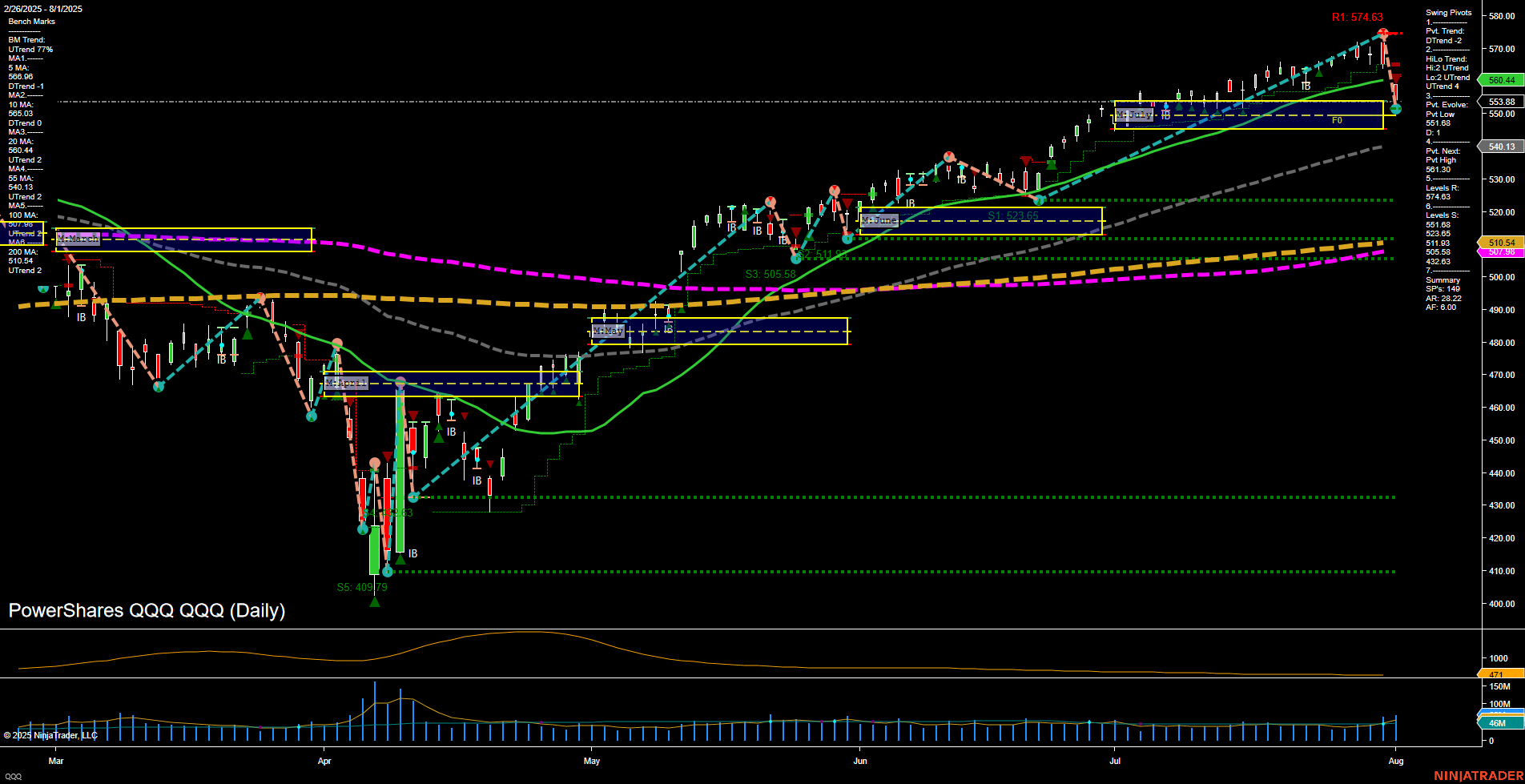

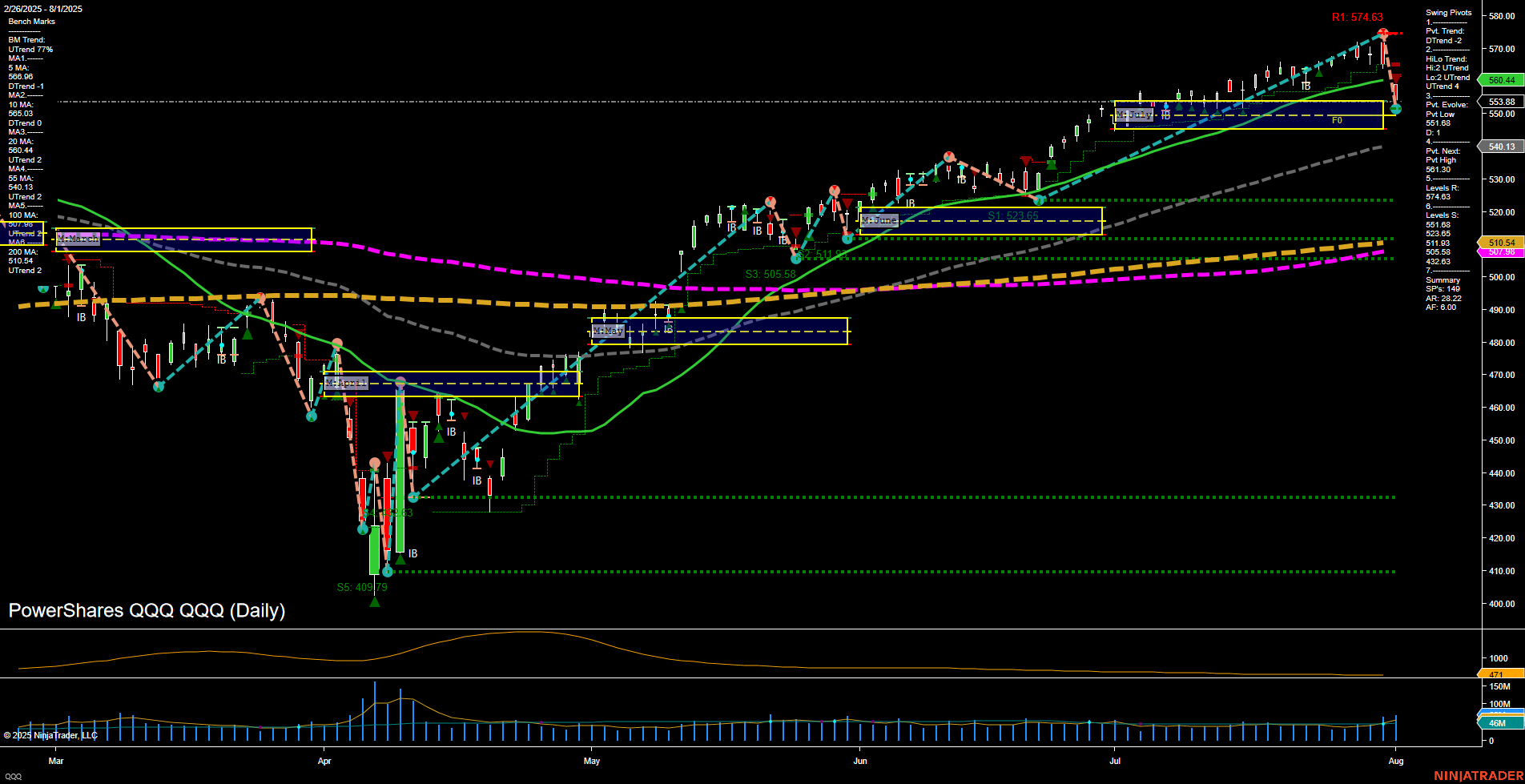

QQQ PowerShares QQQ Daily Chart Analysis: 2025-Aug-04 07:12 CT

Price Action

- Last: 553.88,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 551.08,

- 4. Pvt. Next: Pvt High 574.63,

- 5. Levels R: 574.63, 561.30, 547.63,

- 6. Levels S: 551.08, 523.65, 510.54.

Daily Benchmarks

- (Short-Term) 5 Day: 566.08 Down Trend,

- (Short-Term) 10 Day: 565.03 Down Trend,

- (Intermediate-Term) 20 Day: 560.44 Down Trend,

- (Intermediate-Term) 55 Day: 540.13 Up Trend,

- (Long-Term) 100 Day: 526.04 Up Trend,

- (Long-Term) 200 Day: 510.54 Up Trend.

Additional Metrics

- ATR: 733,

- VOLMA: 32709273.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The QQQ daily chart shows a sharp recent pullback, with large bars and fast momentum to the downside, breaking below short-term moving averages (5, 10, 20-day), all of which have turned down. The short-term swing pivot trend has shifted to a downtrend, while the intermediate-term HiLo trend remains up, indicating a possible corrective phase within a larger uptrend. Key resistance is at 574.63 and 561.30, with immediate support at 551.08 and further below at 523.65 and 510.54. The 55, 100, and 200-day moving averages are still trending up, supporting a bullish long-term structure. ATR is elevated, and volume is above average, suggesting heightened volatility and active participation. The overall structure points to a short-term bearish/corrective move within a longer-term bullish trend, with the market currently testing key support levels after a strong rally.

Chart Analysis ATS AI Generated: 2025-08-04 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.