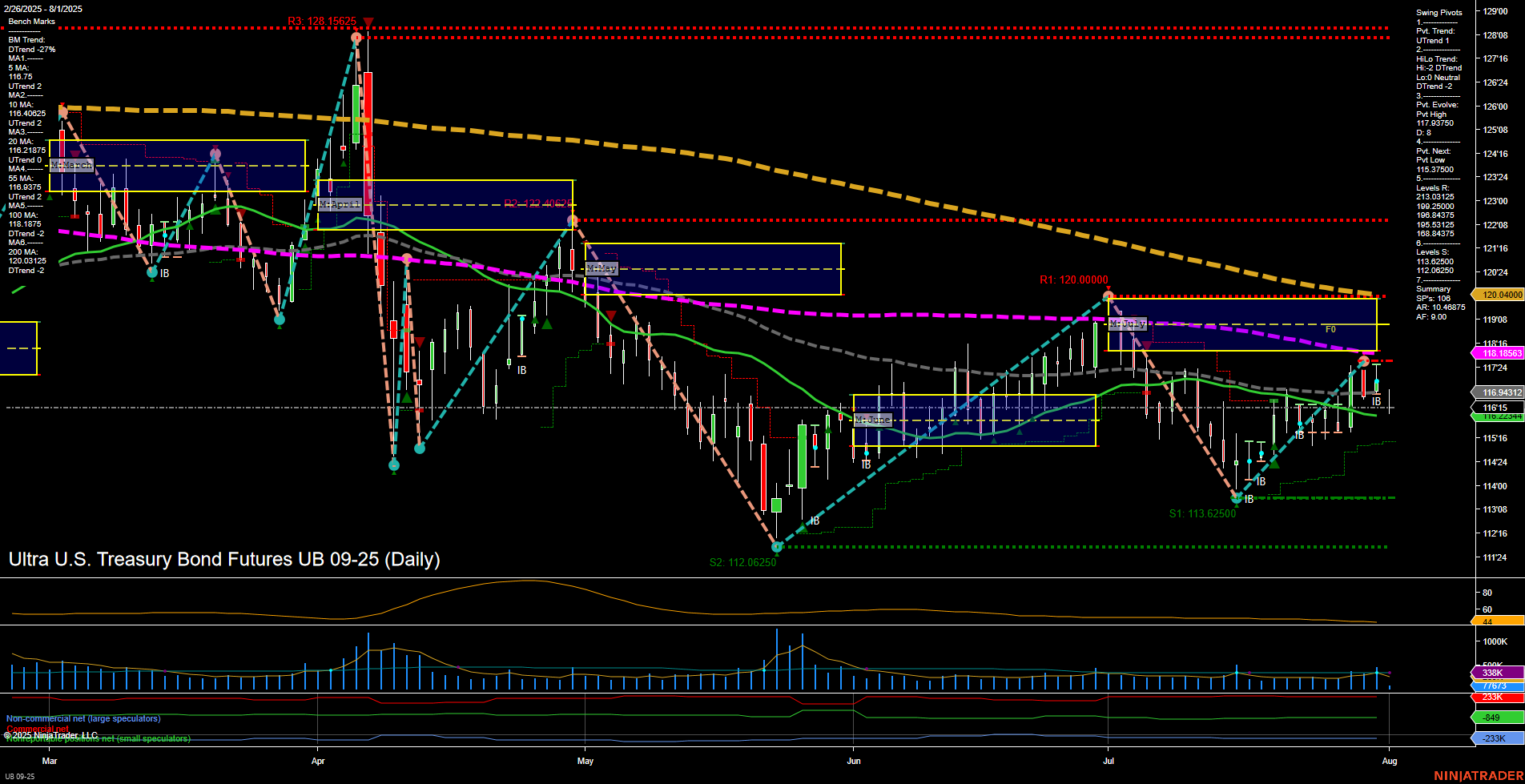

The UB Ultra U.S. Treasury Bond Futures daily chart reflects a market in transition. Short-term price action is mixed, with the last price at 116.15 and average momentum, while the weekly session fib grid (WSFG) shows an upward trend and price above the NTZ center, suggesting some short-term bullishness. However, the monthly (MSFG) and yearly (YSFG) session fib grids both indicate price below their respective NTZ centers and a prevailing downtrend, highlighting persistent intermediate and long-term bearish pressure. Swing pivots show a short-term uptrend (UTrend) but an intermediate-term downtrend (DTrend), with the most recent pivot high at 117.09375 and the next key support at 113.625. Resistance levels are stacked above, with significant barriers at 120.0 and 119.40625, while support is relatively distant, emphasizing the risk of further downside if current levels fail. Daily benchmarks are mixed: the 5-day MA is trending down, while the 10- and 20-day MAs are up, but the 55-, 100-, and 200-day MAs all remain in downtrends, reinforcing the broader bearish structure. ATR and volume metrics suggest moderate volatility and participation. Recent trade signals have been long, reflecting attempts to capture short-term rebounds within a larger bearish context. Overall, the chart suggests a market experiencing short-term countertrend rallies within a dominant intermediate and long-term downtrend, with resistance overhead and support levels below. The environment is characterized by choppy, corrective price action, with the potential for further retracements or consolidation before any sustained directional move.