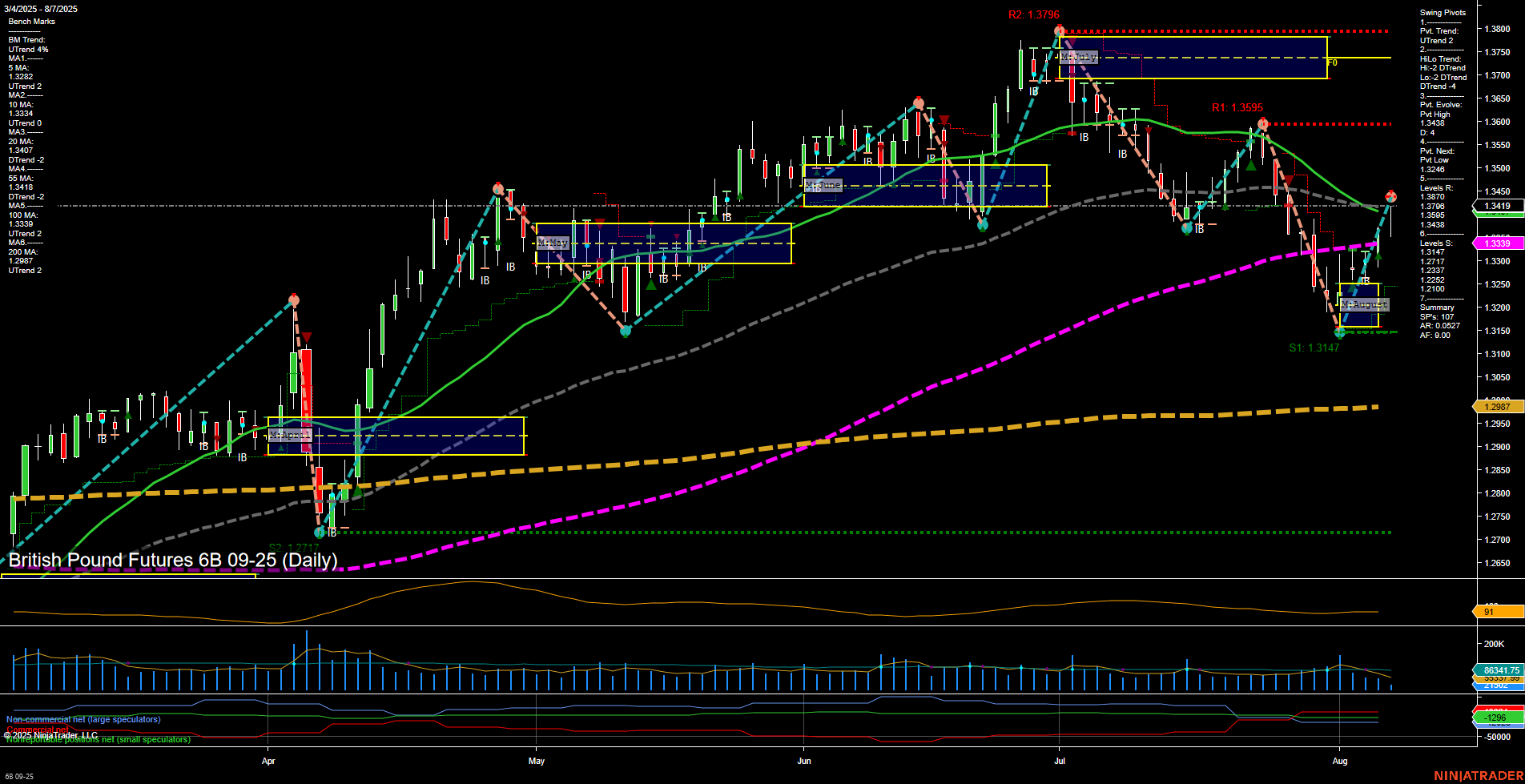

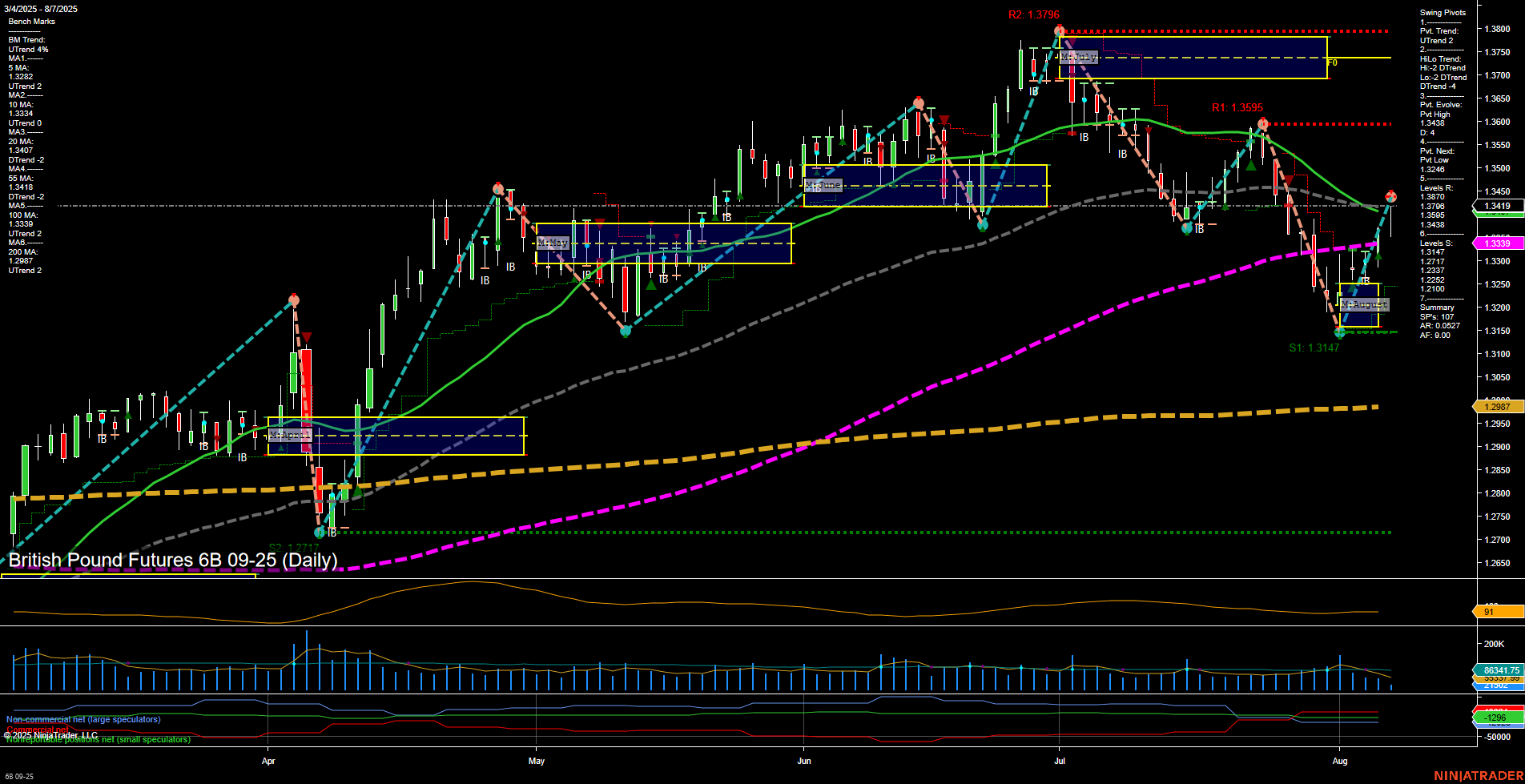

6B British Pound Futures Daily Chart Analysis: 2025-Aug-07 07:00 CT

Price Action

- Last: 1.3334,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 66%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 1.3438,

- 4. Pvt. Next: Pvt Low 1.3246,

- 5. Levels R: 1.3786, 1.3706, 1.3595, 1.3438,

- 6. Levels S: 1.3147, 1.2337, 1.2255, 1.2210.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3282 Up Trend,

- (Short-Term) 10 Day: 1.3244 Up Trend,

- (Intermediate-Term) 20 Day: 1.3419 Down Trend,

- (Intermediate-Term) 55 Day: 1.3418 Down Trend,

- (Long-Term) 100 Day: 1.3300 Down Trend,

- (Long-Term) 200 Day: 1.2987 Up Trend.

Additional Metrics

Recent Trade Signals

- 06 Aug 2025: Long 6B 09-25 @ 1.333 Signals.USAR-WSFG

- 06 Aug 2025: Long 6B 09-25 @ 1.3324 Signals.USAR-MSFG

- 01 Aug 2025: Long 6B 09-25 @ 1.3263 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) daily chart shows a recent recovery from a swing low, with price action now above key short-term and long-term moving averages. The short-term trend has shifted bullish, supported by upward momentum and recent long trade signals. Intermediate-term trends remain mixed, with the HiLo pivot trend still in a downtrend, but the monthly and weekly session fib grids both indicate upward bias as price holds above their NTZ centers. Long-term structure is constructive, with the yearly fib grid and 200-day moving average both trending up. Resistance is clustered above at 1.3438 and higher, while support is well-defined at 1.3147. Volatility and volume are moderate, suggesting a stable environment for swing setups. The market is in a potential transition phase, with short-term bullishness possibly leading to a broader trend reversal if intermediate-term resistance levels are overcome.

Chart Analysis ATS AI Generated: 2025-08-07 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.