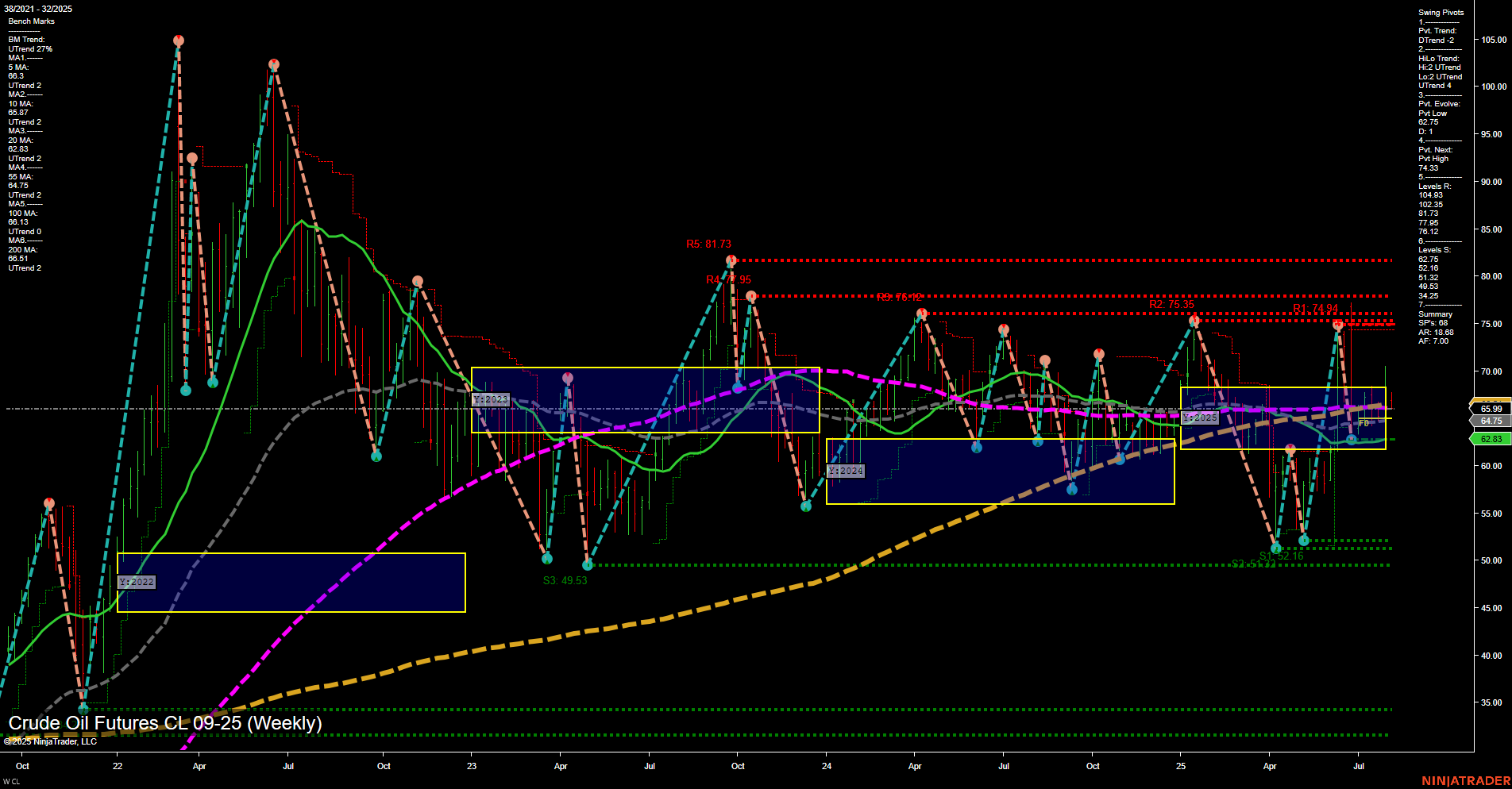

Crude oil futures are currently experiencing a period of slow momentum with medium-sized weekly bars, reflecting a market in transition. The short-term and intermediate-term trends are both bearish, as indicated by the WSFG and MSFG readings, with price action below their respective NTZ/F0% levels and recent short trade signals confirming downside pressure. The swing pivot structure shows a developing downtrend in the short term, but the intermediate-term HiLo trend remains up, suggesting some underlying support or potential for a counter-trend move. Key resistance levels cluster in the mid-to-high $70s, while support is established at $62.16 and lower at $51.33 and $49.53. Benchmark moving averages reinforce the mixed outlook: short and intermediate-term MAs are trending down, while the 20-week and 200-week MAs are up, and the 55- and 100-week MAs are down, highlighting a market caught between longer-term support and shorter-term selling pressure. The long-term YSFG trend is up, but with price only marginally above the yearly NTZ, the bullish case is not yet dominant. Overall, the market is consolidating after a recent sell-off, with volatility likely as it tests key support and resistance zones. Swing traders should note the potential for choppy price action and the importance of watching for a decisive break from the current range to signal the next directional move.