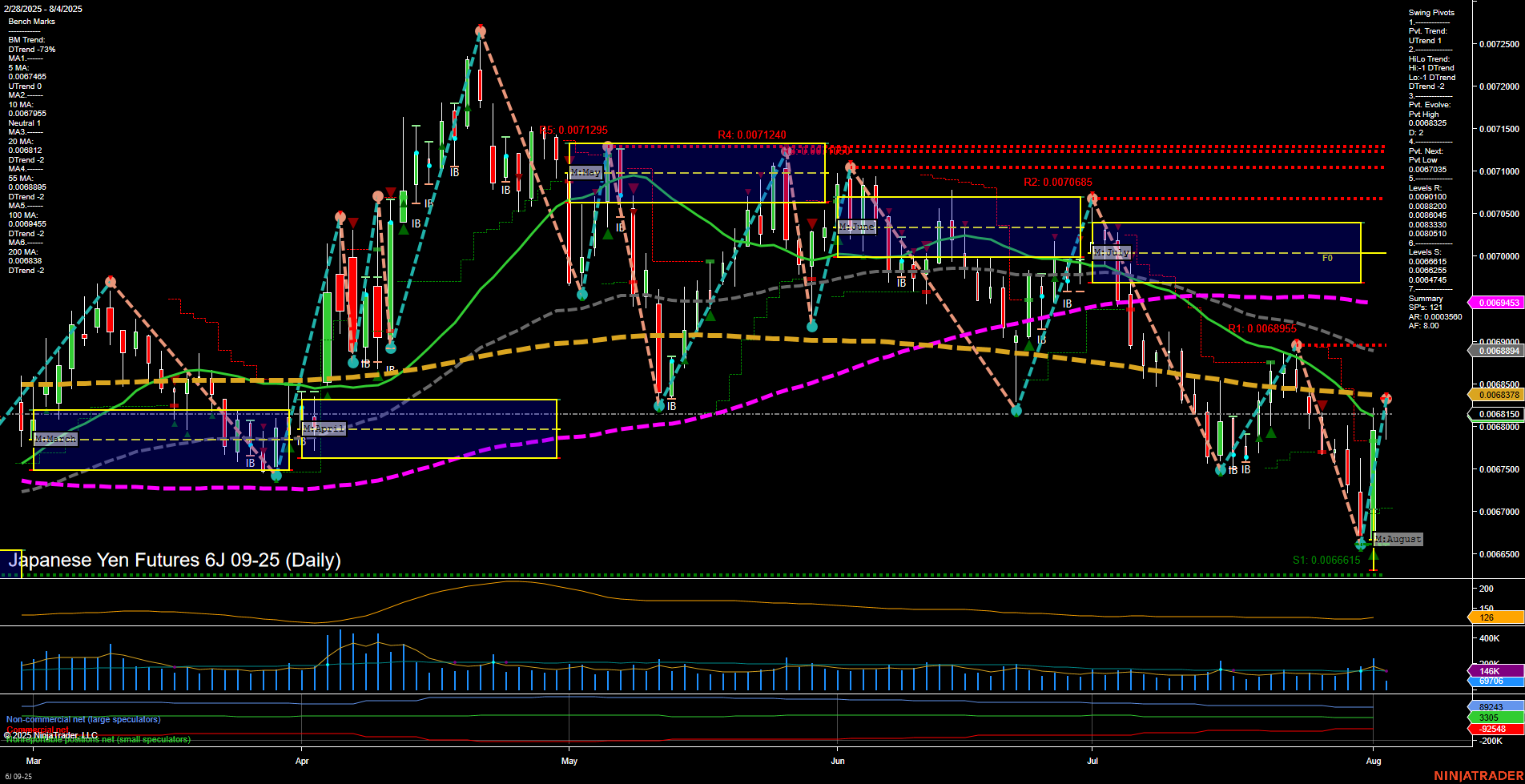

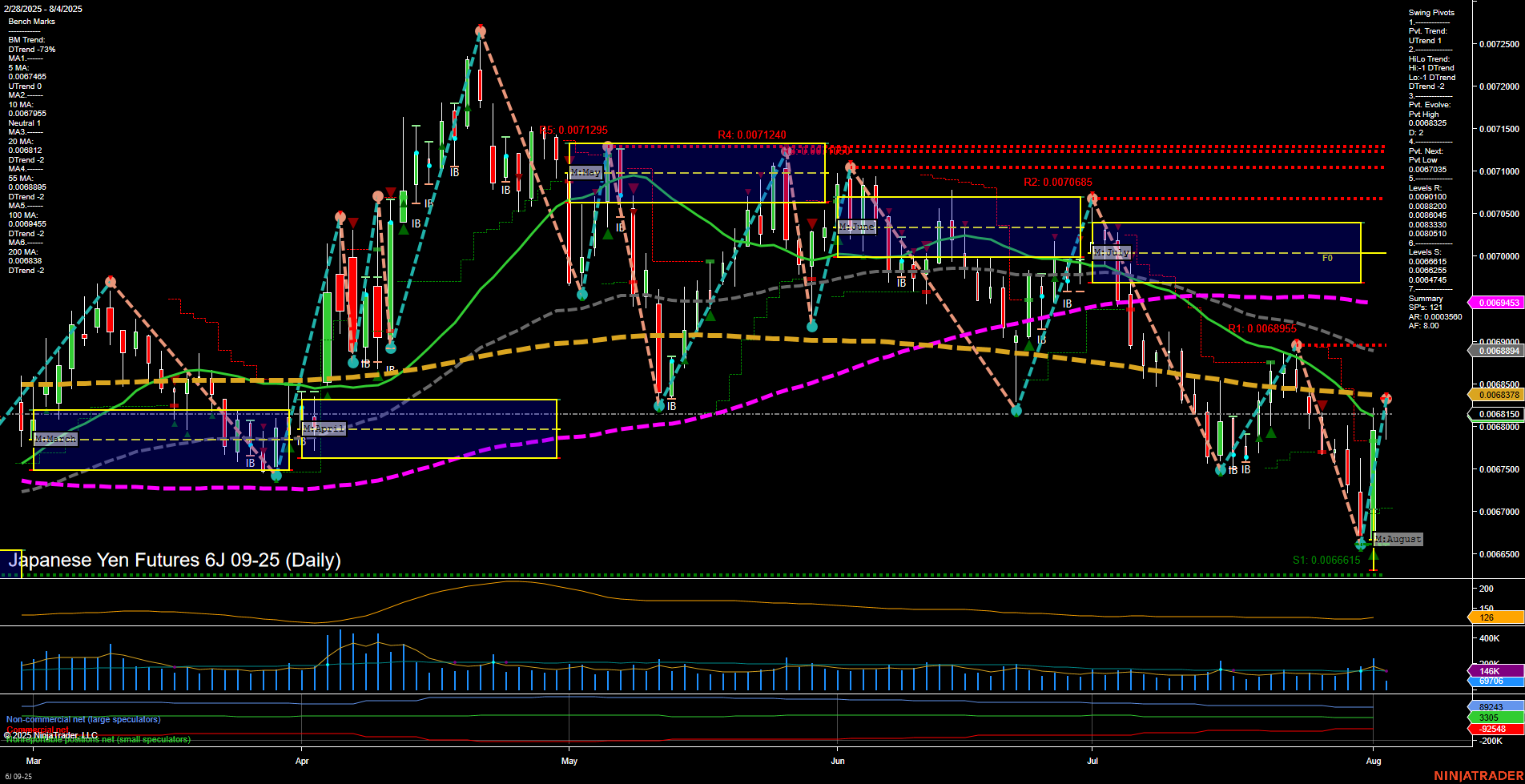

6J Japanese Yen Futures Daily Chart Analysis: 2025-Aug-04 07:02 CT

Price Action

- Last: 0.0068376,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 42%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0066525,

- 4. Pvt. Next: Pvt low 0.0067035,

- 5. Levels R: 0.0072500, 0.0072000, 0.0071295, 0.0071240, 0.0070685, 0.0069595, 0.0069510, 0.0068840, 0.0068775, 0.0068475,

- 6. Levels S: 0.0066615.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0067485 Down Trend,

- (Short-Term) 10 Day: 0.0067995 Down Trend,

- (Intermediate-Term) 20 Day: 0.0068588 Down Trend,

- (Intermediate-Term) 55 Day: 0.0068843 Down Trend,

- (Long-Term) 100 Day: 0.0069453 Down Trend,

- (Long-Term) 200 Day: 0.0068884 Down Trend.

Additional Metrics

Recent Trade Signals

- 01 Aug 2025: Long 6J 09-25 @ 0.0067865 Signals.USAR.TR120

- 30 Jul 2025: Short 6J 09-25 @ 0.006743 Signals.USAR.TR720

- 28 Jul 2025: Short 6J 09-25 @ 0.006793 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6J Japanese Yen Futures daily chart shows a recent surge in price action with large, fast momentum bars, indicating a strong short-term move off recent lows. The short-term swing pivot trend has shifted to an uptrend, but all benchmark moving averages from short to long-term remain in a downtrend, reflecting persistent bearish pressure over the past months. The weekly session fib grid (WSFG) trend is down with price below the NTZ, suggesting short-term weakness, while the monthly (MSFG) and yearly (YSFG) session fib grids both show price above their NTZs and an uptrend, hinting at a possible intermediate and long-term recovery. Swing pivot resistance levels are stacked above, with the nearest support at 0.0066615, which recently held during the latest sell-off. Recent trade signals show a mix of short and long entries, reflecting the choppy, transitional nature of the current market. Volatility remains elevated (ATR 118), and volume is robust. Overall, the market is in a short-term neutral phase with potential for further upside retracement, but intermediate-term structure remains bearish until key resistance levels are reclaimed. Long-term outlook is turning bullish as higher time frame trends begin to shift, but confirmation is still needed.

Chart Analysis ATS AI Generated: 2025-08-04 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.