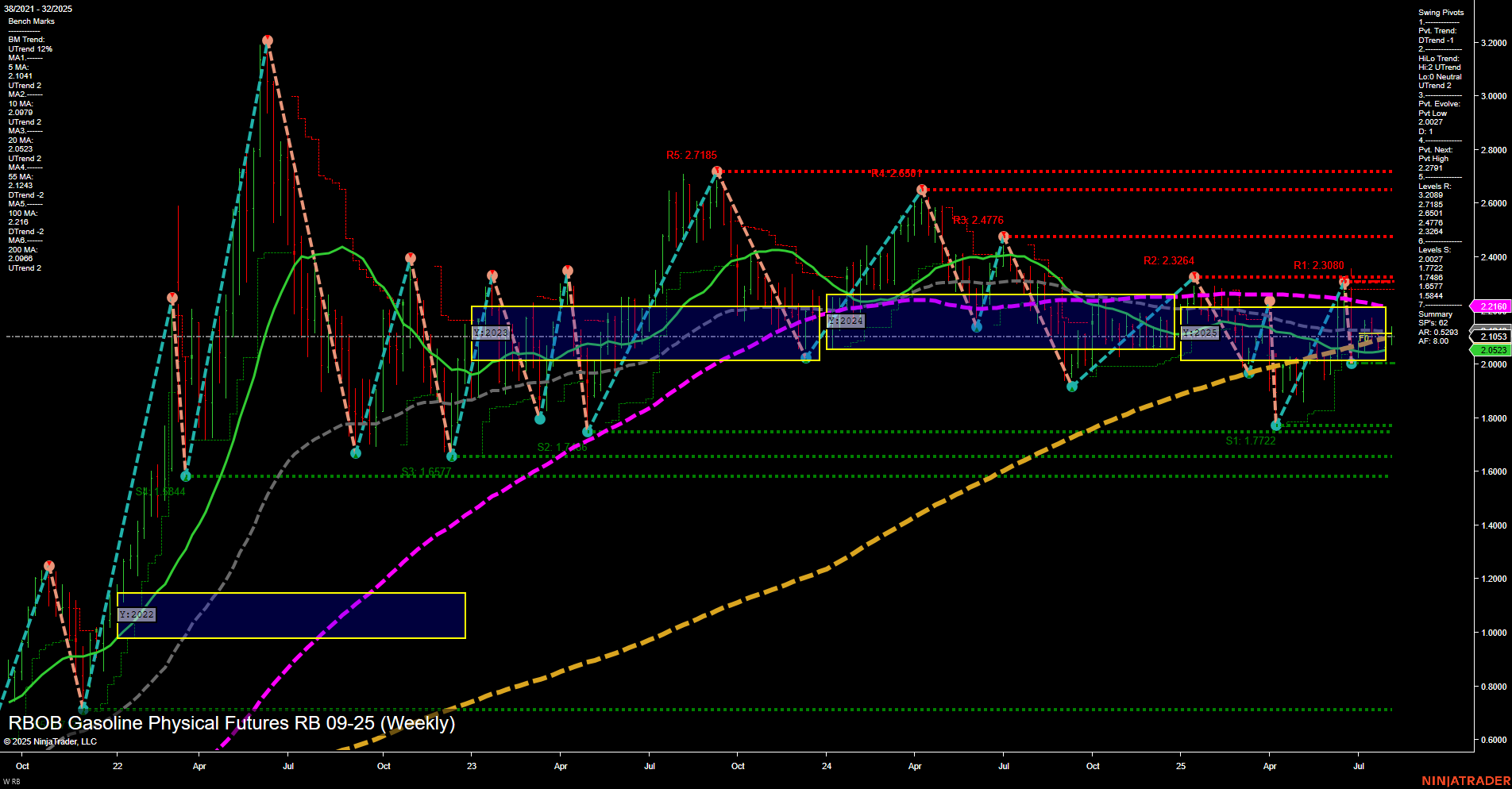

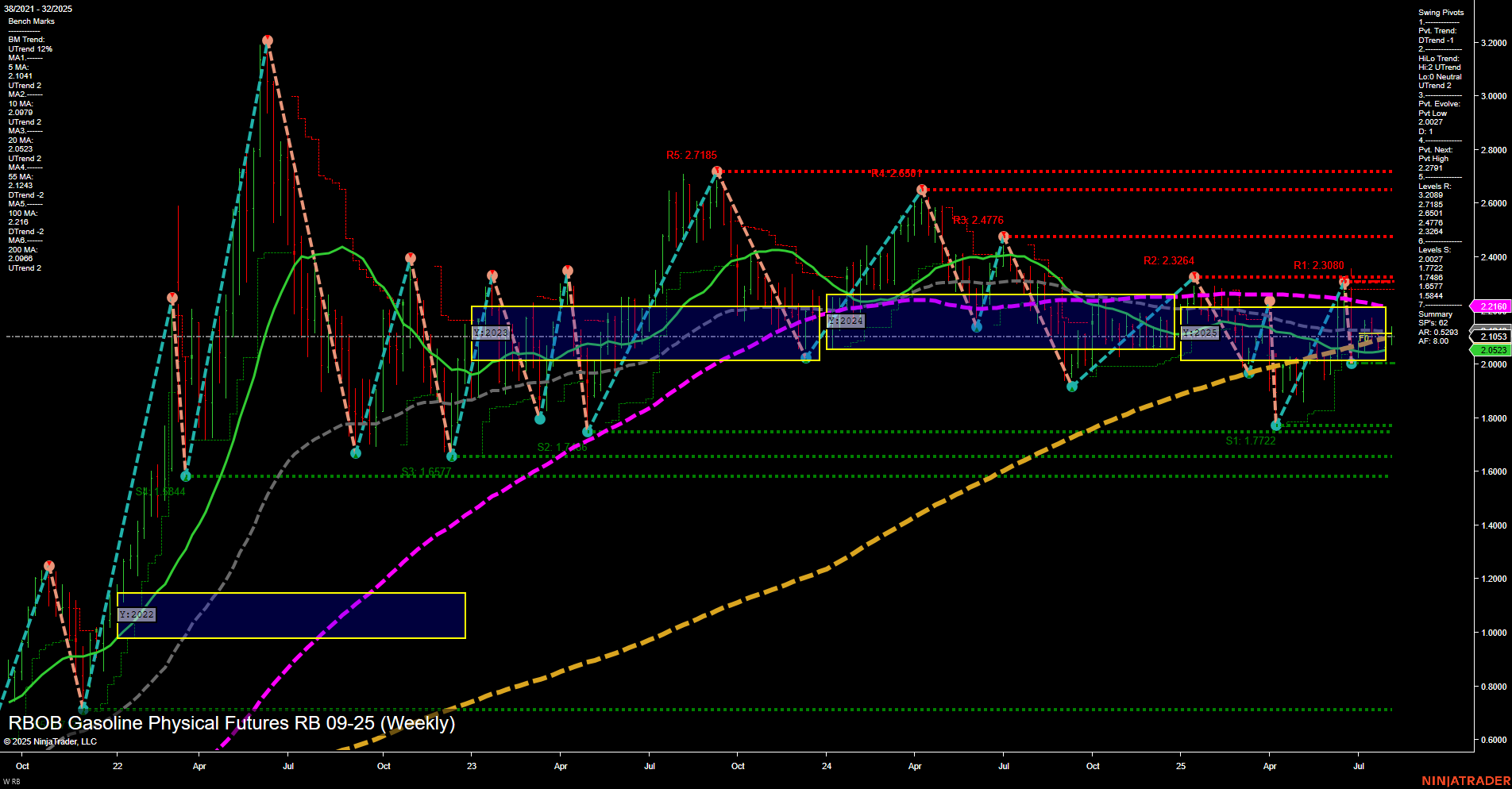

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Aug-07 07:14 CT

Price Action

- Last: 2.0953,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -24%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 2.027,

- 4. Pvt. Next: Pvt High 2.2091,

- 5. Levels R: 2.7185, 2.6508, 2.4776, 2.3264, 2.3080,

- 6. Levels S: 2.1772, 1.7488, 1.6847, 1.4577, 1.1772.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2.1041 Down Trend,

- (Intermediate-Term) 10 Week: 2.0720 Down Trend,

- (Long-Term) 20 Week: 2.0533 Up Trend,

- (Long-Term) 55 Week: 2.1544 Down Trend,

- (Long-Term) 100 Week: 2.2168 Down Trend,

- (Long-Term) 200 Week: 2.0800 Up Trend.

Recent Trade Signals

- 06 Aug 2025: Short RB 09-25 @ 2.0835 Signals.USAR-WSFG

- 06 Aug 2025: Short RB 09-25 @ 2.1186 Signals.USAR-MSFG

- 31 Jul 2025: Short RB 09-25 @ 2.1674 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures market is currently exhibiting a mixed technical structure. Price action is consolidating near the lower end of the yearly and monthly session fib grids, with slow momentum and medium-sized bars, indicating a lack of strong directional conviction. The short-term trend is neutral, as reflected by the WSFG and recent price action within the NTZ (neutral trading zone). However, the intermediate and long-term trends are tilting bearish, with both the MSFG and YSFG showing price below their respective F0% levels and downward trends. Swing pivots highlight a short-term downtrend, but the intermediate-term HiLo trend remains up, suggesting some underlying support or potential for a bounce. Resistance levels are clustered above 2.30, while support is established near 2.17 and lower. Most weekly benchmarks, especially the 5, 10, 55, and 100-week moving averages, are in downtrends, reinforcing the broader bearish bias, though the 20 and 200-week MAs are still up. Recent trade signals have all been to the short side, aligning with the prevailing intermediate and long-term bearish sentiment. Overall, the market is in a corrective or consolidative phase, with downside pressure dominating but some potential for short-term stabilization or retracement.

Chart Analysis ATS AI Generated: 2025-08-07 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.