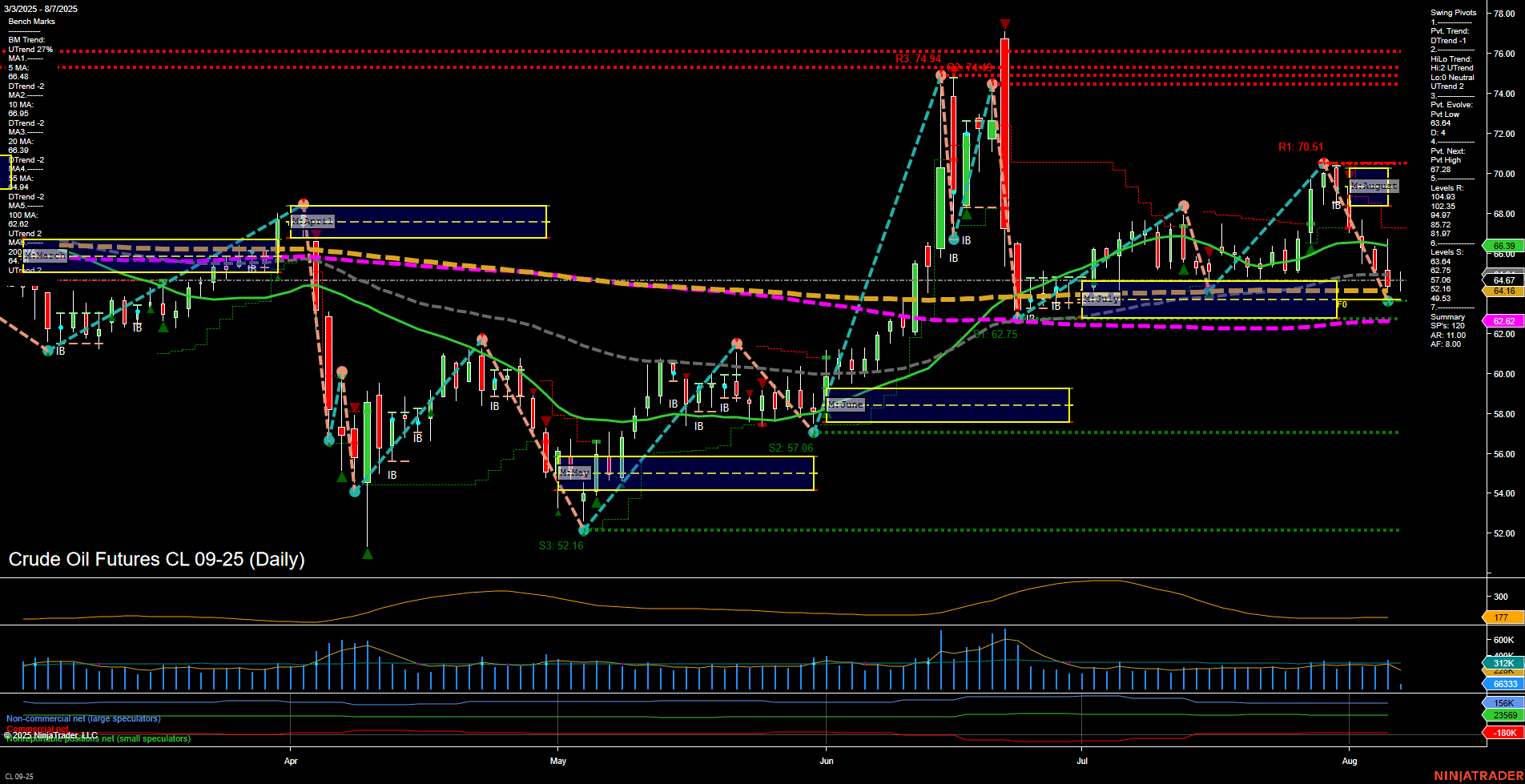

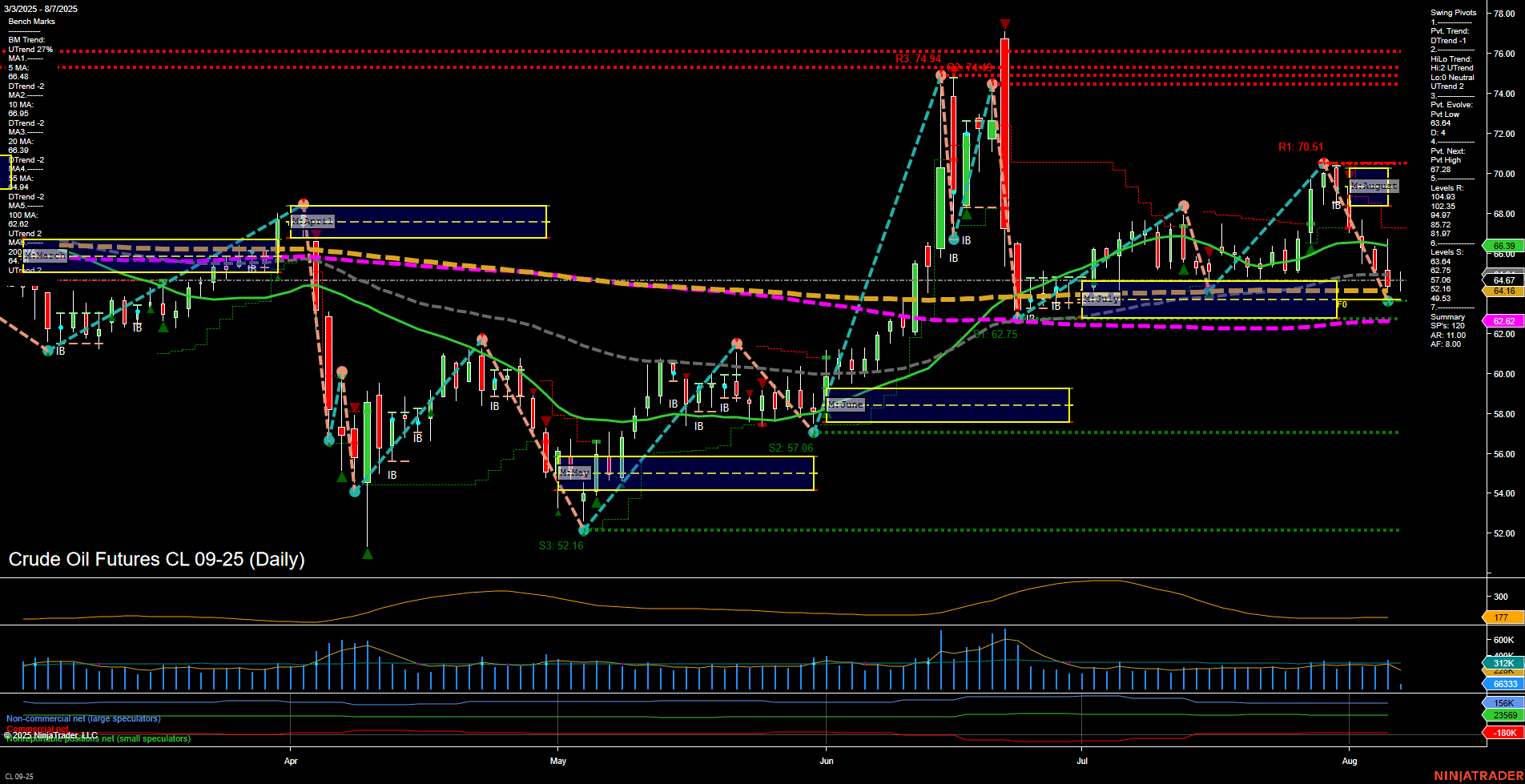

CL Crude Oil Futures Daily Chart Analysis: 2025-Aug-07 07:04 CT

Price Action

- Last: 64.67,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -63%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -42%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 62.75,

- 4. Pvt. Next: Pvt high 67.28,

- 5. Levels R: 70.51, 67.28, 66.17,

- 6. Levels S: 62.75, 57.06, 52.16.

Daily Benchmarks

- (Short-Term) 5 Day: 64.86 Down Trend,

- (Short-Term) 10 Day: 66.39 Down Trend,

- (Intermediate-Term) 20 Day: 66.17 Down Trend,

- (Intermediate-Term) 55 Day: 64.47 Up Trend,

- (Long-Term) 100 Day: 64.16 Up Trend,

- (Long-Term) 200 Day: 62.62 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Aug 2025: Short CL 09-25 @ 65.35 Signals.USAR.TR720

- 05 Aug 2025: Short CL 09-25 @ 66.12 Signals.USAR-WSFG

- 01 Aug 2025: Short CL 09-25 @ 67.49 Signals.USAR-MSFG

- 01 Aug 2025: Short CL 09-25 @ 68.74 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Crude oil futures are currently in a corrective phase, with price action showing a series of lower highs and lower lows, confirming a short-term downtrend. The last price is below all key session fib grid levels (weekly, monthly, yearly), and the momentum is slow, indicating a lack of strong buying interest. The swing pivot structure highlights a dominant short-term downtrend, while the intermediate-term trend remains up, suggesting some underlying support, but the immediate bias is to the downside. Resistance levels are clustered above at 70.51, 67.28, and 66.17, while support is found at 62.75, 57.06, and 52.16. All short-term and intermediate-term moving averages are trending down, reinforcing the bearish outlook, though long-term averages are still in an uptrend, which tempers the longer-term view to neutral. Recent trade signals have all been to the short side, aligning with the prevailing short- and intermediate-term bearish sentiment. Volatility (ATR) and volume (VOLMA) are moderate, suggesting orderly but persistent selling pressure. Overall, the market is in a pullback or retracement phase within a broader consolidation, with the potential for further downside tests unless a significant reversal develops at key support levels.

Chart Analysis ATS AI Generated: 2025-08-07 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.