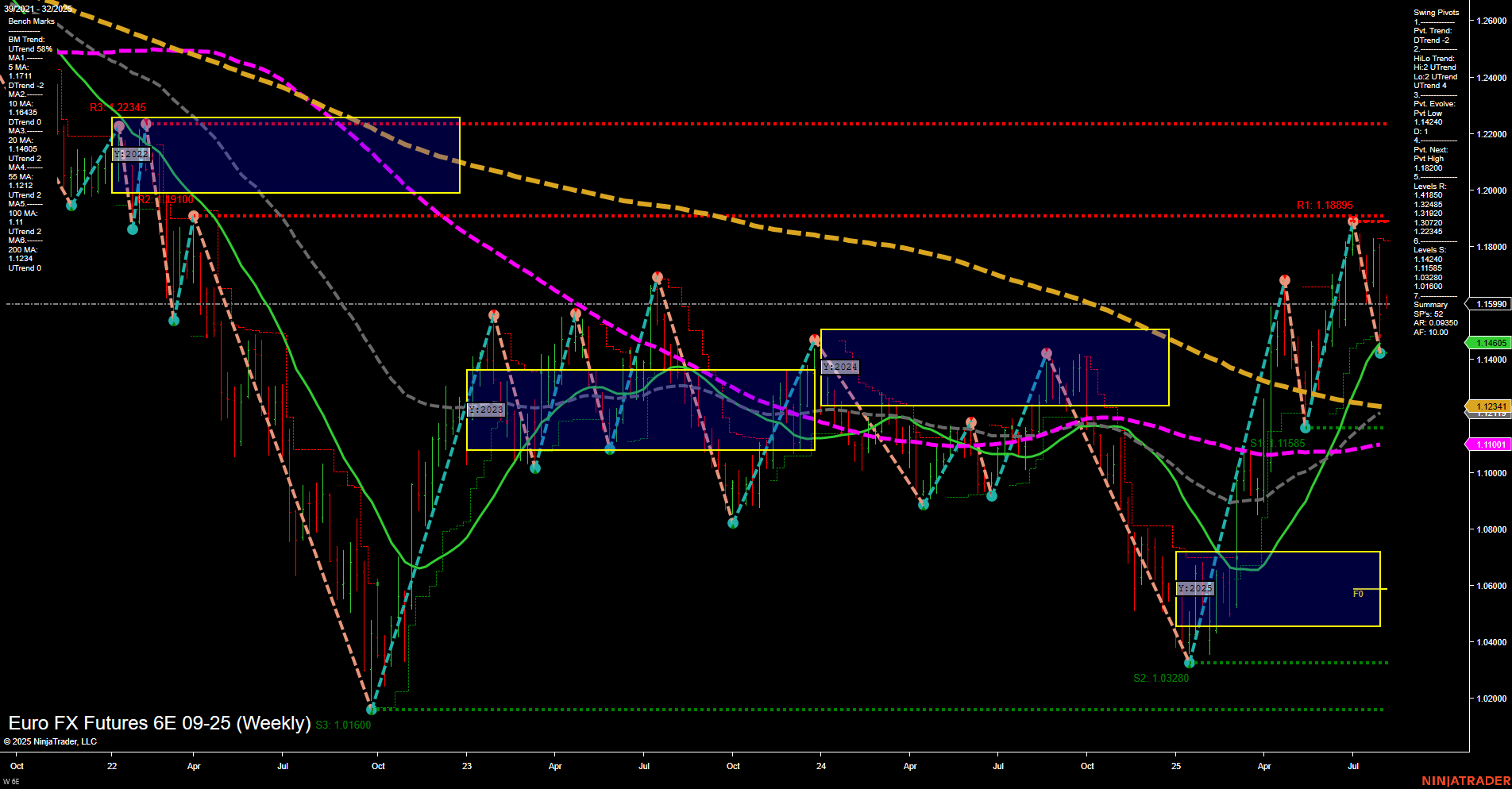

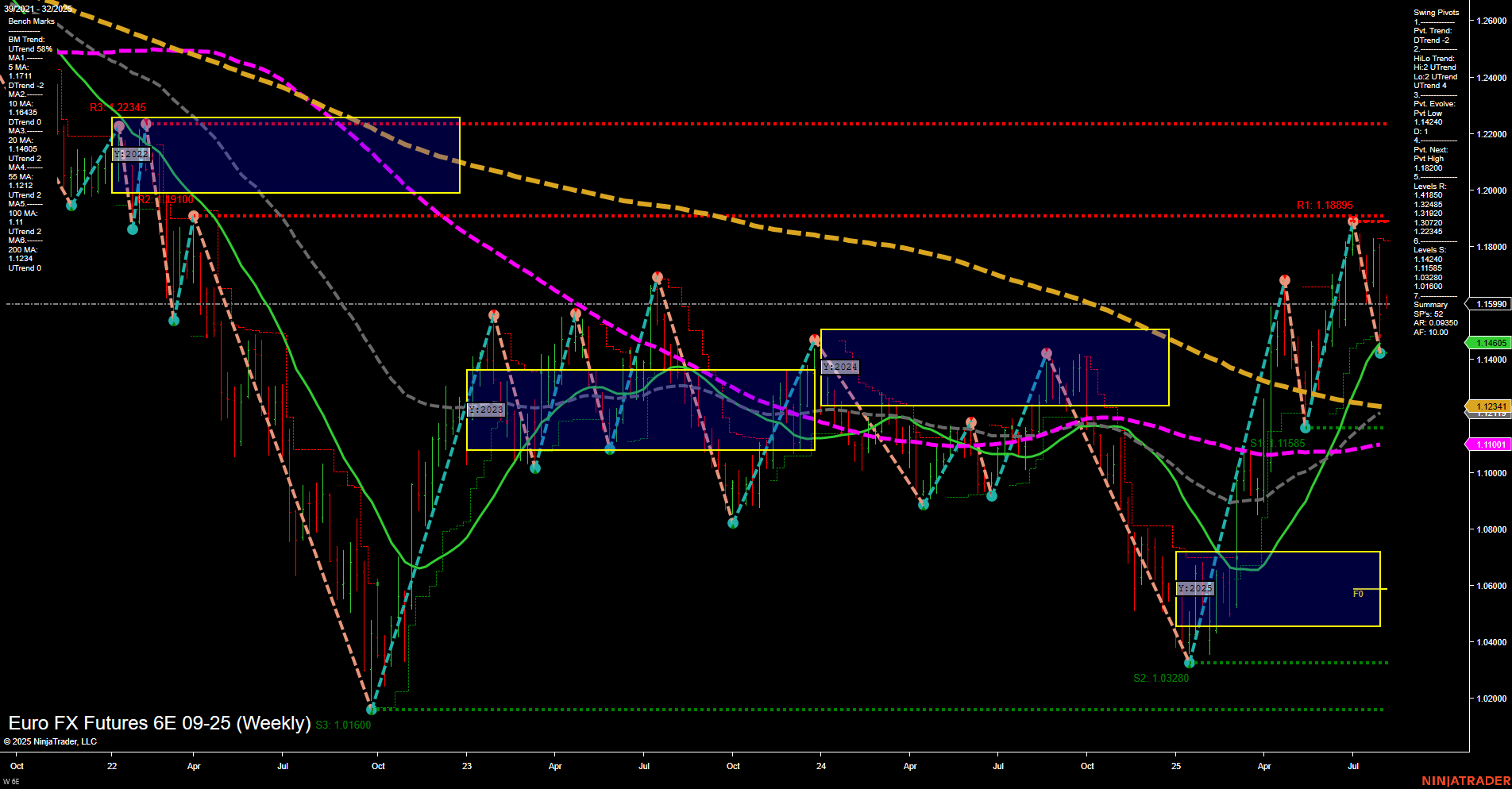

6E Euro FX Futures Weekly Chart Analysis: 2025-Aug-04 07:02 CT

Price Action

- Last: 1.15990,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 31%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 77%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.14200,

- 4. Pvt. Next: Pvt high 1.18200,

- 5. Levels R: 1.22345, 1.19100, 1.18895, 1.18200,

- 6. Levels S: 1.15865, 1.14200, 1.03820, 1.01600.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.1711 Down Trend,

- (Intermediate-Term) 10 Week: 1.1643 Down Trend,

- (Long-Term) 20 Week: 1.14605 Up Trend,

- (Long-Term) 55 Week: 1.12341 Up Trend,

- (Long-Term) 100 Week: 1.11001 Up Trend,

- (Long-Term) 200 Week: 1.20234 Down Trend.

Recent Trade Signals

- 01 Aug 2025: Long 6E 09-25 @ 1.1587 Signals.USAR.TR120

- 29 Jul 2025: Short 6E 09-25 @ 1.162 Signals.USAR.TR720

- 28 Jul 2025: Short 6E 09-25 @ 1.17795 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short-term momentum has turned bearish, with price action below the weekly session fib grid and recent swing pivots indicating a downward move. However, the intermediate and long-term trends remain bullish, supported by the monthly and yearly session fib grids, as well as upward-trending long-term moving averages. The recent trade signals reflect this mixed environment, with both long and short entries triggered in quick succession, highlighting choppy and volatile conditions. Resistance is clustered above at 1.18200 and higher, while support is found at 1.15865 and 1.14200. The market appears to be in a corrective phase within a broader uptrend, with potential for further consolidation or a pullback before any sustained directional move. This environment favors swing traders who can adapt to both trend and counter-trend setups, as the market navigates between key support and resistance levels.

Chart Analysis ATS AI Generated: 2025-08-04 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.