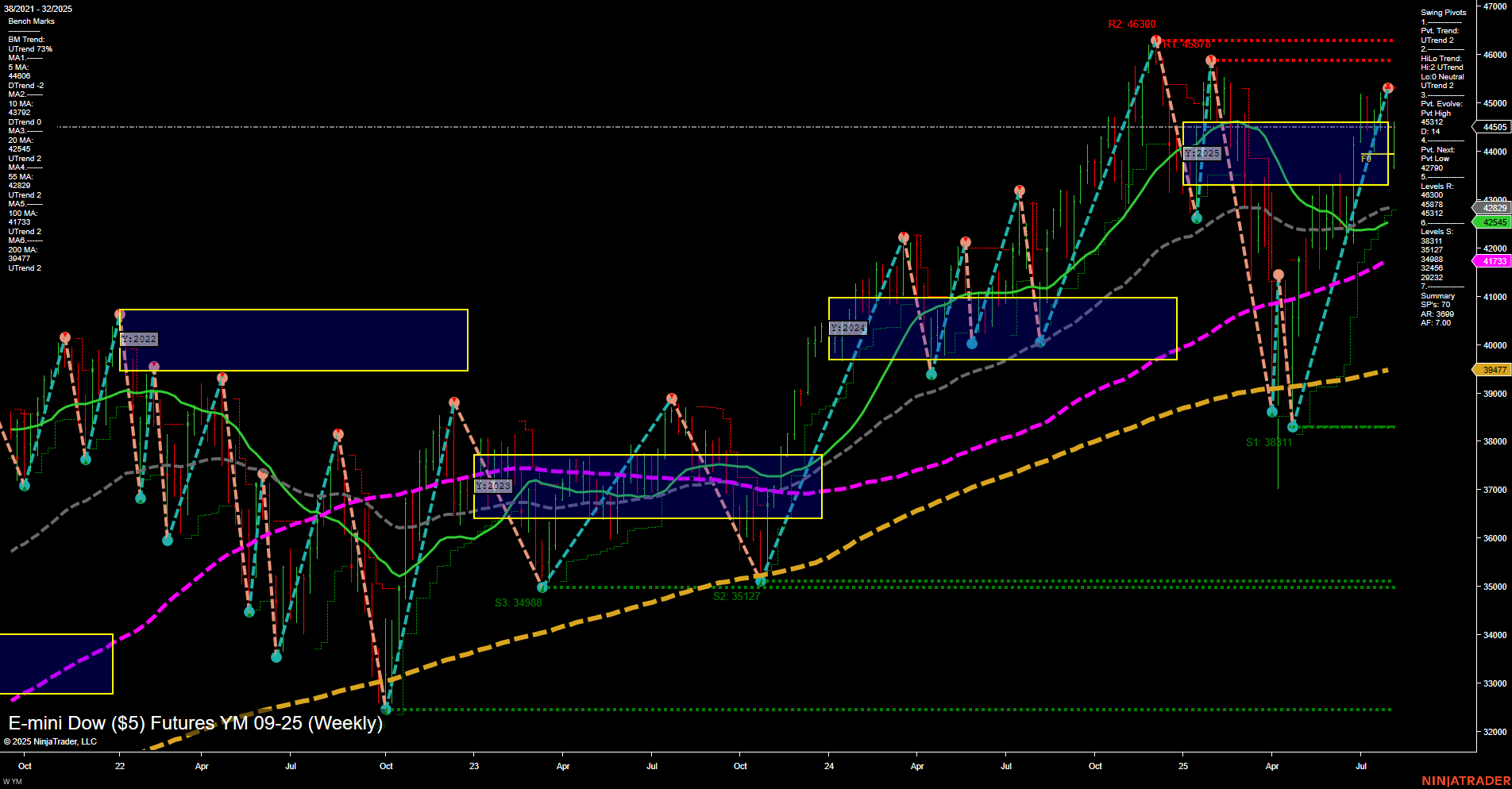

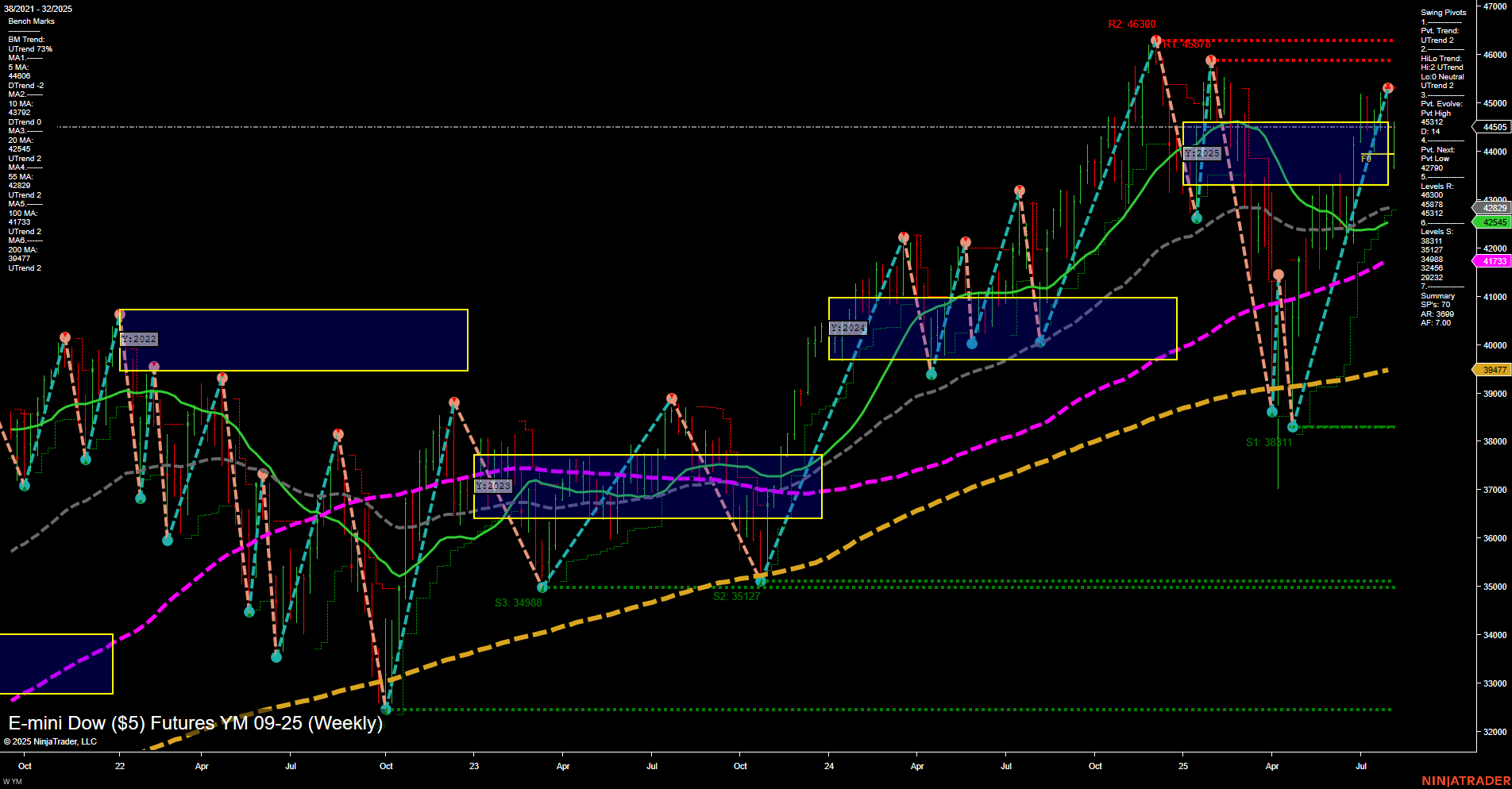

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Aug-07 07:19 CT

Price Action

- Last: 44551,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 80%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 46312,

- 4. Pvt. Next: Pvt low 42545,

- 5. Levels R: 46300, 45878,

- 6. Levels S: 42545, 38311, 35127, 34988.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 44060 Up Trend,

- (Intermediate-Term) 10 Week: 43702 Up Trend,

- (Long-Term) 20 Week: 42545 Up Trend,

- (Long-Term) 55 Week: 41733 Up Trend,

- (Long-Term) 100 Week: 39477 Up Trend,

- (Long-Term) 200 Week: 39477 Up Trend.

Recent Trade Signals

- 07 Aug 2025: Long YM 09-25 @ 44551 Signals.USAR-MSFG

- 04 Aug 2025: Long YM 09-25 @ 44209 Signals.USAR.TR120

- 04 Aug 2025: Long YM 09-25 @ 43901 Signals.USAR-WSFG

- 01 Aug 2025: Short YM 09-25 @ 44238 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart is showing strong bullish momentum across all timeframes. Price is trading above all key moving averages, with the 5, 10, 20, 55, 100, and 200-week benchmarks all trending upward, confirming a robust uptrend. The recent large bars and fast momentum indicate aggressive buying interest, likely fueled by positive sentiment or macroeconomic drivers. The price is well above the NTZ (neutral zone) on the weekly, monthly, and yearly session fib grids, reinforcing the bullish bias. Swing pivots show an evolving uptrend, with the most recent pivot high at 46312 and support levels well below current price, suggesting room for further upside before major resistance is tested. Recent trade signals have been predominantly long, aligning with the prevailing trend. The market has recovered strongly from previous pullbacks, forming higher lows and breaking out of consolidation zones, which is characteristic of a trend continuation phase. Overall, the technical structure supports a bullish outlook, with the potential for further gains as long as price remains above key support and moving averages.

Chart Analysis ATS AI Generated: 2025-08-07 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.