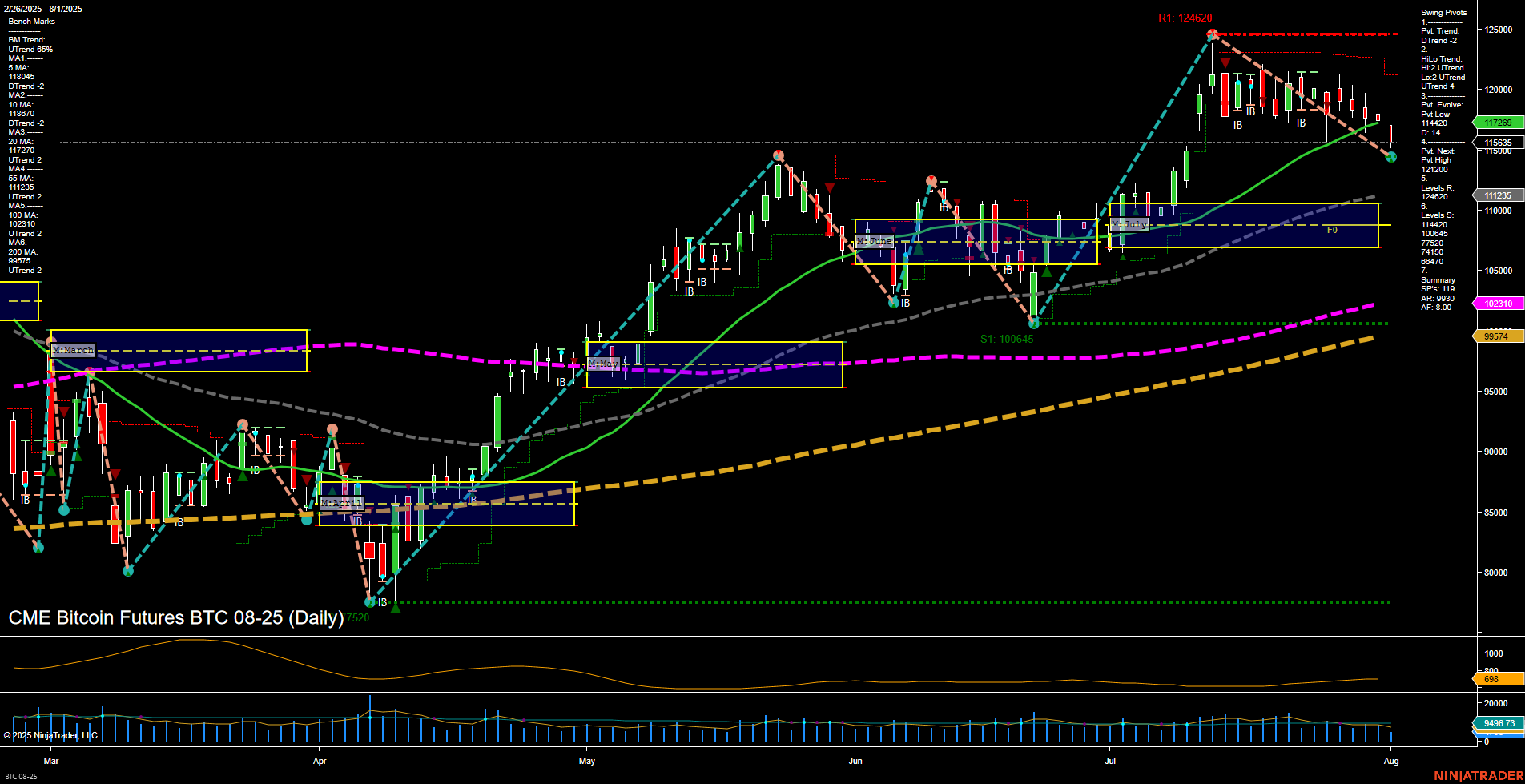

BTC CME futures are currently experiencing a corrective phase after a strong rally earlier in the year. Price action shows medium-sized bars with slow momentum, indicating a lack of aggressive selling but a clear absence of bullish drive. Both the weekly and monthly session fib grids (WSFG and MSFG) are trending down, with price trading below their respective NTZ/F0% levels, confirming short- and intermediate-term bearish sentiment. Swing pivots reinforce this, with both short- and intermediate-term trends in a downtrend, and the most recent pivot evolution at a swing low, suggesting the market is searching for support. Key resistance levels are clustered above at 124620 and 121200, while support is found at 114120 and 111235. Daily benchmarks show short- and intermediate-term moving averages rolling over into downtrends, while the long-term 100 and 200 day MAs remain in uptrends, reflecting the broader bullish structure still intact. ATR and volume metrics indicate moderate volatility and participation. Recent trade signals have triggered short entries, aligning with the prevailing short-term and intermediate-term bearish bias. Overall, the market is in a pullback or retracement phase within a larger uptrend, with the potential for further downside in the near term before any resumption of the long-term bullish trend.