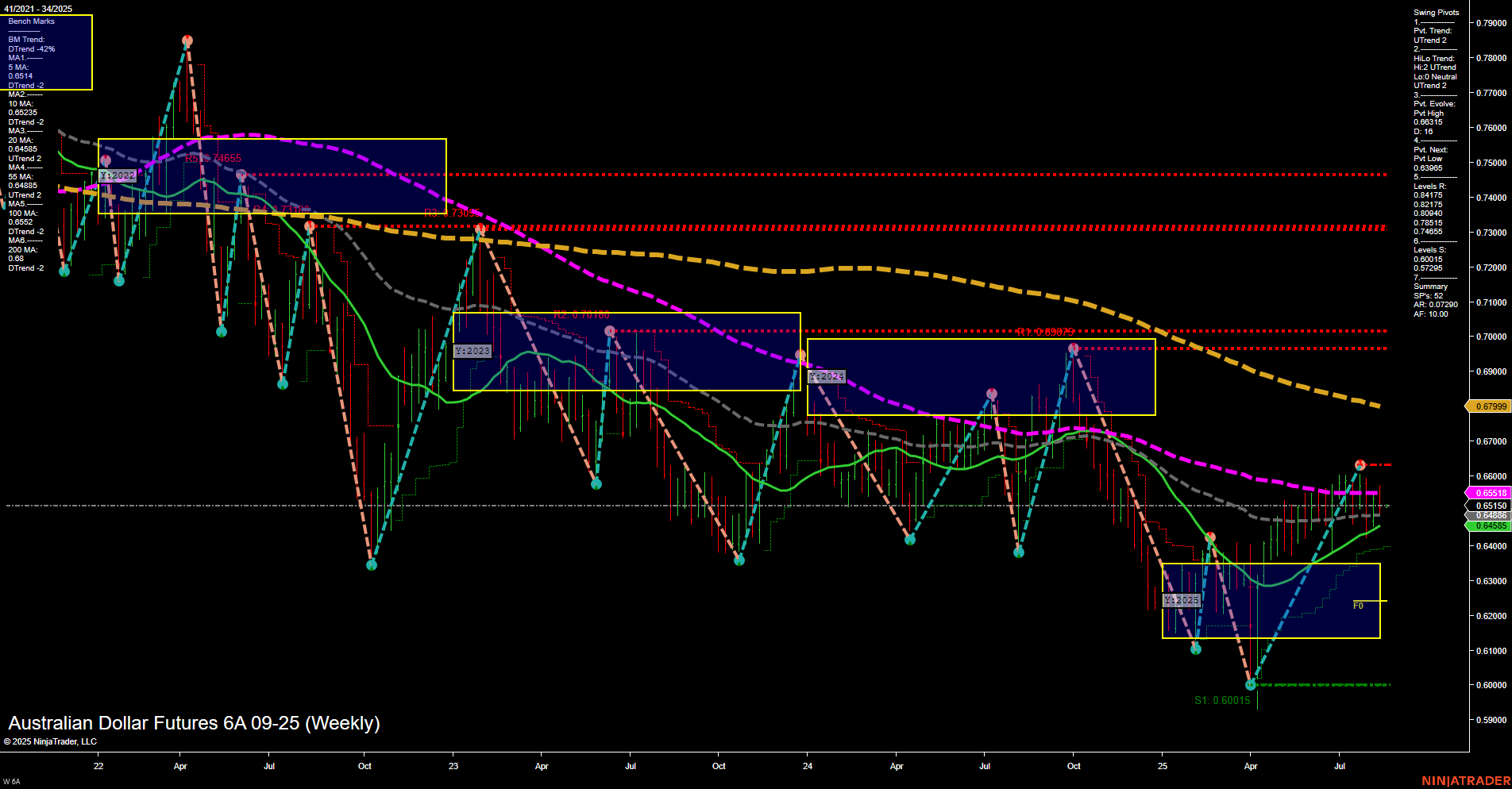

The Australian Dollar Futures (6A) weekly chart shows a market in transition. Price action has recently moved up from a significant swing low, with medium-sized bars and average momentum, indicating a moderate recovery phase. Both short-term and intermediate-term swing pivot trends are up, supported by the 5, 10, and 20-week moving averages all trending higher. However, the long-term structure remains bearish, as the 55, 100, and 200-week moving averages are still in downtrends and positioned above current price, acting as resistance. The price is currently testing a key resistance cluster between 0.65155 and 0.66055, with further resistance at 0.66975 and 0.67999. Support is well-defined at 0.63415 and the major swing low at 0.60015. The neutral bias across the Weekly, Monthly, and Yearly Session Fib Grids suggests a lack of strong directional conviction, with price consolidating near the upper boundary of the recent range. Recent short trade signals indicate that, despite the upward swing, there is caution about further upside, likely due to the proximity of major resistance and the prevailing long-term downtrend. The market appears to be in a corrective rally within a broader bearish context, with potential for either a continuation higher if resistance is broken, or a resumption of the downtrend if sellers reassert control. Volatility is moderate, and the market is at a technical crossroads, awaiting a decisive move.