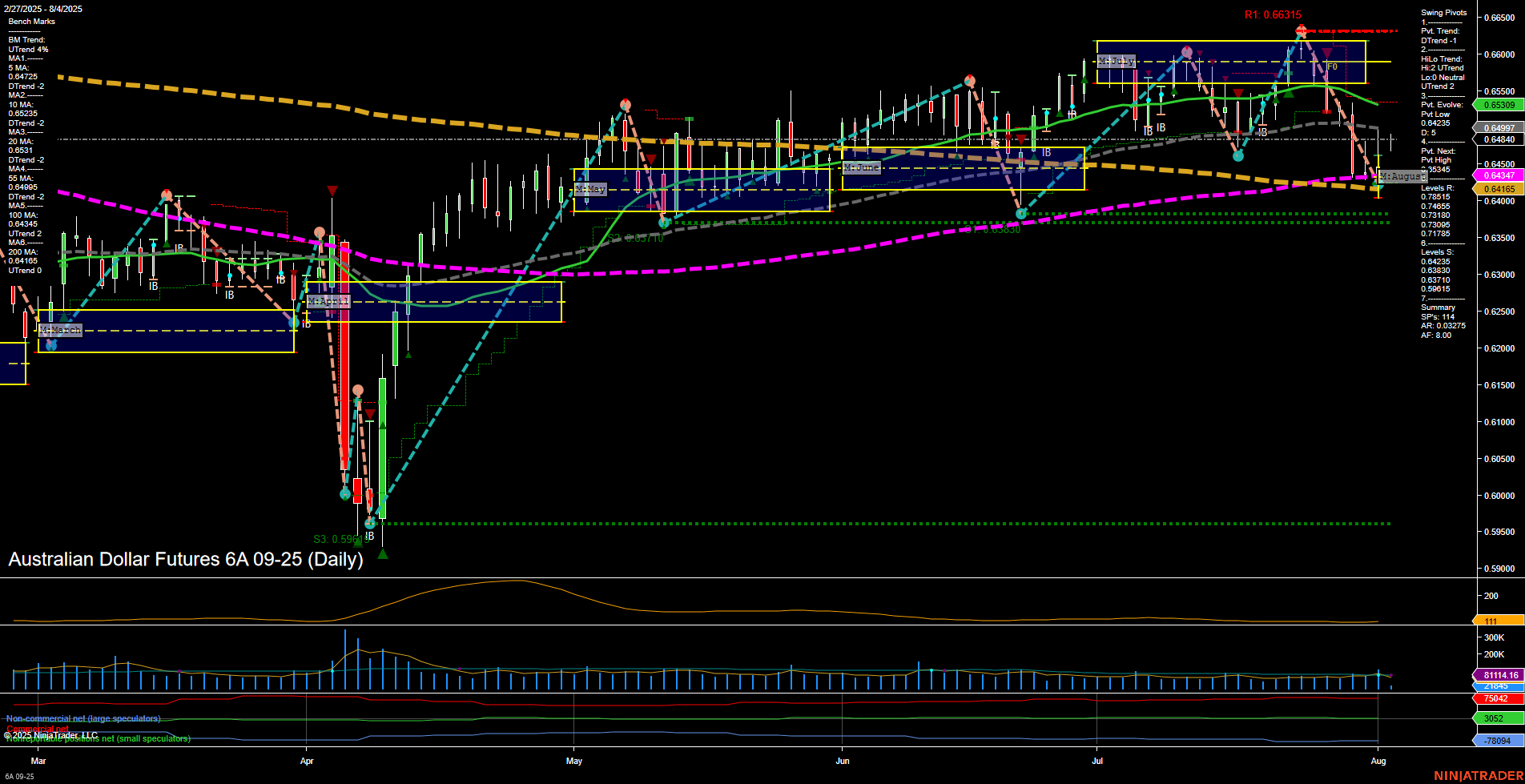

The Australian Dollar Futures (6A) daily chart shows a market in transition, with recent price action characterized by medium-sized bars and slow momentum, suggesting a lack of strong directional conviction. The short-term swing pivot trend has shifted to a downtrend, confirmed by the majority of short-term moving averages (5, 10, 20, and 55 day) all trending lower. However, the intermediate-term HiLo trend remains in an uptrend, indicating underlying support and a possible base forming above the 0.64165 level. The long-term moving averages are mixed, with the 100-day MA still in an uptrend but the 200-day MA pointing down, reflecting a broader consolidation phase. Key resistance levels are clustered at 0.64847, 0.65425, and 0.66315, while support is found at 0.64165 and below. The ATR and volume metrics suggest moderate volatility and participation. The most recent trade signal is a long entry at 0.6482, aligning with a potential attempt to stabilize after a recent pullback. Overall, the chart reflects a market in a corrective phase within a larger consolidation, with short-term bearishness but no clear breakdown or breakout, and intermediate to long-term trends remaining neutral. Traders are likely watching for a decisive move above resistance or a breakdown below key support to confirm the next directional phase.