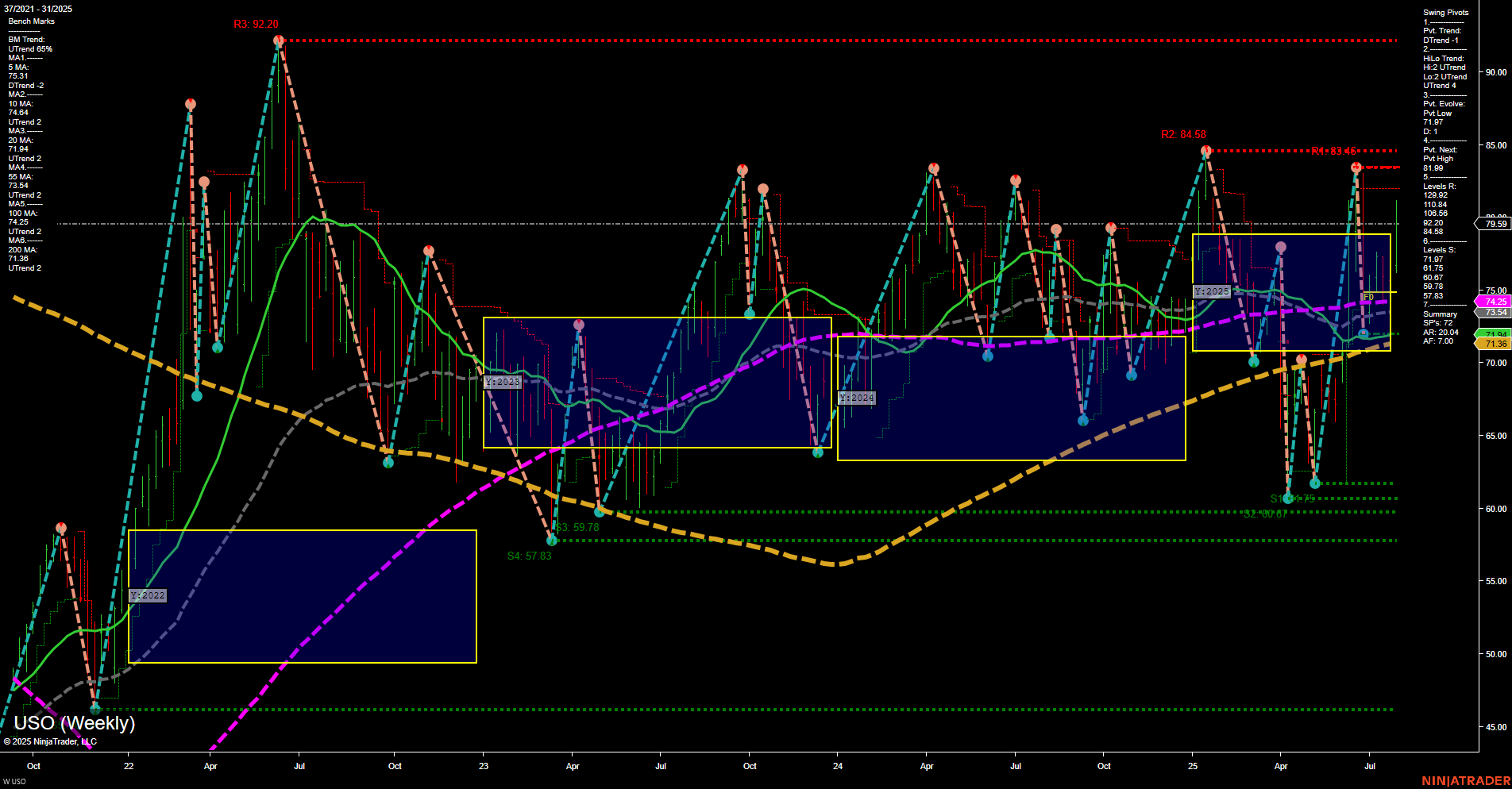

USO is currently trading in a consolidation phase, with price action showing medium-sized bars and average momentum, indicating a lack of strong directional conviction. The short-term and intermediate-term trends are neutral, as reflected by the WSFG and MSFG grids, and confirmed by the swing pivot summary, which shows a short-term downtrend but a mixed intermediate-term trend. The most recent swing low at 67.75 and swing high at 83.46 define the current trading range, with significant resistance overhead at 83.46, 84.58, and 92.20, and support levels at 67.75, 60.67, and 59.78. Benchmark moving averages show a short-term downtrend (5 and 10 week MAs), but the longer-term averages (20, 55, 100, and 200 week) are all in uptrends, suggesting underlying bullish structure remains intact. The price is currently above most long-term moving averages, reinforcing the long-term bullish bias. However, the neutral stance in the short and intermediate term, combined with the presence of the NTZ (neutral trading zone) on the yearly session fib grid, points to a market in balance, awaiting a catalyst for a breakout or breakdown. Swing traders should note the choppy, range-bound environment, with price oscillating between well-defined support and resistance. The market is in a holding pattern, with no clear trend continuation or reversal signal at this time. The overall structure favors patience, as the next significant move will likely be defined by a break of either the 83.46 resistance or the 67.75 support.