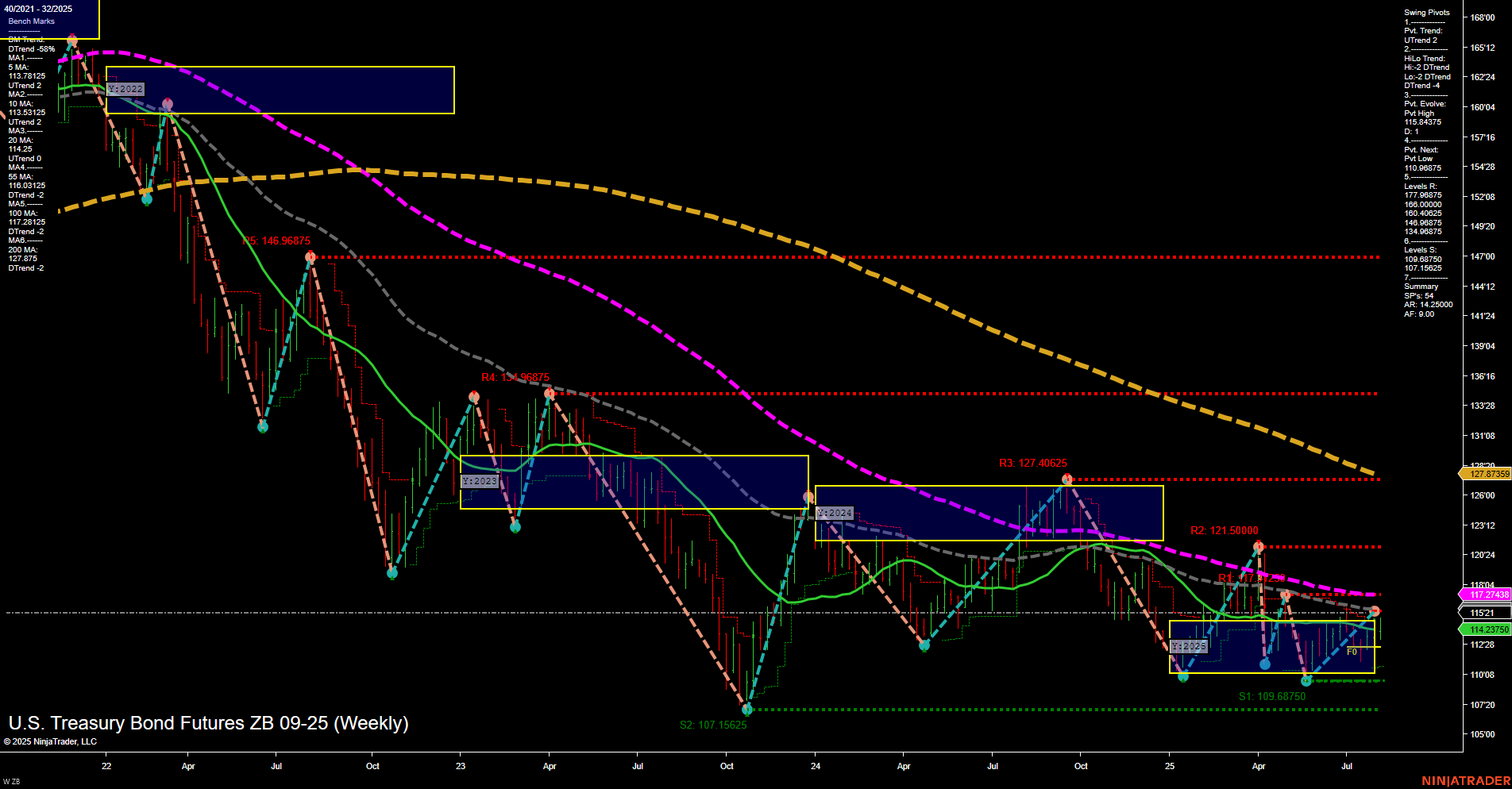

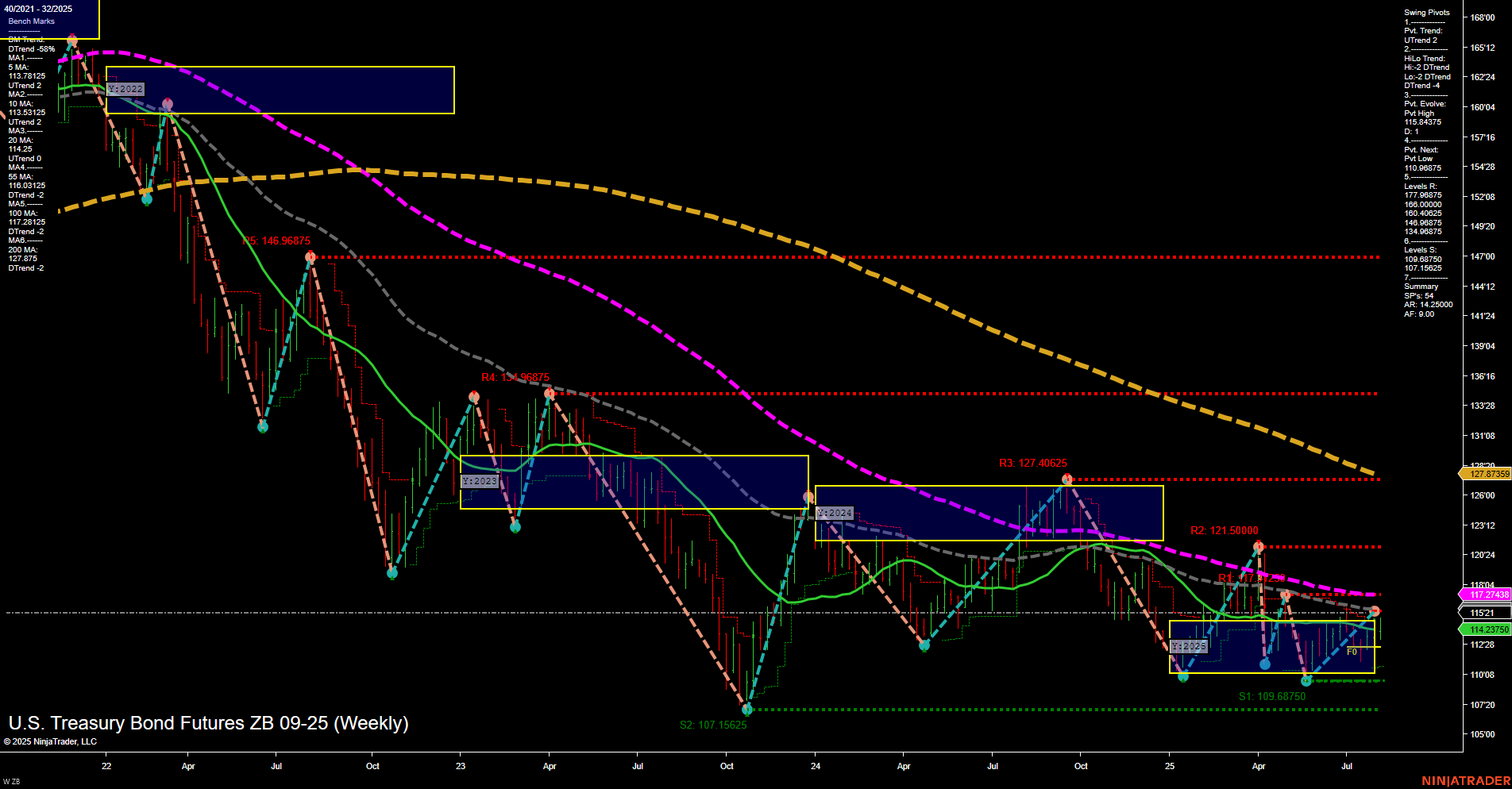

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-03 18:14 CT

Price Action

- Last: 127.8735,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 115.84375,

- 4. Pvt. Next: Pvt low 110.96875,

- 5. Levels R: 146.96875, 141.96875, 127.40625, 121.50000, 119.96875,

- 6. Levels S: 109.68750, 107.15625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.21 Down Trend,

- (Intermediate-Term) 10 Week: 113.8125 Down Trend,

- (Long-Term) 20 Week: 114.2375 Down Trend,

- (Long-Term) 55 Week: 117.2744 Down Trend,

- (Long-Term) 100 Week: 121.7688 Down Trend,

- (Long-Term) 200 Week: 127.8875 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart reflects a persistent bearish environment across all timeframes. Price action remains subdued with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The market is consolidating near the lower end of the recent range, with the last price just below the 200-week moving average, which is trending down alongside all other key benchmarks. Both short-term and intermediate-term swing pivot trends are down, with resistance levels stacked well above current price and support levels not far below, suggesting limited upside potential and a risk of further downside. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) highlights a lack of clear breakout or reversal signals, reinforcing the overall bearish structure. The technical landscape is characterized by lower highs and lower lows, with the market struggling to reclaim lost ground, and no significant bullish reversal patterns evident at this stage.

Chart Analysis ATS AI Generated: 2025-08-03 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.