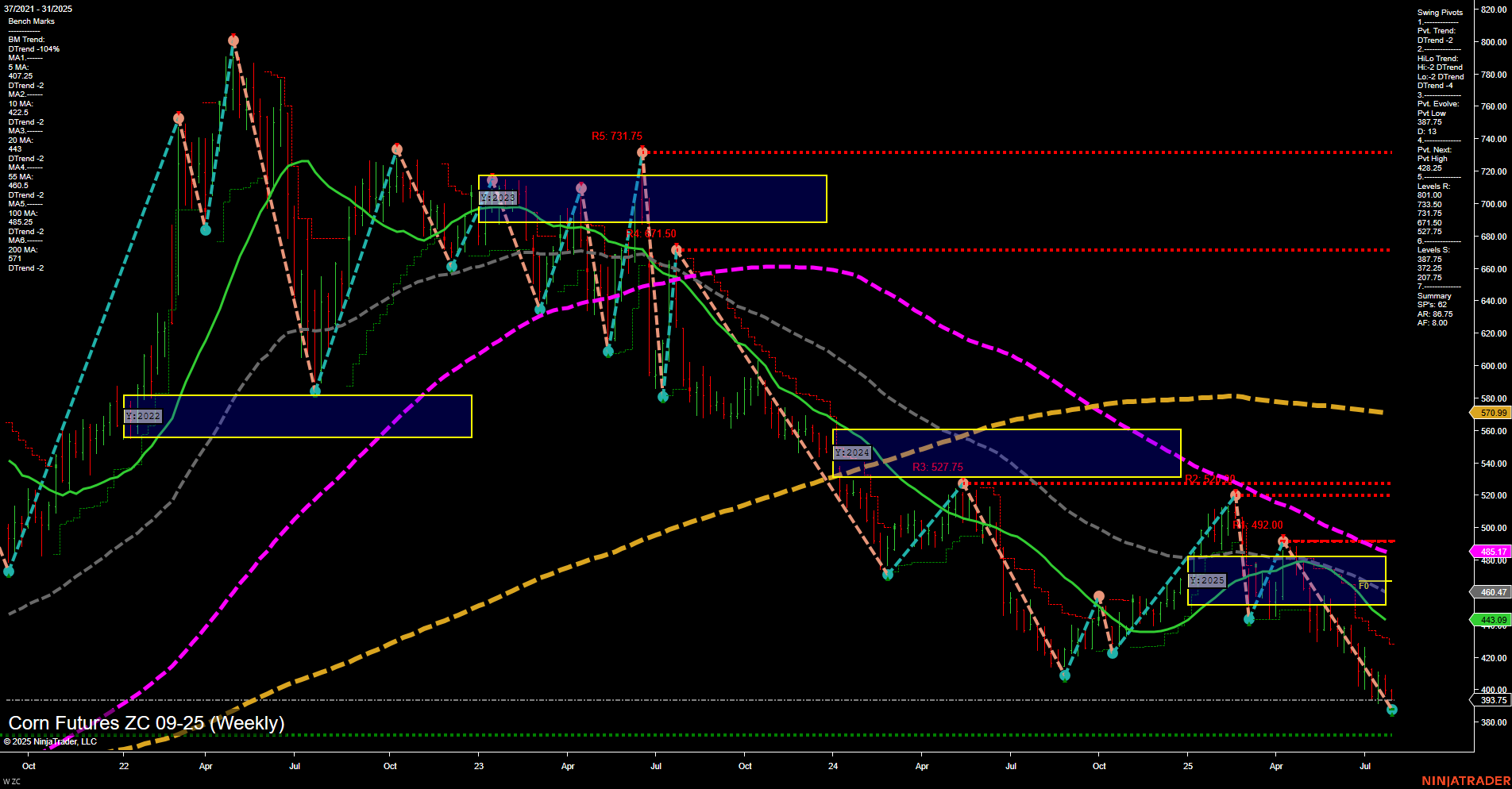

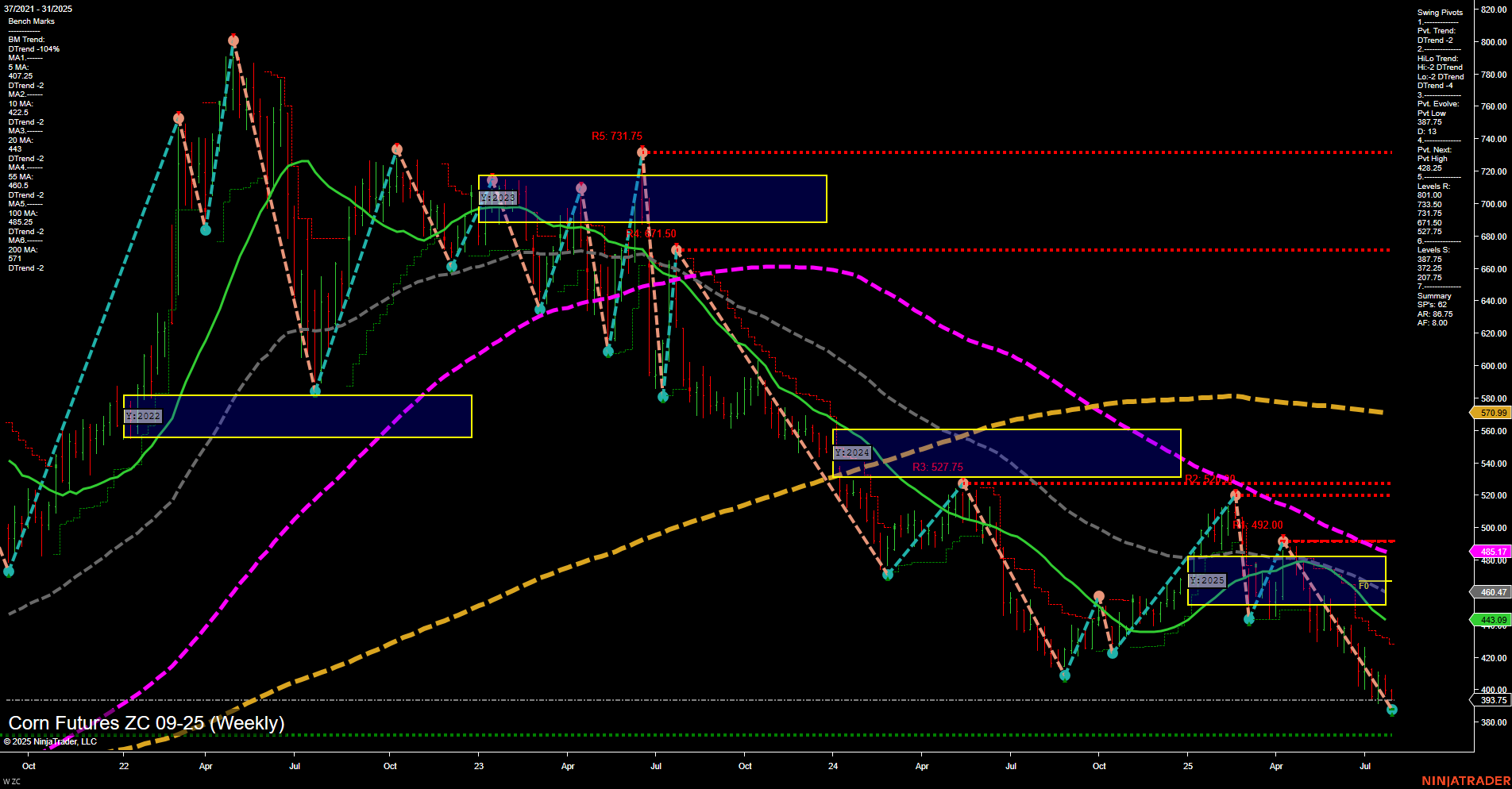

ZC Corn Futures Weekly Chart Analysis: 2025-Aug-01 07:21 CT

Price Action

- Last: 393.75,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -26%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -49%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 393.75,

- 4. Pvt. Next: Pvt high 492.00,

- 5. Levels R: 492.00, 527.75, 671.50, 731.75,

- 6. Levels S: 393.75, 372.25, 207.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 446.47 Down Trend,

- (Intermediate-Term) 10 Week: 465.17 Down Trend,

- (Long-Term) 20 Week: 495.07 Down Trend,

- (Long-Term) 55 Week: 570.99 Down Trend,

- (Long-Term) 100 Week: 605.17 Down Trend,

- (Long-Term) 200 Week: 710.99 Down Trend.

Recent Trade Signals

- 31 Jul 2025: Long ZC 09-25 @ 393.25 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures continue to exhibit a pronounced downtrend across all timeframes, with price action remaining below all major moving averages and key Fibonacci grid levels. The most recent swing pivot has established a new low at 393.75, reinforcing the dominance of sellers and the lack of upward momentum. Resistance levels are stacked well above current price, with the nearest at 492.00, while support is thin and sits just below at 372.25. The slow momentum and medium-sized bars suggest a persistent but not accelerated decline, with no signs of reversal or strong buying interest. All benchmark moving averages are trending down, confirming the prevailing bearish sentiment. The recent long signal at 393.25 appears to be a counter-trend move within a broader bearish structure. Overall, the technical landscape points to continued weakness, with any rallies likely to encounter significant resistance overhead.

Chart Analysis ATS AI Generated: 2025-08-01 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.