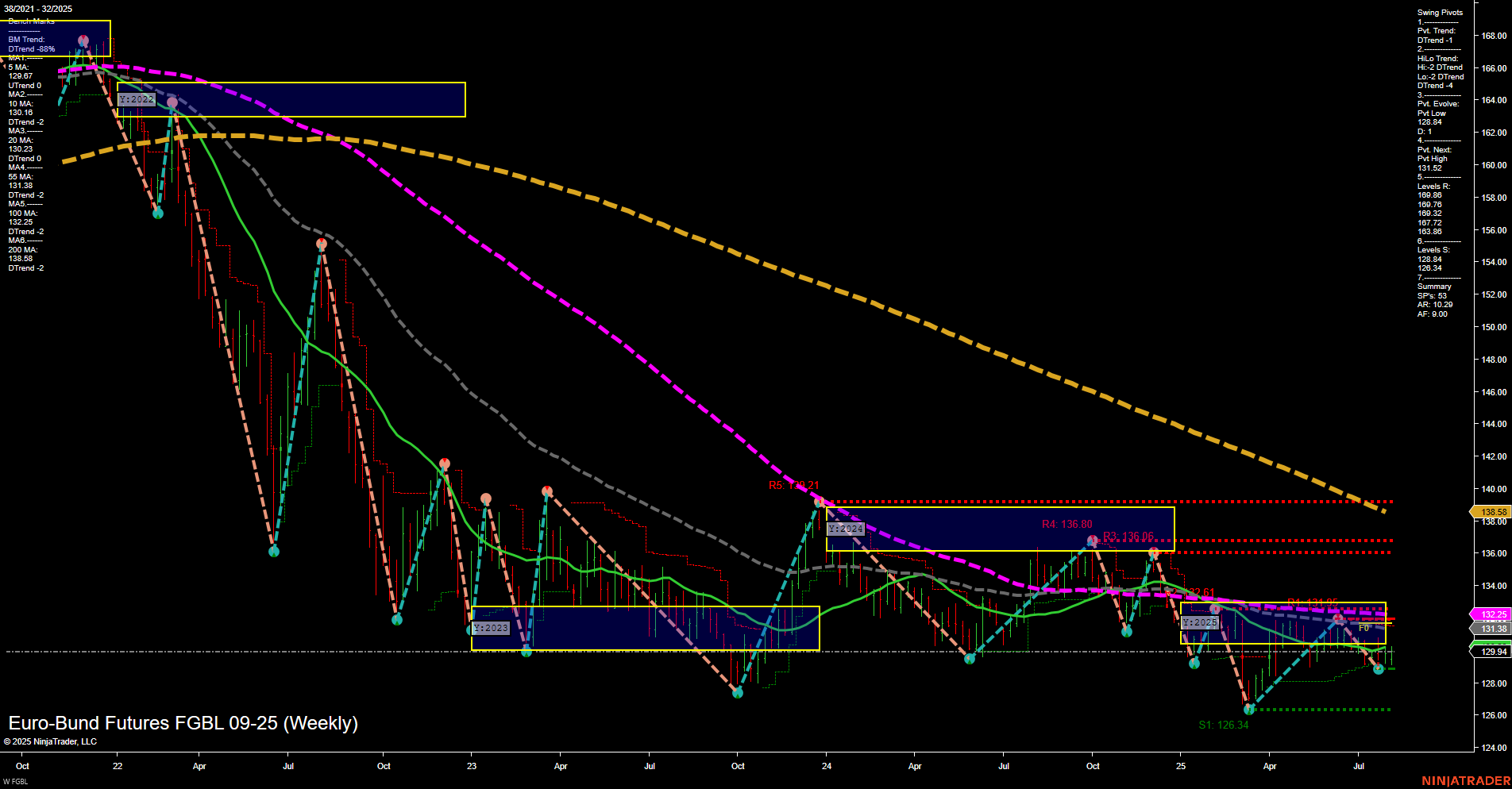

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is currently consolidating with medium-sized bars and average momentum, reflecting indecision after a recent bounce from the swing low at 126.34. Short-term and intermediate-term Fib grid trends (WSFG and MSFG) are both up, with price holding above their respective NTZ/F0% levels, suggesting some bullish undertone in the near term. However, both the short-term and intermediate-term swing pivot trends remain in a downtrend, and the next key resistance is clustered around 132.25–132.61, with major resistance at 136.80. Support is well-defined at 126.34. Weekly benchmarks are mixed: the 20-week MA is turning up, but all other key moving averages (5, 10, 55, 100, 200 week) are still trending down, indicating that the broader long-term structure remains bearish. The yearly session Fib grid trend is down, with price below the yearly NTZ, reinforcing the longer-term bearish bias. Recent trade signals have triggered long entries, reflecting the short-term and intermediate-term grid uptrends, but these are counter to the prevailing long-term downtrend. The market is currently in a consolidation phase, with potential for a short-term rally to test resistance, but the overall structure suggests any upside may be corrective within a larger bearish cycle. Swing traders should note the potential for choppy price action as the market navigates between well-defined support and resistance, with the long-term trend still exerting downward pressure.