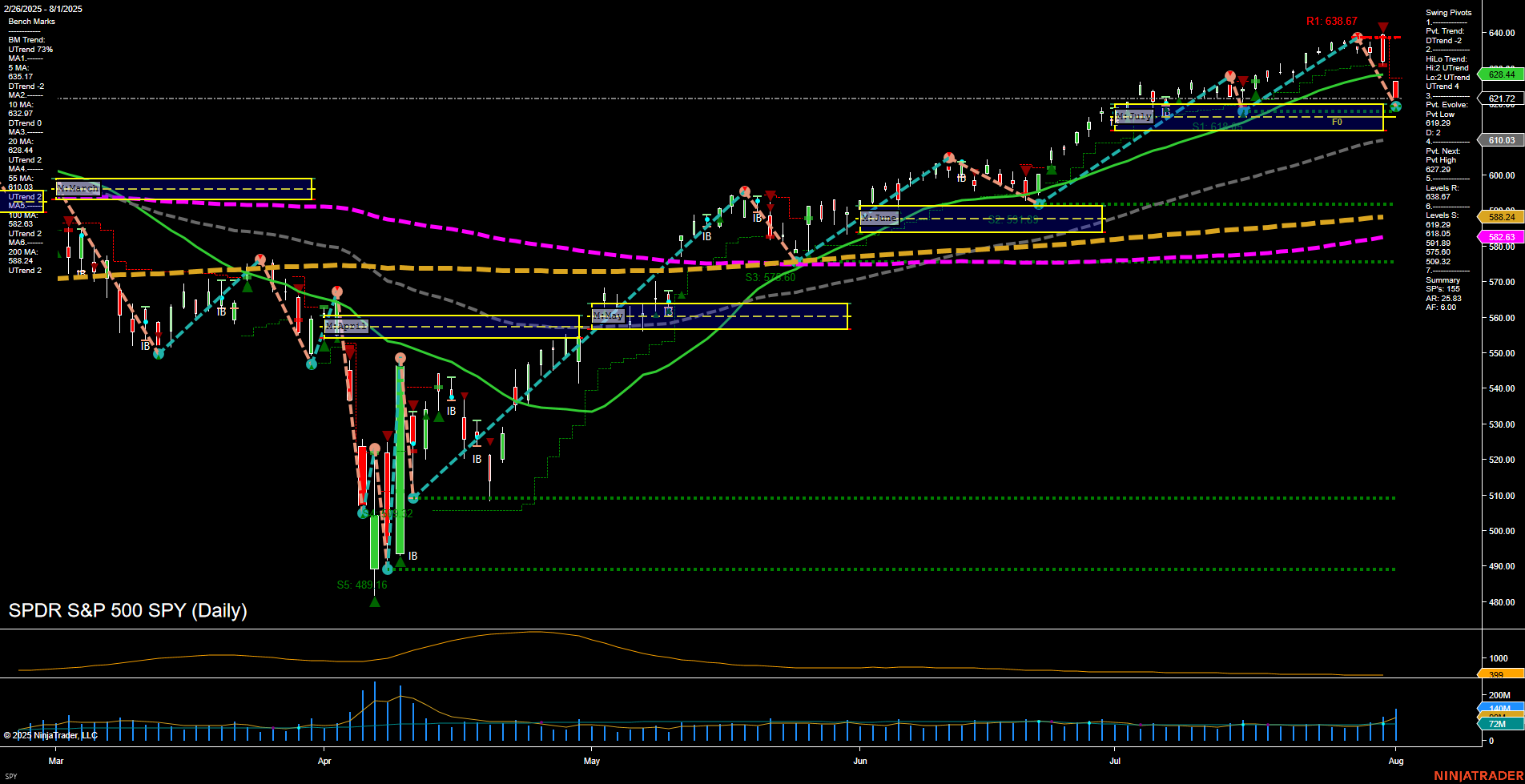

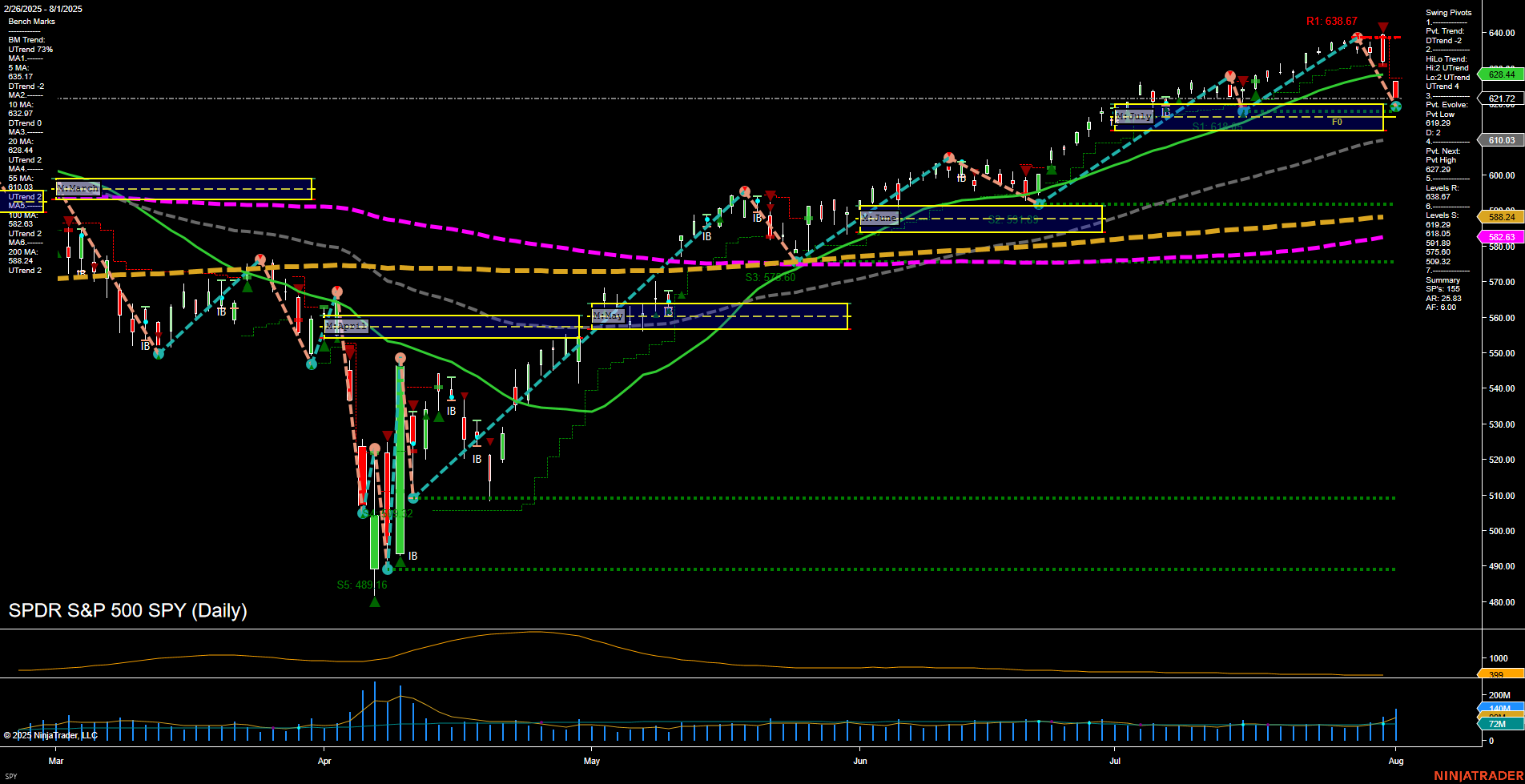

SPY SPDR S&P 500 Daily Chart Analysis: 2025-Aug-03 18:11 CT

Price Action

- Last: 621.72,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 638.67,

- 4. Pvt. Next: Pvt low 610.03,

- 5. Levels R: 638.67, 628.44,

- 6. Levels S: 610.03, 588.24, 582.03, 580.00.

Daily Benchmarks

- (Short-Term) 5 Day: 635.17 Down Trend,

- (Short-Term) 10 Day: 632.07 Down Trend,

- (Intermediate-Term) 20 Day: 622.46 Up Trend,

- (Intermediate-Term) 55 Day: 603.87 Up Trend,

- (Long-Term) 100 Day: 582.23 Up Trend,

- (Long-Term) 200 Day: 558.24 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart shows a recent shift in short-term momentum, with the latest swing pivot marking a lower high at 638.67 and a current downtrend in the short-term pivot structure. Both the 5-day and 10-day moving averages have turned down, confirming this short-term weakness. However, intermediate and long-term trends remain intact to the upside, as seen in the 20, 55, 100, and 200-day moving averages, all trending higher. The intermediate-term swing structure (HiLo Trend) is still in an uptrend, suggesting that the broader move remains constructive despite the current pullback. Key resistance is at 638.67 and 628.44, while support levels to watch are 610.03 and the cluster around 588–582. The ATR and volume metrics indicate a moderate increase in volatility and participation, typical of a corrective phase within a larger uptrend. The market appears to be in a consolidation or retracement phase after a strong rally, with the potential for further downside in the short term before a possible resumption of the broader uptrend if support holds.

Chart Analysis ATS AI Generated: 2025-08-03 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.