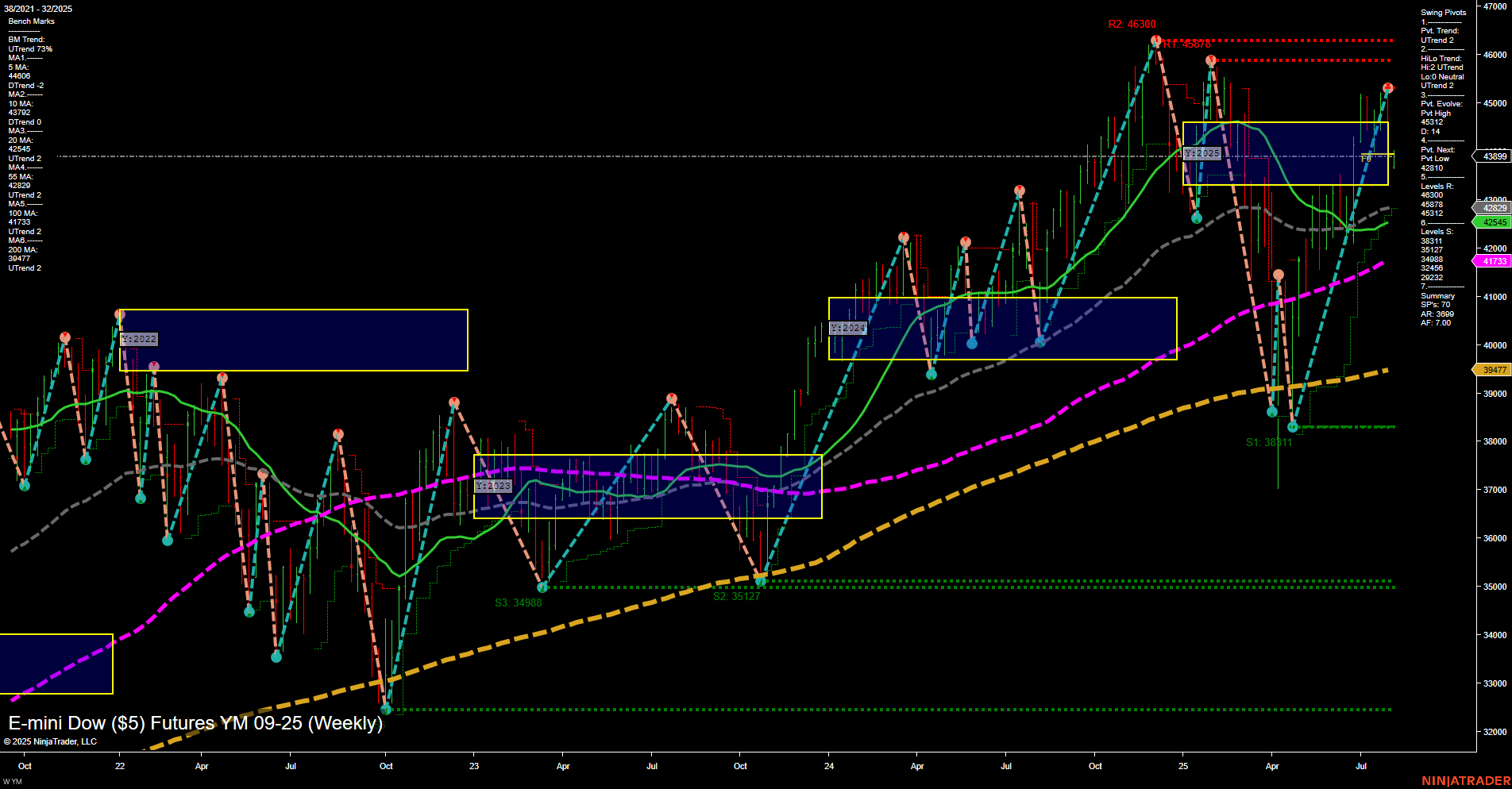

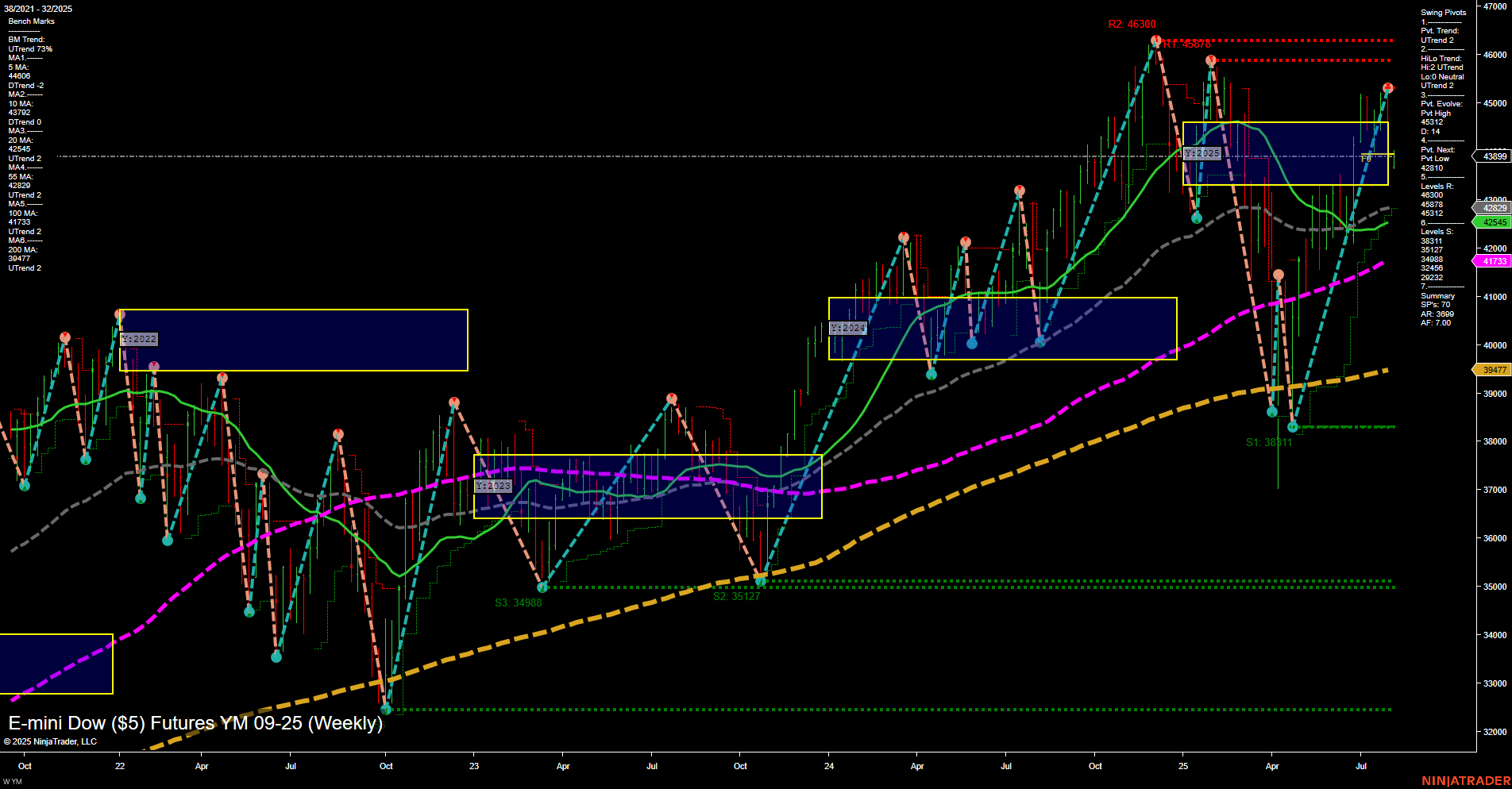

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Aug-04 07:18 CT

Price Action

- Last: 43899,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 46312,

- 4. Pvt. Next: Pvt low 43148,

- 5. Levels R: 46300, 45878,

- 6. Levels S: 43148, 38111, 35127, 34988.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 44606 Up Trend,

- (Intermediate-Term) 10 Week: 43245 Up Trend,

- (Long-Term) 20 Week: 42525 Up Trend,

- (Long-Term) 55 Week: 41733 Up Trend,

- (Long-Term) 100 Week: 40426 Up Trend,

- (Long-Term) 200 Week: 39477 Up Trend.

Recent Trade Signals

- 04 Aug 2025: Short YM 09-25 @ 43894 Signals.USAR-MSFG

- 01 Aug 2025: Short YM 09-25 @ 44238 Signals.USAR.TR720

- 29 Jul 2025: Short YM 09-25 @ 45069 Signals.USAR-WSFG

- 28 Jul 2025: Short YM 09-25 @ 44957 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a market at a technical crossroads. Price action is volatile with large bars and fast momentum, reflecting heightened activity and possible news-driven volatility. The short-term WSFG trend is up, with price above the NTZ, but recent short-term trade signals have shifted to the short side, suggesting a possible near-term pullback or consolidation after a strong move. Intermediate-term (monthly) and long-term (yearly) Fib grid trends are both down, with price below their respective NTZs, indicating that the broader context is still corrective or in retracement mode. However, all major moving averages from 5-week to 200-week are trending up, supporting a longer-term bullish structure. Swing pivots show the most recent evolution at a pivot high (46312) with the next key support at 43148, and major resistance at 46300 and 45878. The market is currently testing support levels after a failed attempt to break higher, and the overall structure suggests a battle between short-term profit-taking and longer-term bullish momentum. The environment is choppy, with potential for both sharp pullbacks and quick recoveries, typical of late-stage uptrends or early-stage corrections.

Chart Analysis ATS AI Generated: 2025-08-04 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.