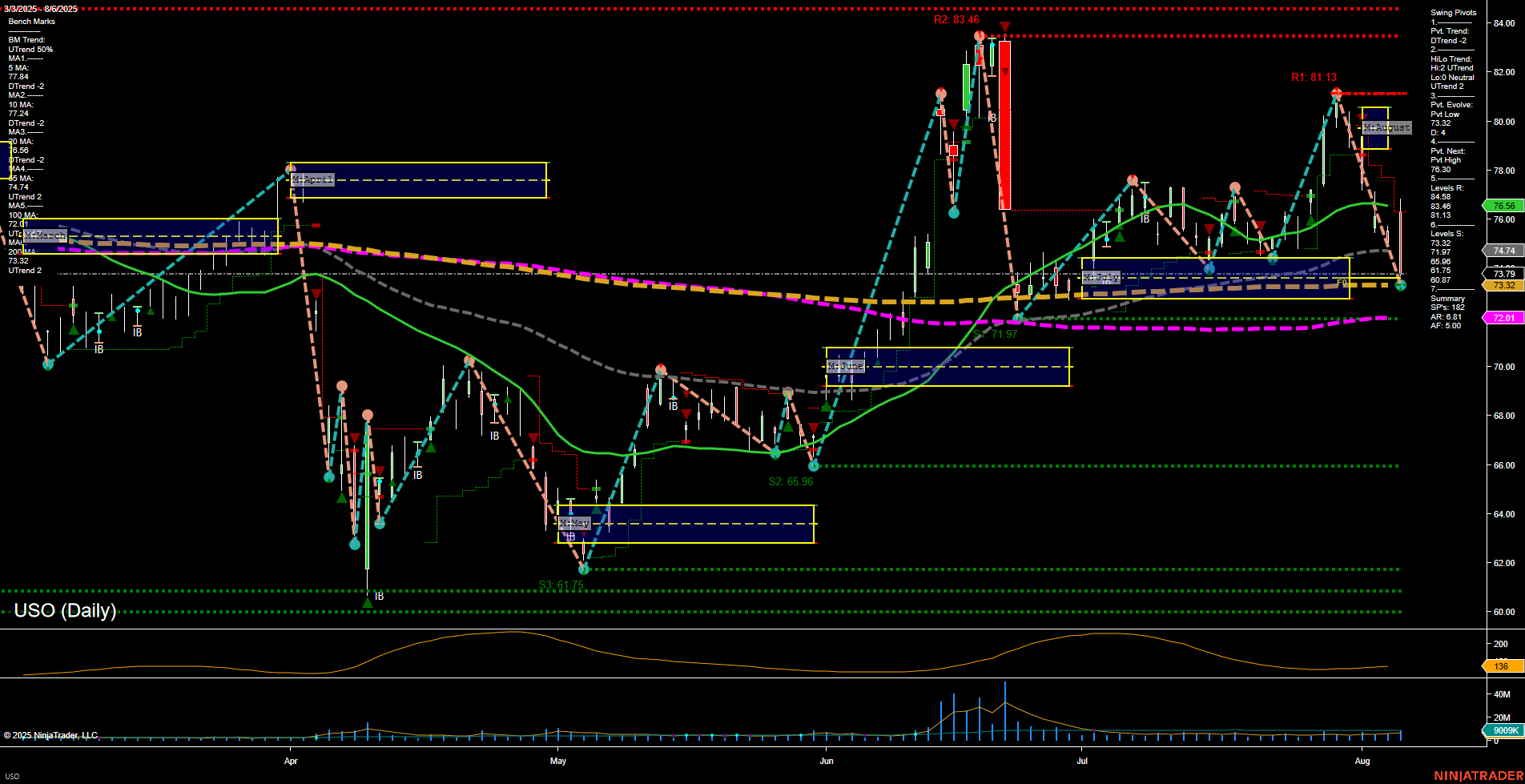

USO is currently experiencing a sharp pullback after a recent swing high at 81.13, with price now at 73.19 and large, fast-moving bars indicating heightened volatility. The short-term trend has shifted to down (DTrend), confirmed by all short-term moving averages (5, 10, 20 day) turning lower, while intermediate and long-term benchmarks remain in uptrends, suggesting the broader structure is still intact. The most recent swing pivot is a high, with the next key support at 71.97 and further downside levels at 65.96 and 61.75, while resistance sits overhead at 76.00, 81.13, and 83.46. The ATR is elevated, and volume remains robust, reflecting active participation and potential for continued volatility. The overall structure points to a corrective phase within a larger uptrend, with the market digesting gains after a strong rally. The neutral stance on both the weekly and monthly session fib grids, as well as the long-term trend, suggests the market is in a consolidation or retracement phase rather than a full reversal. Swing traders should note the potential for further downside tests toward support, but also recognize the underlying uptrend on higher timeframes, which could provide a base for future recovery if support holds.