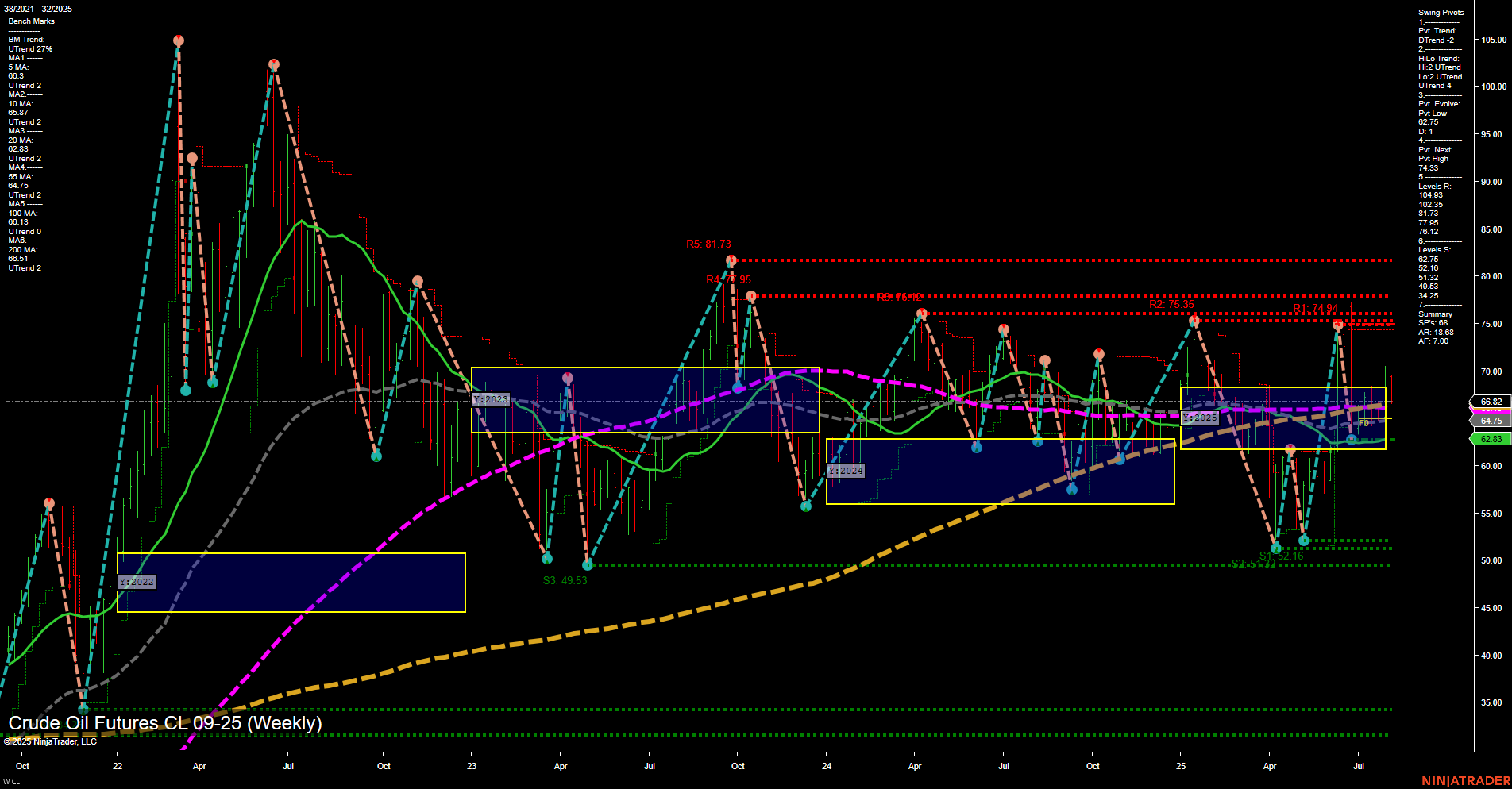

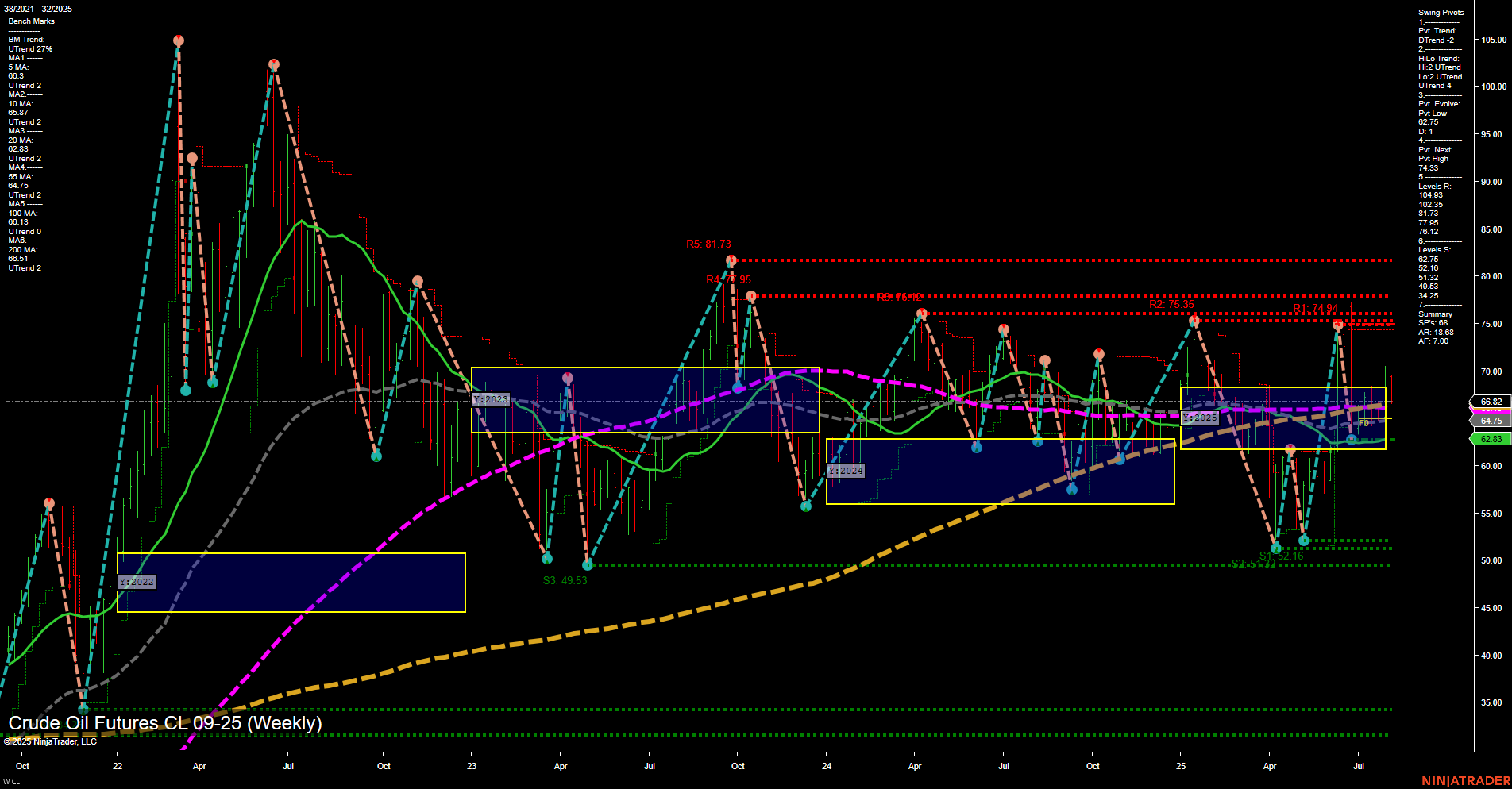

CL Crude Oil Futures Weekly Chart Analysis: 2025-Aug-03 18:03 CT

Price Action

- Last: 64.75,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -13%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 62.75,

- 4. Pvt. Next: Pvt high 74.3,

- 5. Levels R: 81.73, 78.95, 76.42, 75.35, 74.94,

- 6. Levels S: 62.75, 52.16, 51.33, 49.53, 41.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 66.87 Down Trend,

- (Intermediate-Term) 10 Week: 66.23 Down Trend,

- (Long-Term) 20 Week: 62.83 Up Trend,

- (Long-Term) 55 Week: 68.43 Down Trend,

- (Long-Term) 100 Week: 68.15 Down Trend,

- (Long-Term) 200 Week: 60.51 Up Trend.

Recent Trade Signals

- 01 Aug 2025: Short CL 09-25 @ 67.49 Signals.USAR-MSFG

- 01 Aug 2025: Short CL 09-25 @ 68.74 Signals.USAR.TR120

- 30 Jul 2025: Long CL 09-25 @ 69.25 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Crude oil futures are currently experiencing a period of downside pressure in the short and intermediate term, as reflected by the negative WSFG and MSFG trends and the recent short trade signals. Price is trading below both the weekly and monthly NTZ F0% levels, confirming a bearish bias for these timeframes. The most recent swing pivot is a low at 62.75, with the next significant resistance at 74.3 and a cluster of resistance levels above 75. The intermediate-term HiLo trend remains up, suggesting some underlying support, but the prevailing momentum is slow and the price action is consolidating near the lower end of the recent range. Long-term, the yearly trend remains up, with price still above the yearly NTZ F0% and supported by the 20- and 200-week moving averages, but the 55- and 100-week MAs are trending down, indicating a mixed long-term outlook. The market is in a corrective phase, with potential for further choppy or range-bound action unless a decisive breakout occurs above resistance or a breakdown below support.

Chart Analysis ATS AI Generated: 2025-08-03 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.