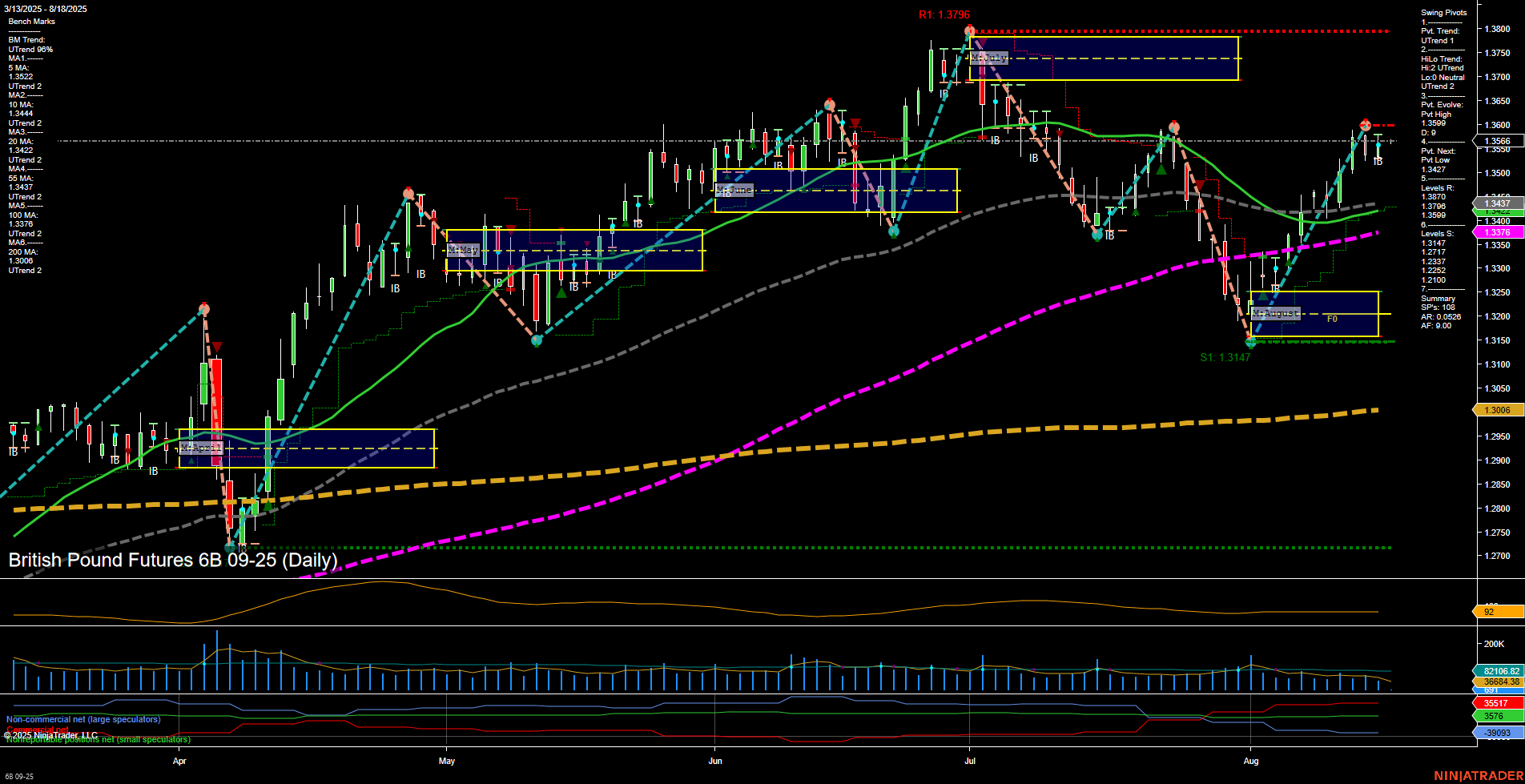

The British Pound Futures (6B) daily chart shows a market in transition. Price action is currently at 1.3536 with medium-sized bars and average momentum, indicating neither strong acceleration nor exhaustion. The short-term WSFG trend is down, with price below the weekly NTZ, suggesting some near-term resistance and possible consolidation or pullback. However, both the monthly (MSFG) and yearly (YSFG) session fib grids are trending up, with price above their respective NTZs, reflecting a broader bullish structure. Swing pivots confirm a short-term uptrend (UTrend) and intermediate-term uptrend, with the most recent pivot high at 1.3536 and next key support at 1.3147. Resistance levels are layered above, with the major swing high at 1.3796. All benchmark moving averages (from 5-day to 200-day) are in uptrends, reinforcing the underlying bullish bias on intermediate and long-term timeframes. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals show mixed short-term direction, with a short signal following a recent long, highlighting the choppy nature of the current short-term environment. Overall, the chart reflects a market in a bullish intermediate and long-term trend, but with short-term consolidation or corrective action underway. The structure suggests the potential for further upside if support holds and the short-term trend resumes higher, but the presence of resistance and recent mixed signals point to a period of digestion or sideways movement before the next directional move.