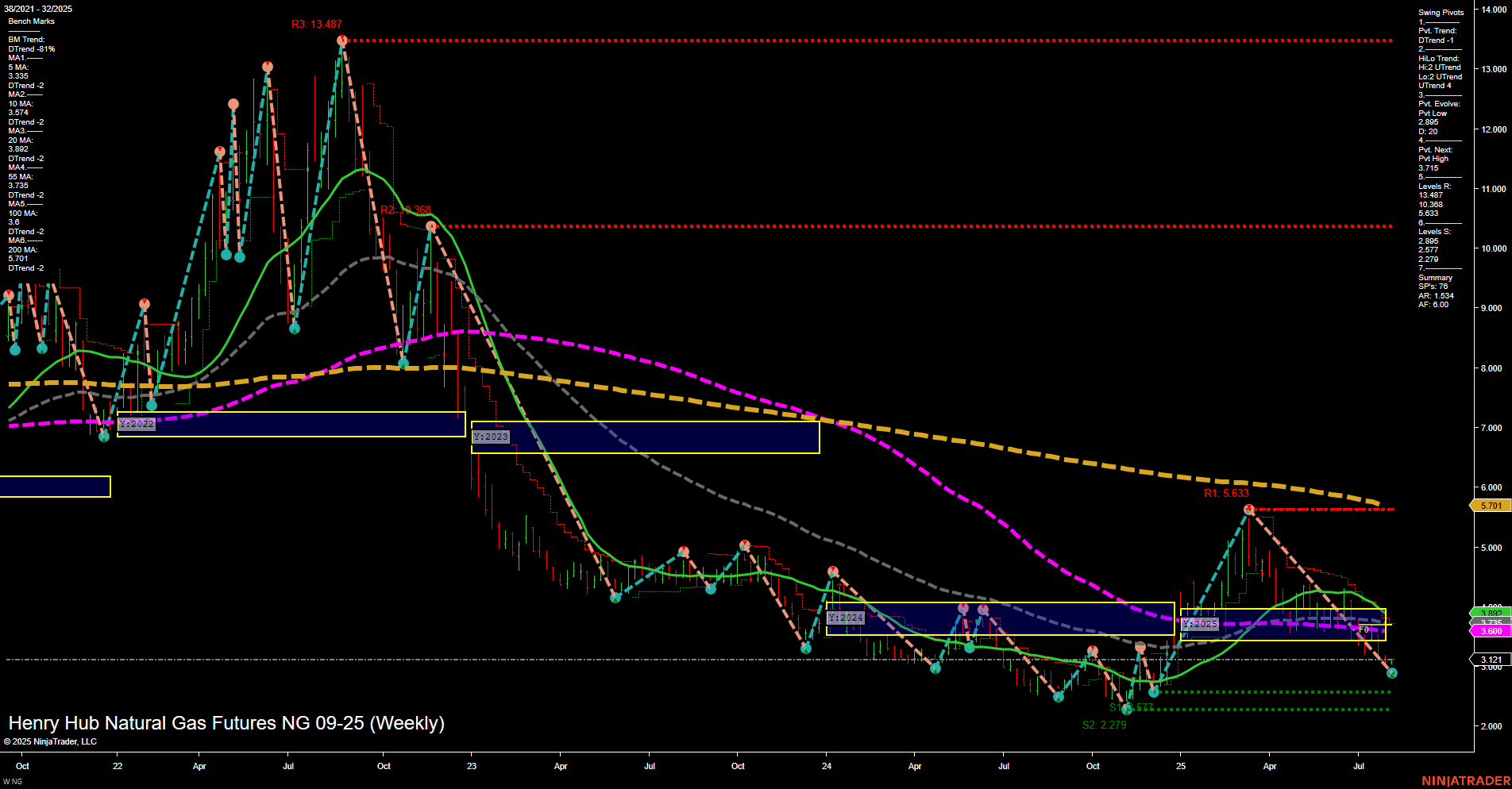

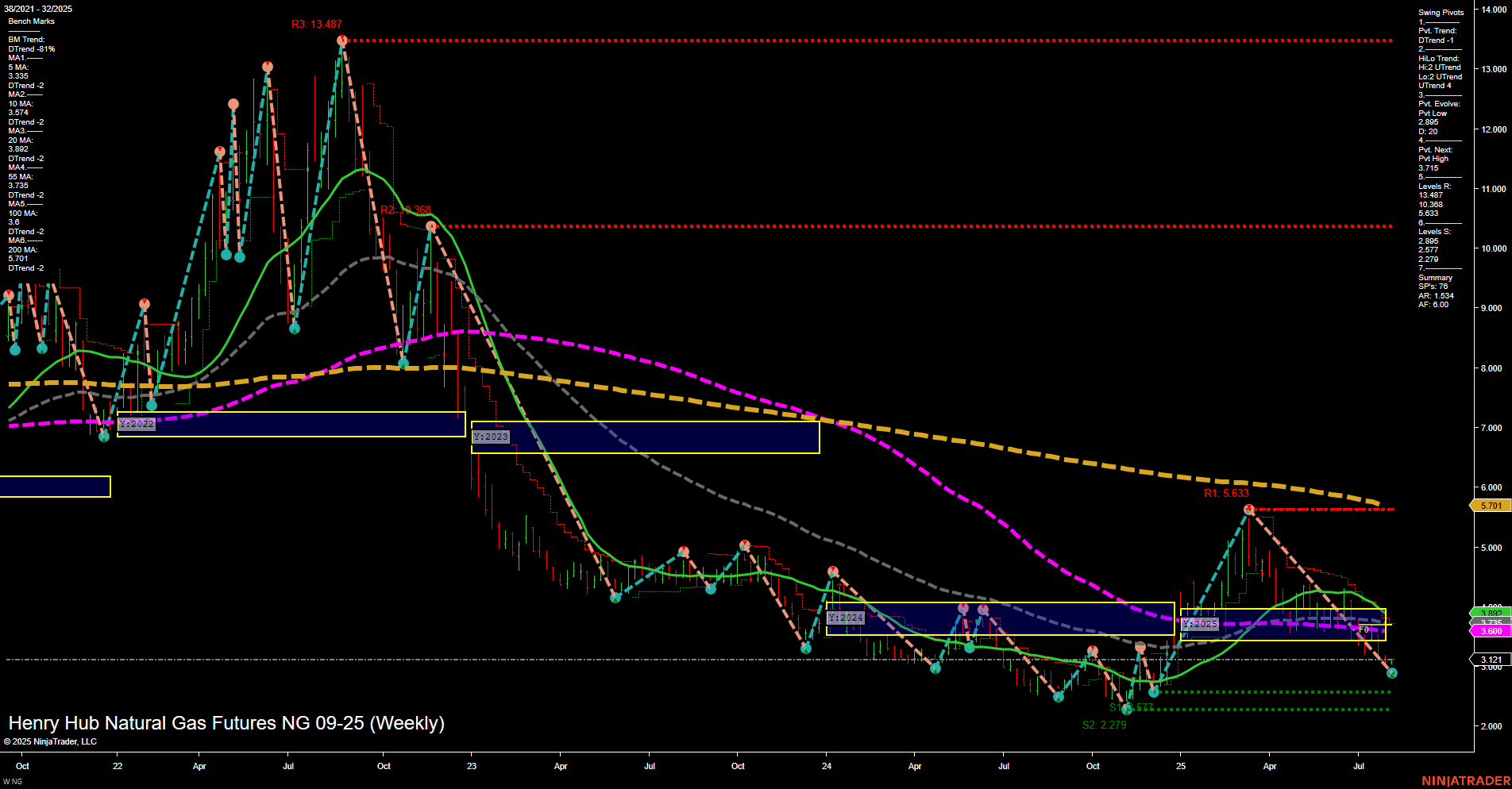

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Aug-07 07:11 CT

Price Action

- Last: 3.096,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.209,

- 4. Pvt. Next: Pvt high 3.715,

- 5. Levels R: 13.487, 10.338, 6.633, 5.633,

- 6. Levels S: 2.895, 2.877, 2.279.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.335 Down Trend,

- (Intermediate-Term) 10 Week: 3.174 Down Trend,

- (Long-Term) 20 Week: 3.600 Down Trend,

- (Long-Term) 55 Week: 4.782 Down Trend,

- (Long-Term) 100 Week: 5.394 Down Trend,

- (Long-Term) 200 Week: 5.701 Down Trend.

Recent Trade Signals

- 07 Aug 2025: Long NG 09-25 @ 3.096 Signals.USAR-WSFG

- 06 Aug 2025: Long NG 09-25 @ 3.053 Signals.USAR.TR120

- 05 Aug 2025: Short NG 09-25 @ 2.977 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The weekly chart for NG Henry Hub Natural Gas Futures shows a market in a broad consolidation phase after a prolonged downtrend. Price action is currently subdued, with medium-sized bars and slow momentum, reflecting indecision and a lack of strong directional conviction. The short-term swing pivot trend is down, but the intermediate-term HiLo trend has shifted to up, suggesting some underlying support and potential for a base to form. However, all key moving averages (5, 10, 20, 55, 100, and 200 week) remain in clear downtrends, reinforcing a bearish long-term structure.

Recent trade signals indicate mixed activity, with both long and short entries triggered in the past week, further highlighting the choppy and range-bound nature of the market. Major resistance levels are well above current price, while support is clustered just below, indicating a market that is testing the lower end of its recent range. The neutral bias across the session fib grids (weekly, monthly, yearly) aligns with the current lack of trend conviction.

Overall, the market is in a transition phase, with short- and intermediate-term signals neutral and the long-term outlook still bearish. Price is consolidating near support, and traders are likely watching for a decisive breakout or breakdown to establish the next major directional move.

Chart Analysis ATS AI Generated: 2025-08-07 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.