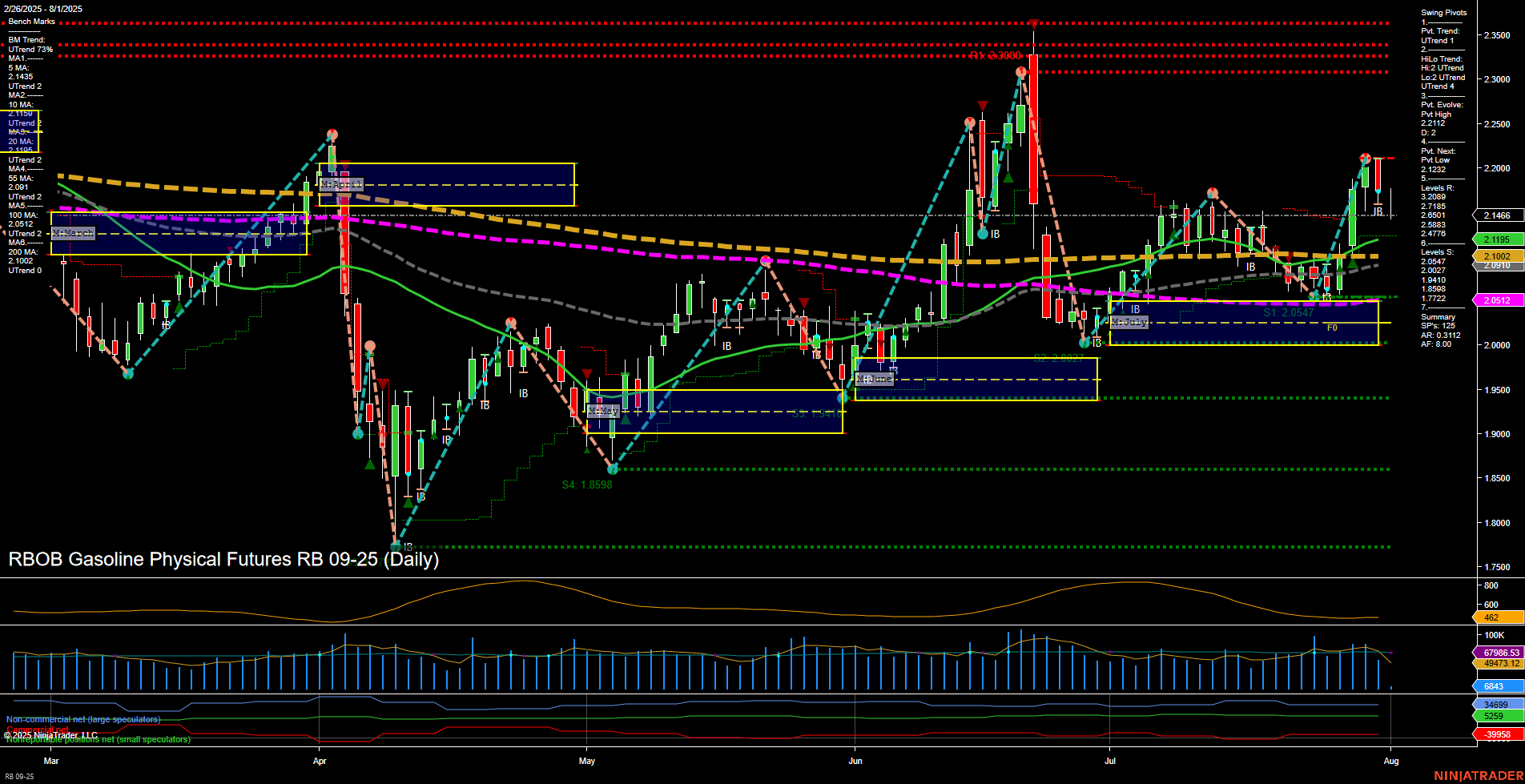

The RBOB Gasoline futures market is currently showing mixed signals across timeframes. Price action is consolidating near the 2.12 level with medium-sized bars and average momentum, indicating a pause after recent volatility. The short-term WSFG trend is up, with price above the weekly NTZ, but the monthly MSFG trend is down, with price below the August NTZ, suggesting a possible retracement or consolidation phase. Yearly trend remains up, supporting a longer-term bullish bias. Swing pivots indicate an uptrend in both short- and intermediate-term, with the most recent pivot high at 2.2112 and next potential pivot low at 2.1232, highlighting a key support/resistance zone. Resistance levels cluster above 2.21, while support is layered below 2.10, suggesting a range-bound environment in the near term. All benchmark moving averages are trending up, reinforcing the underlying strength in the longer-term structure. However, recent trade signals show both short and long entries, reflecting the choppy, two-way action and lack of clear directional conviction in the short run. Volatility (ATR) and volume (VOLMA) are elevated, consistent with recent swings and potential for further sharp moves. Overall, the market is in a consolidation phase with a bullish long-term structure, but short- and intermediate-term trends are neutral as price tests key support and resistance levels. Traders are likely watching for a breakout from this range to confirm the next directional move.