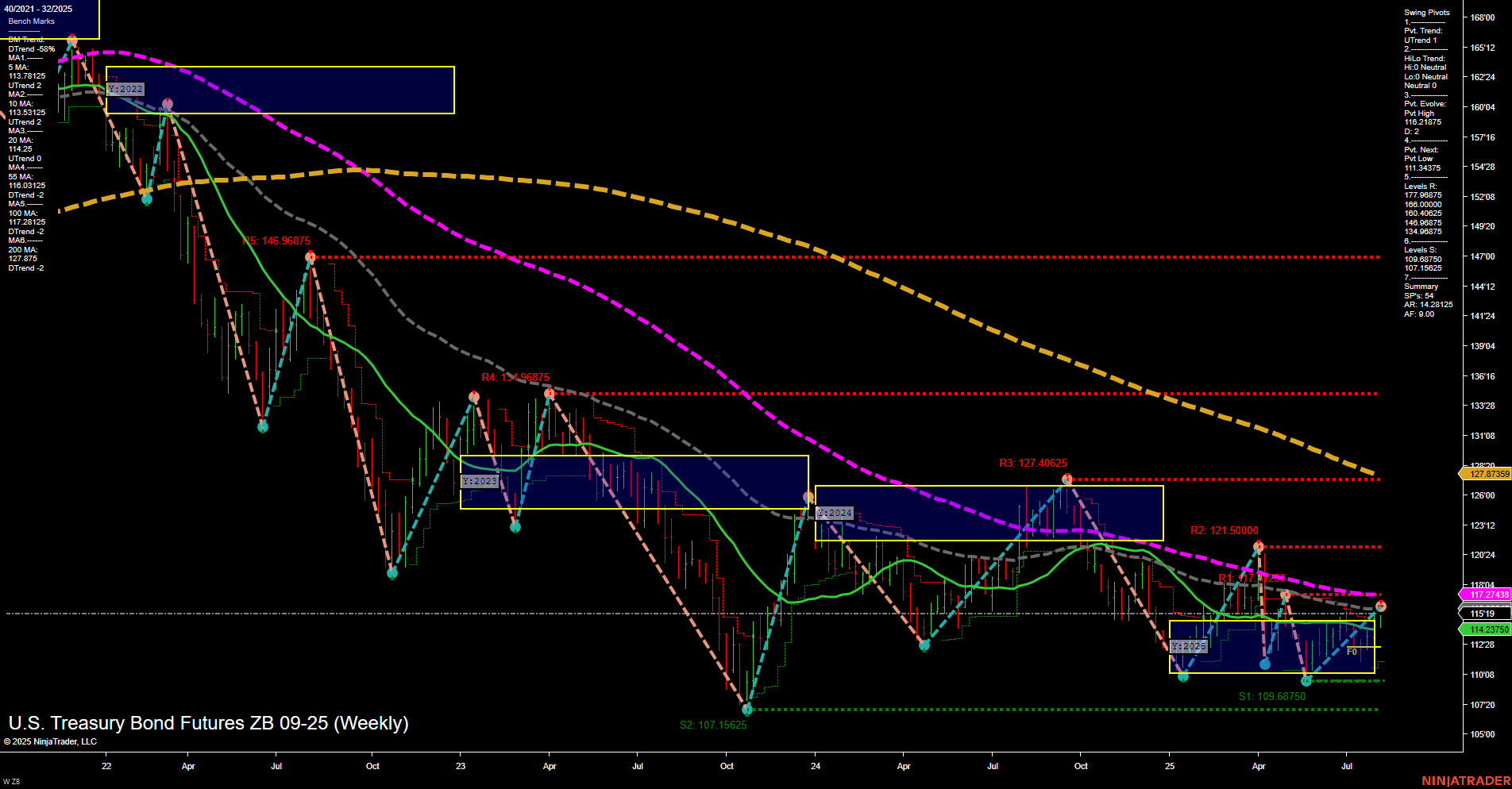

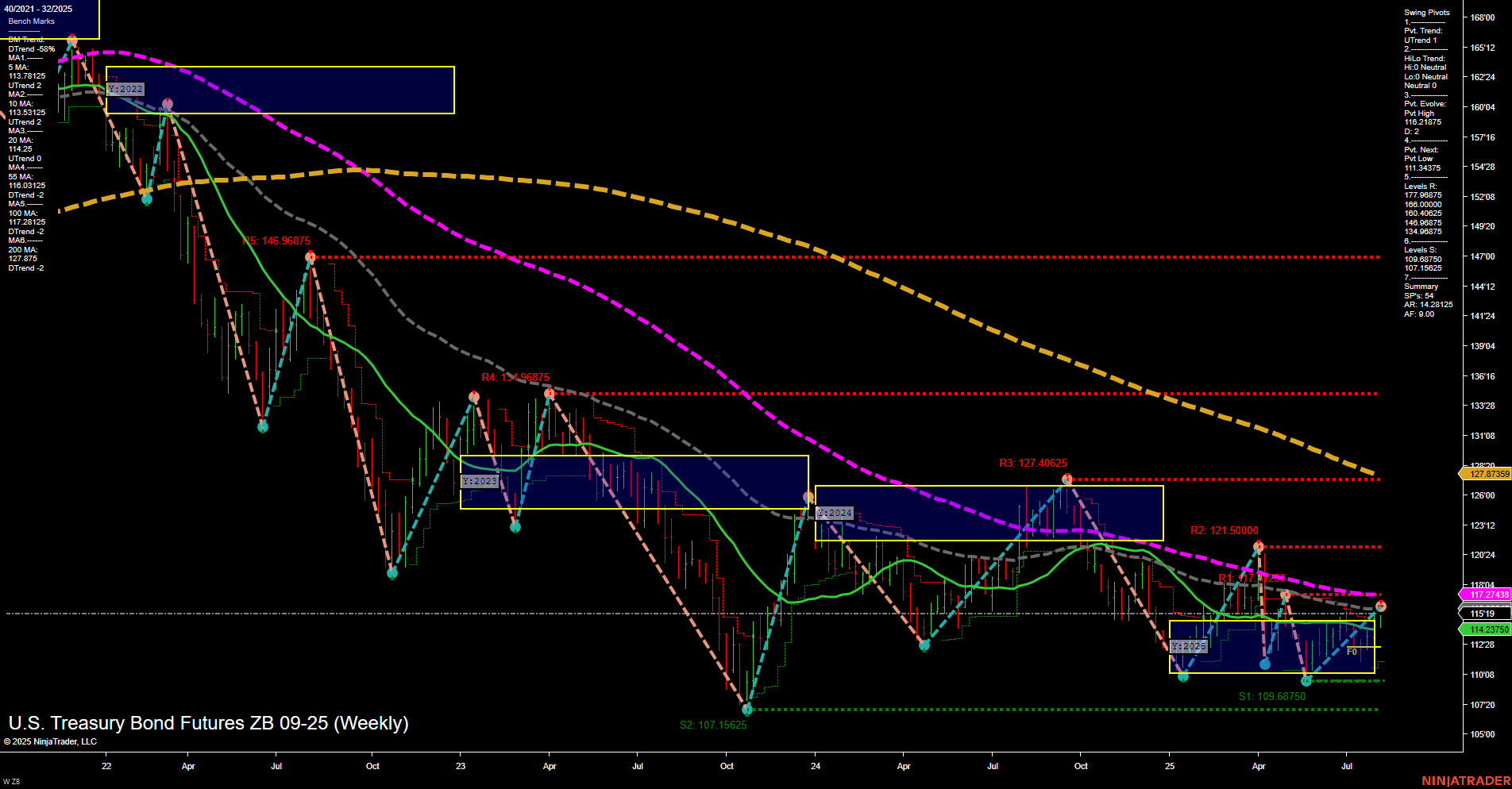

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-07 07:20 CT

Price Action

- Last: 127.8735,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 116.21875,

- 4. Pvt. Next: Pvt Low 111.94375,

- 5. Levels R: 146.96875, 131.96875, 127.40625, 121.50000, 119.96875,

- 6. Levels S: 109.68750, 107.15625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.19 Down Trend,

- (Intermediate-Term) 10 Week: 114.2375 Down Trend,

- (Long-Term) 20 Week: 117.27438 Down Trend,

- (Long-Term) 55 Week: 121.8125 Down Trend,

- (Long-Term) 100 Week: 131.78125 Down Trend,

- (Long-Term) 200 Week: 147.96875 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart reflects a market in a prolonged downtrend, with all major moving averages (from 5-week to 200-week) trending lower, confirming persistent bearish sentiment across timeframes. Price action is currently consolidating within a neutral zone (NTZ) as indicated by the WSFG, MSFG, and YSFG, with momentum remaining slow and bars of medium size, suggesting a lack of strong directional conviction. The most recent swing pivot trend is down (DTrend), and the next key support levels are at 109.68750 and 107.15625, while resistance is stacked above at 119.96875, 121.50000, and higher. Intermediate-term HiLo trend is neutral, indicating some stabilization after prior declines, but the overall structure remains heavy with lower highs and lower lows dominating the chart. The market appears to be in a broad consolidation phase after a significant selloff, with no clear signs of reversal yet. This environment is typical of a market digesting prior moves, possibly awaiting new macroeconomic catalysts or policy signals before establishing a new trend direction.

Chart Analysis ATS AI Generated: 2025-08-07 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.