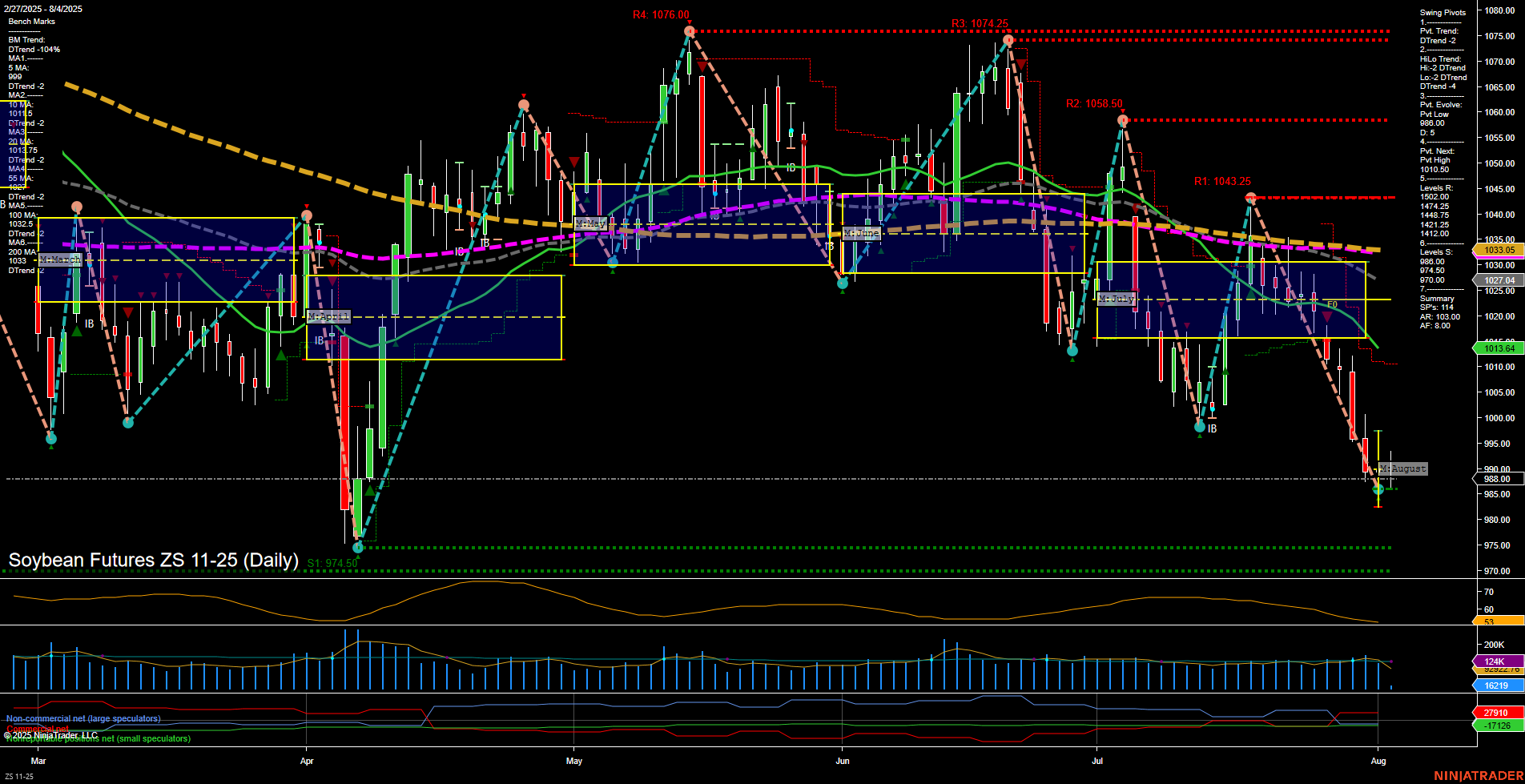

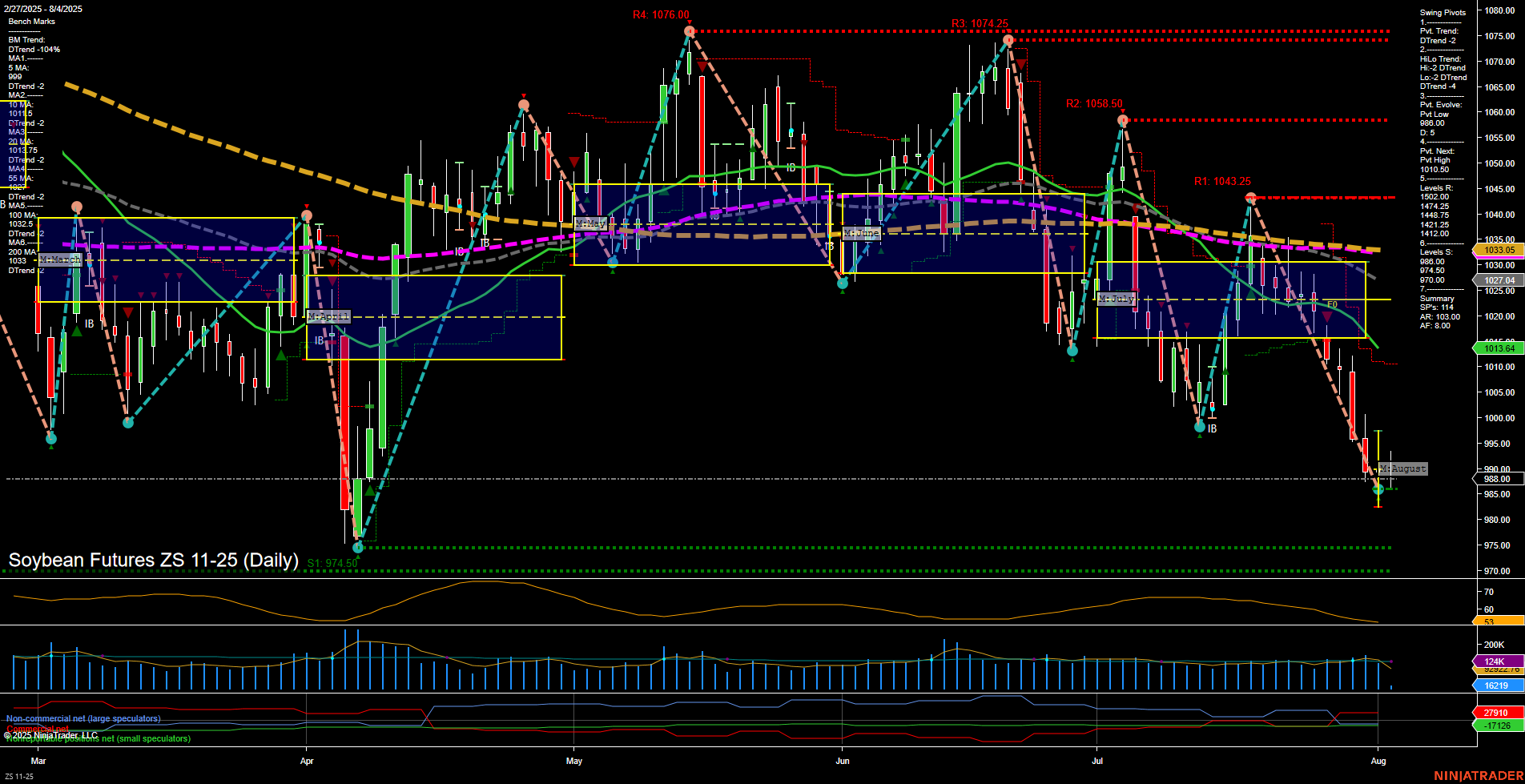

ZS Soybean Futures Daily Chart Analysis: 2025-Aug-04 07:19 CT

Price Action

- Last: 983.50,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 974.50,

- 4. Pvt. Next: Pvt high 1010.50,

- 5. Levels R: 1058.50, 1043.25, 1010.50,

- 6. Levels S: 974.50.

Daily Benchmarks

- (Short-Term) 5 Day: 991 Down Trend,

- (Short-Term) 10 Day: 1001 Down Trend,

- (Intermediate-Term) 20 Day: 1023 Down Trend,

- (Intermediate-Term) 55 Day: 1033 Down Trend,

- (Long-Term) 100 Day: 1041 Down Trend,

- (Long-Term) 200 Day: 1064 Down Trend.

Additional Metrics

Recent Trade Signals

- 30 Jul 2025: Short ZS 11-25 @ 1002 Signals.USAR.TR720

- 30 Jul 2025: Short ZS 11-25 @ 1007.75 Signals.USAR-WSFG

- 28 Jul 2025: Short ZS 11-25 @ 1016.25 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

ZS Soybean Futures are exhibiting a clear bearish structure across all timeframes. Price is trading below all key moving averages, with each benchmark MA trending down, confirming persistent downside momentum. The most recent swing pivots show a dominant downtrend, with the last pivot low at 974.50 and resistance levels stacked well above current price, indicating that rallies are being sold and lower highs are forming. The price is also below the NTZ (neutral trading zone) on the weekly, monthly, and yearly session fib grids, reinforcing the negative bias. Recent trade signals have all triggered on the short side, aligning with the prevailing trend. Volatility, as measured by ATR, remains moderate, and volume is steady, suggesting the move is supported by participation but not marked by panic. The market appears to be in a trend continuation phase after a breakdown from consolidation, with no immediate signs of reversal. This environment favors trend-following strategies, with attention on potential support at the recent swing low and resistance at prior pivot highs.

Chart Analysis ATS AI Generated: 2025-08-04 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.