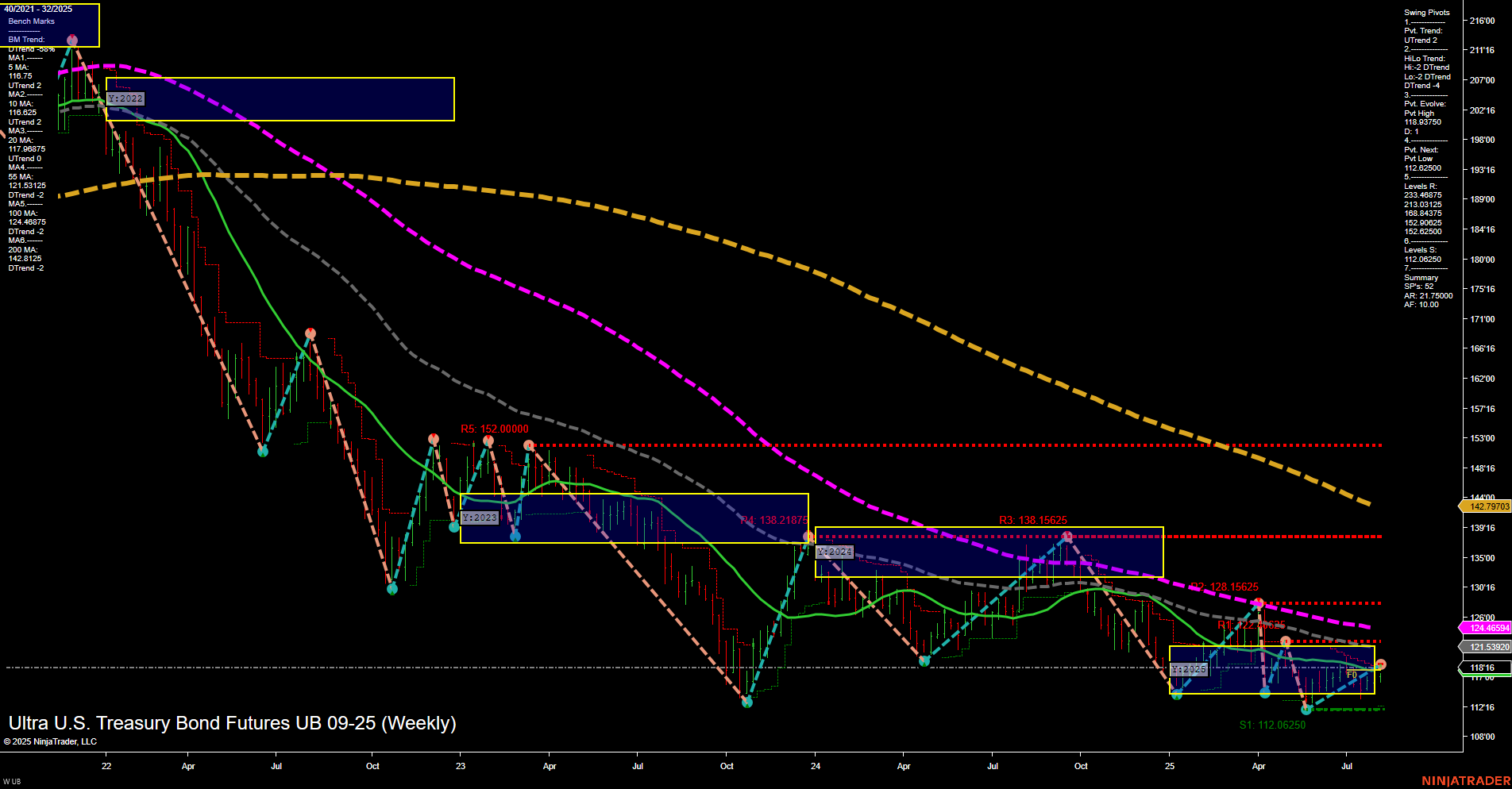

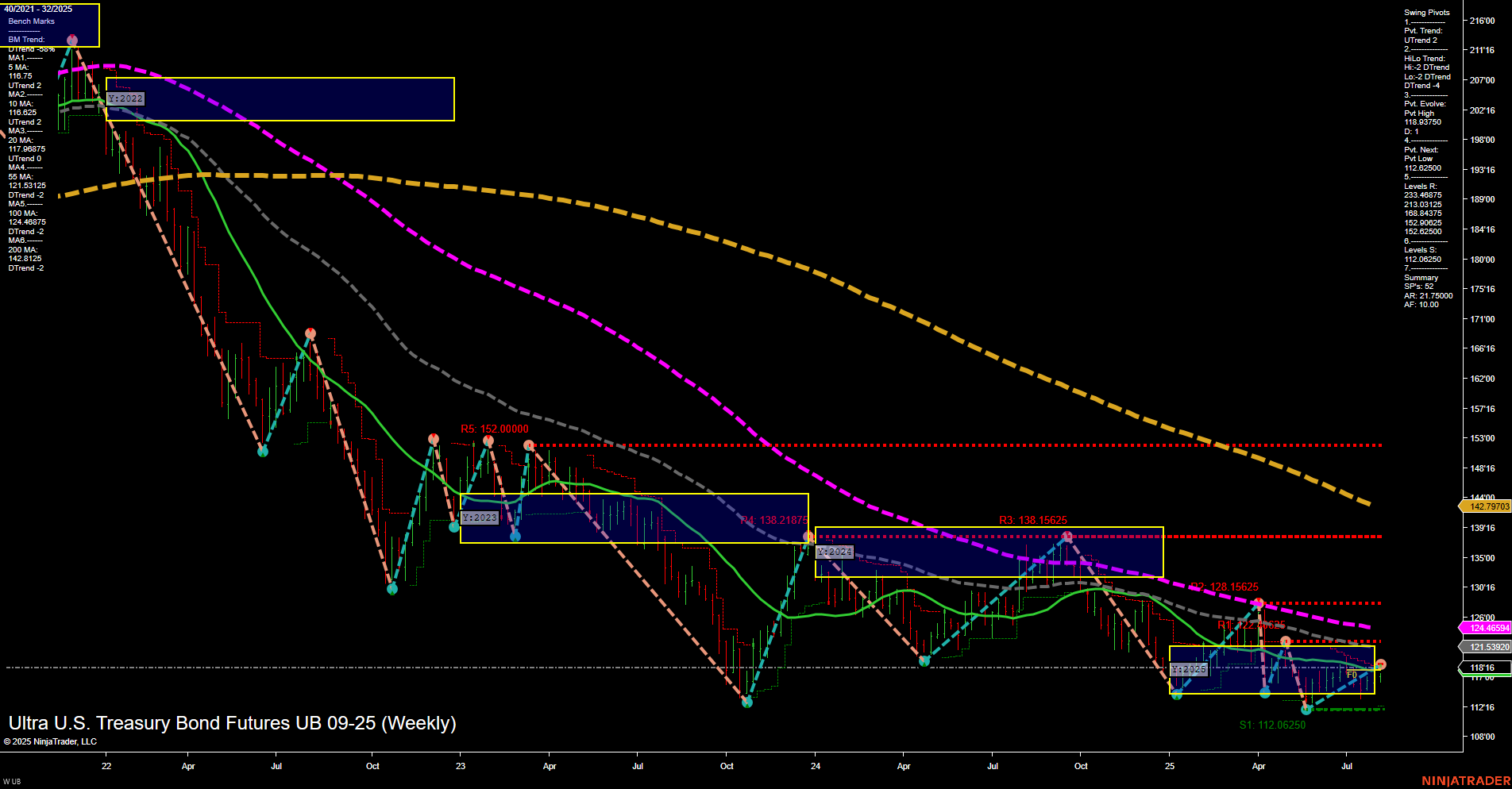

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-03 18:12 CT

Price Action

- Last: 117'19 (117.59375),

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 118.9375,

- 4. Pvt. Next: Pvt low 112.0625,

- 5. Levels R: 233.46875, 213.03125, 184.8125, 152.0000, 138.21875, 128.15625, 121.5625,

- 6. Levels S: 112.0625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 117.96 Up Trend,

- (Intermediate-Term) 10 Week: 116.02 Up Trend,

- (Long-Term) 20 Week: 121.54 Down Trend,

- (Long-Term) 55 Week: 124.46 Down Trend,

- (Long-Term) 100 Week: 142.80 Down Trend,

- (Long-Term) 200 Week: 142.80 Down Trend.

Recent Trade Signals

- 30 Jul 2025: Long UB 09-25 @ 117.71875 Signals.USAR.TR720

- 29 Jul 2025: Long UB 09-25 @ 116.4375 Signals.USAR-WSFG

- 28 Jul 2025: Long UB 09-25 @ 116.59375 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a notable shift in short-term momentum, with price action breaking above the NTZ center and both the WSFG and MSFG trends pointing up. Recent trade signals confirm renewed bullish interest, and the 5- and 10-week moving averages are trending higher, supporting a short-term uptrend. However, the intermediate-term HiLo trend remains down, and the 20-, 55-, 100-, and 200-week moving averages are all in established downtrends, indicating that the broader structure is still bearish. Resistance levels cluster above, with 121'16 and 128'05 as key hurdles, while 112'06 stands as major support. The market is in a recovery phase, with a potential for further upside if short-term momentum persists, but faces significant overhead resistance and remains in a long-term corrective structure. The environment is characterized by a possible trend continuation off recent lows, but with the risk of pullbacks as the market tests higher resistance zones.

Chart Analysis ATS AI Generated: 2025-08-03 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.